Xcel Energy 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

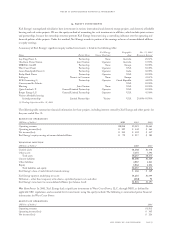

16. financial instruments

fair values

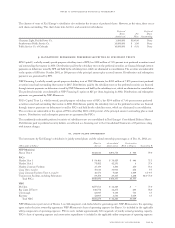

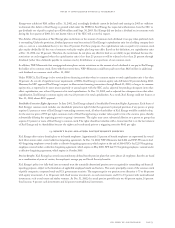

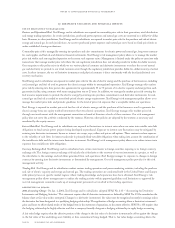

The estimated Dec. 31 fair values of Xcel Energy’s recorded financial instruments are:

2002 2001

Carrying Carrying

(Thousands of dollars) Amount Fair Value Amount Fair Value

Mandatorily redeemable preferred securities of subsidiary trusts $ 494,000 $ 463,348 $ 494,000 $ 486,270

Long-term investments $ 653,208 $ 651,443 $ 619,976 $ 620,703

Notes receivable, including current portion $ 996,167 $ 996,167 $ 782,079 $ 782,079

Long-term debt, including current portion $14,306,509 $12,172,059 $11,948,527 $11,955,741

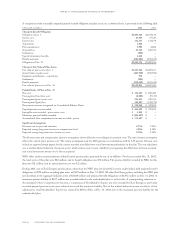

The carrying amount of cash, cash equivalents and short-term investments approximates fair value because of the short maturity of those

instruments. The fair values of Xcel Energy’s long-term investments, mainly debt securities in an external nuclear decommissioning

fund, are estimated based on quoted market prices for those or similar investments. The fair value of notes receivable is based on expected

future cash flows discounted at market interest rates. The balance in notes receivable consists primarily of fixed rate, from 4.75 to

19.5 percent, and variable rate notes that mature between 2003 and 2024. Notes receivable include a $366-million direct financing lease

related to a long-term sales agreement for NRG’s Schkopau project, and other notes related to projects at NRG that are generally

secured by equity interests in partnerships and joint ventures. The fair value of Xcel Energy’s long-term debt and the mandatorily

redeemable preferred securities are estimated based on the quoted market prices for the same or similar issues, or the current rates for debt

of the same remaining maturities and credit quality.

The fair value estimates presented are based on information available to management as of Dec. 31, 2002 and 2001. These fair value

estimates have not been comprehensively revalued for purposes of these Consolidated Financial Statements since that date, and current

estimates of fair values may differ significantly from the amounts presented herein.

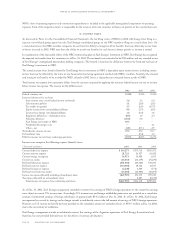

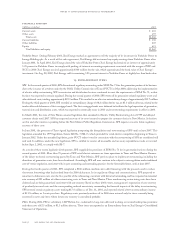

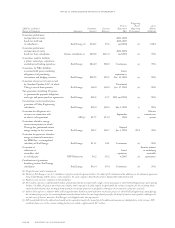

guarantees

Xcel Energy provides various guarantees and bond indemnities supporting certain of its subsidiaries. The guarantees issued by Xcel Energy

guarantee payment or performance by its subsidiaries under specified agreements or transactions. As a result, Xcel Energy’s exposure

under the guarantees is based upon the net liability of the relevant subsidiary under the specified agreements or transactions. Most of

the guarantees issued by Xcel Energy limit the exposure of Xcel Energy to a maximum amount stated in the guarantees. Unless otherwise

indicated below, the guarantees require no liability to be recorded, contain no recourse provisions and require no collateral. On Dec. 31, 2002,

Xcel Energy had the following amount of guarantee and exposure under these guarantees:

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 79