Xcel Energy 2002 Annual Report Download - page 13

Download and view the complete annual report

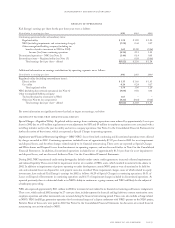

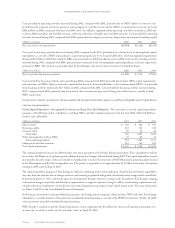

Please find page 13 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2005 funding requirement would increase to $60 million, and 2006 funding required would be $70 million. Current funding regulations

are under legislative review in 2003, and if not retained in their current form, could change these funding requirements materially.

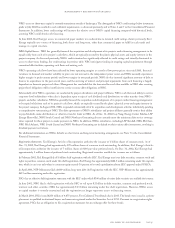

Regulation Xcel Energy is a registered holding company under the PUHCA. As a result, Xcel Energy, its utility subsidiaries and certain

of its nonutility subsidiaries are subject to extensive regulation by the SEC under the PUHCA with respect to issuances and sales of

securities, acquisitions and sales of certain utility properties and intra-system sales of certain goods and services. In addition, the

PUHCA generally limits the ability of registered holding companies to acquire additional public utility systems and to acquire and

retain businesses unrelated to the utility operations of the holding company. See further discussion of financing restrictions under

Liquidity and Capital Resources.

The electric and natural gas rates charged to customers of Xcel Energy’s utility subsidiaries are approved by the FERC and the regulatory

commissions in the states in which they operate. The rates are generally designed to recover plant investment, operating costs and an

allowed return on investment. Xcel Energy requests changes in rates for utility services through filings with the governing commissions.

Because comprehensive rate changes are requested infrequently in some states, changes in operating costs can affect Xcel Energy’s

financial results. In addition to changes in operating costs, other factors affecting rate filings are sales growth, conservation and

demand-side management efforts, and the cost of capital.

Most of the retail rate schedules for Xcel Energy’s utility subsidiaries provide for periodic adjustments to billings and revenues to allow

for recovery of changes in the cost of fuel for electric generation, purchased energy, purchased natural gas and, in Minnesota and

Colorado, conservation and energy management program costs. In Minnesota and Colorado, changes in electric capacity costs are not

recovered through these rate adjustment mechanisms. For Wisconsin electric operations, where automatic cost-of-energy adjustment

clauses are not allowed, the biennial retail rate review process and an interim fuel-cost hearing process provide the opportunity for rate

recovery of changes in electric fuel and purchased energy costs in lieu of a cost-of-energy adjustment clause. In Colorado, PSCo has an

ICA mechanism that allows for an equal sharing among customers and shareholders of certain fuel and energy costs and certain gains

and losses on trading margins.

Regulated public utilities are allowed to record as regulatory assets certain costs that are expected to be recovered from customers in

future periods and to record as regulatory liabilities certain income items that are expected to be refunded to customers in future periods.

In contrast, nonregulated enterprises would expense these costs and recognize the income in the current period. If restructuring or other

changes in the regulatory environment occur, Xcel Energy may no longer be eligible to apply this accounting treatment, and may be

required to eliminate such regulatory assets and liabilities from its balance sheet. Such changes could have a material adverse effect on

Xcel Energy’s results of operations in the period the write-off is recorded.

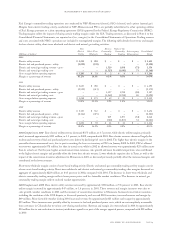

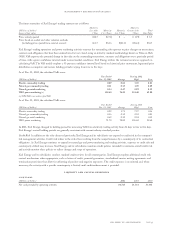

At Dec. 31, 2002, Xcel Energy reported on its balance sheet regulatory assets of approximately $404 million and regulatory liabilities

of approximately $297 million that would be recognized in the statement of operations in the absence of regulation. In addition to a

potential write-off of regulatory assets and liabilities, restructuring and competition may require recognition of certain stranded costs

not recoverable under market pricing. Xcel Energy currently does not expect to write off any stranded costs unless market price levels

change or cost levels increase above market price levels. See Notes 1 and 20 to the Consolidated Financial Statements for further

discussion of regulatory deferrals.

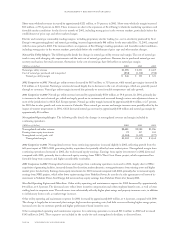

Merger Rate Agreements As part of the merger approval process, Xcel Energy agreed to reduce its rates in several jurisdictions. The

discussion below summarizes the rate reductions in Colorado, Minnesota, Texas and New Mexico.

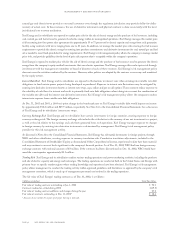

As part of the merger approval process in Colorado, PSCo agreed to:

– reduce its retail electric rates by an annual rate of $11 million for the period of August 2000 through July 2002;

– file a combined electric and natural gas rate case in 2002, with new rates effective January 2003;

– cap merger costs associated with the electric operations at $30 million and amortize the merger costs for ratemaking purposes

through 2002;

– extend its ICA mechanism through Dec. 31, 2002, with an increase in the ICA base rate from $12.78 per megawatt-hour to a rate

based on 2001 actual costs;

– continue the electric performance-based regulatory plan (PBRP) and the electric quality service plan (QSP) currently in effect through

2006, with modifications to cap electric earnings at a 10.5-percent return on equity for 2002, to reflect no earnings sharing in 2003

since new base rates would have recently been established, and to increase potential bill credits if quality standards are not met; and

– develop a QSP for the natural gas operations to be effective for calendar years 2002 through 2007.

As part of the merger approval process in Minnesota, NSP-Minnesota agreed to:

– reduce its Minnesota electric rates by $10 million annually through 2005;

– not increase its electric rates through 2005, except under limited circumstances;

– not seek recovery of certain merger costs from customers; and

– meet various quality standards.

management’s discussion and analysis

xcel energy inc. and subsidiaries page 27