Xcel Energy 2002 Annual Report Download - page 25

Download and view the complete annual report

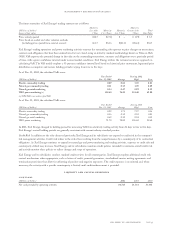

Please find page 25 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At the present time and based on conversations with various lenders, Xcel Energy management believes that the appropriate course is to

seek a consensual restructuring of NRG with its creditors. Following an agreement on the restructuring with NRG’s creditors, as described

in Note 4 to the Consolidated Financial Statements, it is expected that NRG would commence a Chapter 11 bankruptcy proceeding

and immediately seek approval of a prenegotiated plan of reorganization. If a consensual restructuring cannot be reached, the likelihood

of NRG becoming subject to a protracted voluntary or involuntary bankruptcy proceeding is increased. If a consensual restructuring of

NRG cannot be obtained and NRG remains outside of a bankruptcy proceeding, NRG is expected to continue selling assets to reduce

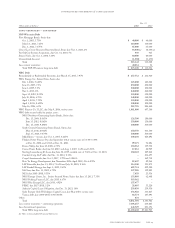

its debt and improve its liquidity. Through Jan. 31, 2003, NRG completed a number of transactions, which resulted in net cash proceeds

to NRG after debt pay-downs and after financial advisor fees of approximately $350 million.

Xcel Energy Impacts During 2002, Xcel Energy provided NRG with $500 million of cash infusions. In May 2002, Xcel Energy and

NRG entered into a support and capital subscription agreement (Support Agreement) pursuant to which Xcel Energy agreed, under

certain circumstances, to provide an additional $300 million to NRG. Xcel Energy has not, to date, provided funds to NRG under this

agreement. See discussion of preliminary settlement with NRG’s creditors at Note 4 to the Consolidated Financial Statements.

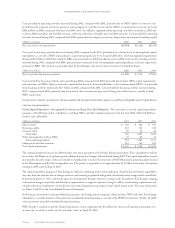

Many companies in the regulated utility industry, with which the independent power industry is closely linked, also are restructuring or

reviewing their strategies. Several of these companies are discontinuing going forward with unregulated investments, seeking to divest of

their unregulated subsidiaries or attempting to have their regulated subsidiaries acquire their unregulated subsidiaries. This may lead to

an increased competition between the regulated utilities and the unregulated power producers within certain markets. In such instances,

NRG may compete with regulated utilities in the influence of market designs and rulemaking.

On March 26, 2003, Xcel Energy’s board of directors approved a tentative settlement with holders of most of NRG’s long-term notes

and the steering committee representing NRG’s bank lenders regarding alleged claims of such creditors against Xcel Energy, including

claims related to the Support Agreement. The settlement is subject to a variety of conditions as set forth below, including definitive

documentation. As described in Note 4 to the Consolidated Financial Statements, the settlement would require Xcel Energy to pay up

to $752 million over 13 months. Xcel Energy would expect to fund those payments with cash from tax savings. The principal terms of

the settlement as of the date of this report were as follows:

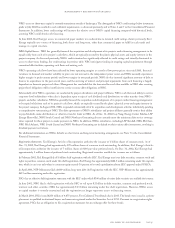

Xcel Energy would pay up to $752 million to NRG to settle all claims of NRG and the claims of NRG against Xcel Energy, including

all claims under the Support Agreement.

$350 million would be paid at or shortly following the consummation of a restructuring of NRG’s debt through a bankruptcy proceeding.

It is expected that this payment would be made prior to year-end 2003. $50 million would be paid on Jan. 1, 2004, and all or any part of such

payment could be made, at Xcel Energy’s election, in Xcel Energy common stock. Up to $352 million would be paid on April 30, 2004,

except to the extent that Xcel Energy had not received at such time tax refunds equal to $352 million associated with the loss on its

investment in NRG. To the extent Xcel Energy had not received such refunds, the April 30 payment would be due on May 30, 2004.

$390 million of the Xcel Energy payments are contingent on receiving releases from NRG creditors. To the extent Xcel Energy does not

receive a release from an NRG creditor, Xcel Energy’s obligation to make $390 million of the payments would be reduced based on the

amount of the creditor’s claim against NRG. As noted below, however, the entire settlement is contingent upon Xcel Energy receiving

releases from at least 85 percent of the claims in various NRG creditor groups. As a result, it is not expected that Xcel Energy’s payment

obligations would be reduced by more than approximately $60 million. Any reduction would come from the Xcel Energy payment due

on April 30, 2004.

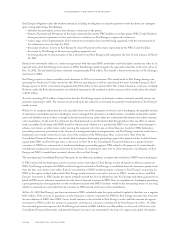

Upon the consummation of NRG’s debt restructuring through a bankruptcy proceeding, Xcel Energy’s exposure on any guarantees or

other credit supported obligations incurred by Xcel Energy for the benefit of NRG or any subsidiary would be terminated, and any cash

collateral posted by Xcel Energy would be returned to it. The current amount of such cash collateral is approximately $11.5 million.

As part of the settlement with Xcel Energy, any intercompany claims of Xcel Energy against NRG or any subsidiary arising from the

provision of intercompany goods or services or the honoring of any guarantee will be paid in full in cash in the ordinary course except

that the agreed amount of such intercompany claims arising or accrued as of Jan. 31, 2003, will be reduced from approximately $55 million as

asserted by Xcel Energy to $13 million. The $13 million agreed amount is to be paid upon the consummation of NRG’s debt restructuring

with $3 million in cash and an unsecured promissory note of NRG on market terms in the principal amount of $10 million.

NRG and its direct and indirect subsidiaries would not be reconsolidated with Xcel Energy or any of its other affiliates for tax purposes

at any time after its June 2002 reaffiliation or treated as a party to or otherwise entitled to the benefits of any tax sharing agreement with

Xcel Energy. Likewise, NRG would not be entitled to any tax benefits associated with the tax loss Xcel Energy expects to incur in

connection with the write-down of its investment in NRG.

management’s discussion and analysis

xcel energy inc. and subsidiaries page 39