Xcel Energy 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other liquidity and capital resource considerations

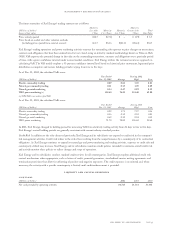

NRG Financial Issues and Potential Bankruptcy Historically, NRG has obtained cash from operations, issuance of debt and equity

securities, borrowings under credit facilities, capital contributions from Xcel Energy, reimbursement by Xcel Energy of tax benefits

pursuant to a tax-sharing agreement and proceeds from nonrecourse project financings. NRG has used these funds to finance operations;

service debt obligations; fund the acquisition, development and construction of generation facilities; finance capital expenditures; and meet

other cash and liquidity needs.

As discussed previously, substantially all of NRG’s operations are conducted by project subsidiaries and project affiliates. NRG’s cash

flow and ability to service corporate-level indebtedness when due is dependent upon receipt of cash dividends and distributions or other

transfers from NRG’s projects and other subsidiaries. The debt agreements of NRG’s subsidiaries and project affiliates generally restrict

their ability to pay dividends, make distributions or otherwise transfer funds to NRG. As of Dec. 31, 2002, Loy Yang, Killingholme,

Energy Center Kladno, LSP Energy (Batesville), NRG South Central and NRG Northeast Generating do not currently meet the

minimum debt service coverage ratios required for these projects to make payments to NRG.

Killingholme, NRG South Central and NRG Northeast Generating are in default on their credit agreements. NRG believes the

situations at Energy Center Kladno, Loy Yang and Batesville do not create an event of default and will not allow the lenders to

accelerate the project financings.

In all of these cases, NRG’s corporate-level financial obligations to project lenders is limited to no more than six-months’ debt service.

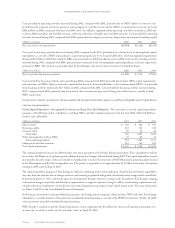

As discussed previously, NRG’s operating cash flows have been affected by lower operating margins as a result of low power prices

since mid-2001. Seasonal variations in demand and market volatility in prices are not unusual in the independent power sector, and

NRG normally experiences higher margins in peak summer periods and lower margins in non-peak periods. NRG also has incurred

significant amounts of debt to finance its acquisitions in the past several years, and the servicing of interest and principal repayments

from such financing is largely dependent on domestic project cash flows. NRG’s management has concluded that the forecasted free

cash flow available to NRG after servicing project-level obligations will be insufficient to service recourse debt obligations.

Since mid-2002, as discussed previously, NRG has experienced severe financial difficulties, resulting primarily from declining credit ratings

and lower prices for power. These financial difficulties have caused NRG to, among other things, miss several scheduled payments of interest

and principal on its bonds and incur an approximately $3-billion asset impairment charge. The asset impairment charge relates to write-offs

for anticipated losses on sales of several projects as well as anticipated losses for projects for which NRG has stopped funding. In addition,

as a result of having its credit ratings downgraded, NRG is in default of obligations to post cash collateral of approximately $1 billion.

Furthermore, on Nov. 6, 2002, lenders to NRG accelerated approximately $1.1 billion of NRG’s debt under the construction revolver financing

facility, rendering the debt immediately due and payable. In addition, on Feb. 27, 2003, lenders to NRG accelerated approximately $1.0 billion

of NRG Energy’s debt under the corporate revolver financing facility, rendering the debt immediately due and payable. NRG continues to

work with its lenders and bondholders on a comprehensive restructuring plan. NRG does not contemplate making any principal or interest

payments on its corporate-level debt pending the restructuring of its obligations. Consequently, NRG is, and expects to continue to be, in

default under various debt instruments. By reason of these various defaults, the lenders are able to seek to enforce their remedies, if they so

choose, and that would likely lead to a bankruptcy filing by NRG in 2003.

Whether NRG does or does not reach a consensual restructuring plan with its creditors, there is a substantial likelihood that NRG will

be the subject of a bankruptcy proceeding in 2003. If an agreement is reached with NRG’s creditors on a restructuring plan, it is expected

that NRG would as soon as practicable commence a Chapter 11 bankruptcy case and immediately seek approval of a prenegotiated

plan of reorganization. Absent an agreement with NRG’s creditors and the continued forbearance by such creditors, NRG will be

subject to substantial doubt as to its ability to continue as a going concern and will likely be the subject of a voluntary or involuntary

bankruptcy proceeding, which, due to the lack of a prenegotiated plan of reorganization, would be expected to take an extended

period of time to be resolved and may involve claims against Xcel Energy under the equitable doctrine of substantive consolidation,

as discussed following.

In addition to the collateral requirements, NRG must continue to meet its ongoing operational and construction funding requirements.

Since NRG’s credit-rating downgrade, its cost of borrowing has increased and it has not been able to access the capital markets. NRG

believes that its current funding requirements under its already reduced construction program may be unsustainable given its inability to

raise money in the capital markets and the uncertainties involved in obtaining additional equity funding from Xcel Energy. NRG and

Xcel Energy have retained financial advisors to help work through these liquidity issues.

As discussed previously, NRG is not making any payments of principal or interest on its corporate-level debt, and neither NRG nor any

subsidiary is making payment of principal or interest on publicly held bonds. This failure to pay, coupled with past and anticipated

proceeds from the sales of projects, has provided NRG with adequate liquidity to meet its day-to-day operating costs. However, there

can be no assurance that holders of NRG indebtedness, on which interest and principal are not being paid, will not seek to accelerate

the payment of their indebtedness, which would likely lead to NRG seeking relief under the bankruptcy laws.

page 38 xcel energy inc. and subsidiaries

management’s discussion and analysis