Xcel Energy 2002 Annual Report Download - page 15

Download and view the complete annual report

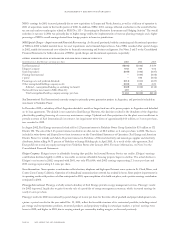

Please find page 15 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.memorandum from the IRS national office, which communicated a position adverse to PSRI. Consequently, the IRS examination division

has disallowed the interest expense deductions for the tax years 1993 through 1997. After consultation with tax counsel, it is Xcel Energy’s

position that the tax law does not support the IRS determination. Although the ultimate resolution of this matter is uncertain,

management continues to believe it will successfully resolve this matter without a material adverse impact on Xcel Energy’s results of

operations. However, defense of PSCo’s position may require significant cash outlays on a temporary basis, if refund litigation is

pursued in U.S. District Court.

The total disallowance of interest expense deductions for the period of 1993 through 1997 is approximately $175 million. Additional

interest expense deductions for the period 1998 through 2002 are estimated to total approximately $317 million. Should the IRS

ultimately prevail on this issue, tax and interest payable through Dec. 31, 2002, would reduce earnings by an estimated $214 million,

after tax. If COLI interest expense deductions were no longer available, annual earnings for 2003 would be reduced by an estimated

$33 million, after tax, prospectively, which represents 8 cents per share using 2003 share levels.

Environmental Matters Our environmental costs include payments for nuclear plant decommissioning, storage and ultimate disposal of

spent nuclear fuel, disposal of hazardous materials and wastes, remediation of contaminated sites and monitoring of discharges to the

environment. A trend of greater environmental awareness and increasingly stringent regulation has caused, and may continue to cause,

slightly higher operating expenses and capital expenditures for environmental compliance.

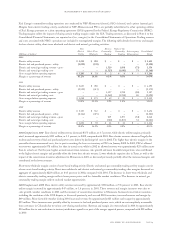

In addition to nuclear decommissioning and spent nuclear fuel disposal expenses, costs charged to our operating expenses for environmental

monitoring and disposal of hazardous materials and wastes were approximately:

– $149 million in 2002

– $146 million in 2001

– $144 million in 2000

We expect to expense an average of approximately $177 million per year from 2003 through 2007 for similar costs. However, the precise

timing and amount of environmental costs, including those for site remediation and disposal of hazardous materials, are currently unknown.

Additionally, the extent to which environmental costs will be included in and recovered through rates is not certain.

Capital expenditures on environmental improvements at our regulated facilities, which include the cost of constructing spent nuclear fuel

storage casks, were approximately:

– $108 million in 2002

– $136 million in 2001

– $57 million in 2000

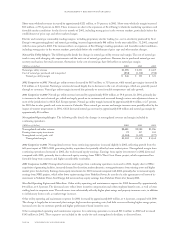

Our regulated utilities expect to incur approximately $44 million in capital expenditures for compliance with environmental regulations

in 2003 and approximately $948 million during the period from 2003 through 2007. Most of the costs are related to modifications to

reduce the emissions of NSP-Minnesota’s generating plants located in the Minneapolis-St. Paul metropolitan area. See Notes 18 and 19

to the Consolidated Financial Statements for further discussion of our environmental contingencies.

NRG expects to incur as much as $145 million in capital expenditures over the next five years to address conditions that existed when it

acquired facilities, and to comply with new regulations.

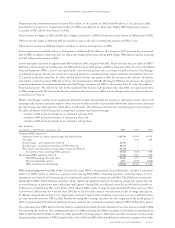

Impact of Other Nonregulated Investments Xcel Energy’s investments in nonregulated operations have had a significant impact on its

results of operations. Xcel Energy does not expect to continue investing in nonregulated domestic and international power production

projects through NRG, but may continue investing in natural gas marketing and trading through e prime and construction projects

through Utility Engineering. Xcel Energy’s nonregulated businesses may carry a higher level of risk than its traditional utility businesses

due to a number of factors, including:

– competition, operating risks, dependence on certain suppliers and customers, and domestic and foreign environmental and

energy regulations;

– partnership and government actions and foreign government, political, economic and currency risks; and

– development risks, including uncertainties prior to final legal closing.

Xcel Energy’s earnings from nonregulated subsidiaries, other than NRG, also include investments in international projects, primarily in

Argentina, through Xcel Energy International, and broadband communications systems through Seren. Management currently intends

to hold and operate these investments, but is evaluating their strategic fit in Xcel Energy’s business portfolio. As of Dec. 31, 2002, Xcel

Energy’s investment in Seren was approximately $255 million. Seren had capitalized $290 million for plant in service and had incurred

another $21 million for construction work in progress for these systems at Dec. 31, 2002. Xcel Energy International’s gross investment

in Argentina, excluding unrealized currency translation losses of approximately $62 million, was $112 million at Dec. 31, 2002. Given the

political and economic climate in Argentina, Xcel Energy continues to closely monitor the investment for asset impairment. Currently,

management believes that no impairment exists in addition to what was recognized in 2002, as previously discussed.

management’s discussion and analysis

xcel energy inc. and subsidiaries page 29