Xcel Energy 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

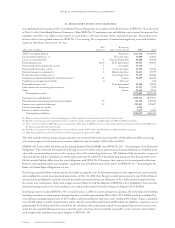

22. summarized quarterly financial data (unaudited)

Subsequent to the issuance of Xcel Energy’s financial statements for the quarter ended Sept. 30, 2002, NRG’s management determined

that the accounting for certain transactions required revision.

NRG determined that it had misapplied the provisions of SFAS No. 144 related to asset grouping in connection with the review

for impairment of its long-lived assets during the quarter ended Sept. 30, 2002. SFAS No. 144 requires that for purposes of testing

recoverability, assets be grouped at the lowest level for which identifiable cash flows are largely independent of the cash flows of

other assets. NRG recalculated the asset impairment tests in accordance with SFAS No. 144 using the appropriate asset grouping for

independent cash flows for each generation facility. As a result, NRG concluded that asset impairments should have been recorded

for two projects known as Bayou Cove Peaking Power LLC and Somerset Power LLC. Since NRG concluded that the “triggering

events” that led to the impairment charge were experienced in the third quarter of 2002, the asset impairments related to these projects

should have been recorded as of Sept. 30, 2002. NRG calculated the asset impairment charges for Bayou Cove Peaking Power LLC

and Somerset Power LLC to be $126.5 million and $49.3 million, respectively.

In connection with NRG’s year-end audit, two additional items were found to be inappropriately recorded as of Sept. 30, 2002. These

items included the inappropriate treatment of interest rate swap transactions as cash flow hedges and the decrease in the value of a bond

remarketing option from the original price paid by NRG. The error correction for the interest rate swaps resulted in the recording of

additional income of $61.6 million as of Sept. 30, 2002. The recognition of the decrease in the value of the remarketing option resulted

in a charge to income of $15.9 million as of Sept. 30, 2002.

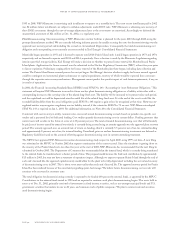

A summary of the significant effects of the restatement, including the impact of fourth quarter discontinued operations decisions, on

Xcel Energy’s consolidated statements of operations for the three and nine months ended Sept. 30, 2002, is as follows:

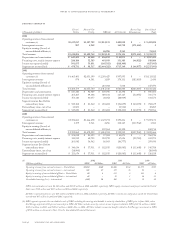

As Previously Reported As Restated

Three Months Nine Months Three Months Nine Months

(Thousands of dollars, except per share amounts) Ended Ended Ended Ended

Consolidated Statements of Operations

Revenue $ 2,473,331 $ 7,070,824 $ 2,473,331 $ 7,070,824

Operating income (1,948,725) (1,334,201) (2,140,418) (1,525,894)

Income (loss) from continuing operations (1,496,959) (1,317,413) (1,627,039) (1,447,493)

Discontinued operations – income (loss) (577,001) (565,741) (577,001) (565,741)

Net income (loss) (2,073,960) (1,883,154) (2,204,040) (2,013,234)

Earnings (loss) available for common shareholders (2,075,020) (1,886,334) (2,205,100) (2,016,414)

Earnings (loss) per share from continuing operations – basic and diluted $ (3.77) $ (3.51) $ (4.10) $ (3.85)

Earnings (loss) per share discontinued operations – basic and diluted $ (1.45) $ (1.50) $ (1.45) $ (1.50)

Earnings per share – basic and diluted $ (5.22) $ (5.01) $ (5.55) $ (5.35)

During the fourth quarter of 2002, NRG determined that it had inadvertently offset its investment in Jackson County, Miss., bonds in

the amount of $155.5 million against long-term debt of the same amount owed to the County. This resulted in an understatement of

NRG’s assets and liabilities by $155.5 million as of Sept. 30, 2002. In addition, the restatement for Bayou Cove Peaking LLC and

Somerset Power LLC impairments reduced the previously reported net property, plant and equipment balance by $175.8 million.

The restatement for the interest rate swaps had no impact on total shareholder’s equity and the restatement for the remarketing

option reduced other assets by $15.9 million.

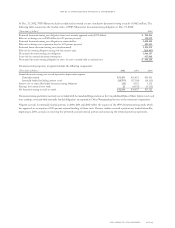

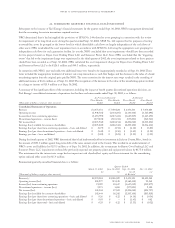

Summarized quarterly unaudited financial data is as follows:

Quarter Ended

March 31, 2002 June 30, 2002 Sept. 30, 2002 Dec. 31, 2002

(a) (a) (a) (d) (a)

(Thousands of dollars, except per share amounts) As Restated

Revenue(c) $2,370,584 $2,226,909 $ 2,473,331 $2,453,548

Operating income (loss) 298,977 315,548 (2,140,418) 93,562

Income (loss) from continuing operations 93,929 85,617 (1,627,039) (213,877)

Discontinued operations – income (loss) 9,575 1,685 (577,001) 9,120

Net income (loss) 103,504 87,302 (2,204,040) (204,757)

Earnings (loss) available for common shareholders 102,444 86,242 (2,205,100) (205,818)

Earnings (loss) per share from continuing operations – basic and diluted $ 0.26 $ 0.22 $ (4.10) $ (0.54)

Earnings (loss) per share discontinued operations – basic and diluted $ 0.03 $ – $ (1.45) $ 0.02

Earnings (loss) per share total – basic and diluted $ 0.29 $ 0.22 $ (5.55) $ (0.52)

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 99