Xcel Energy 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

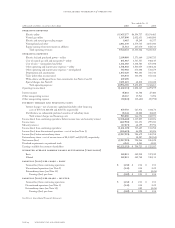

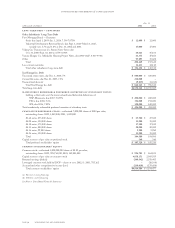

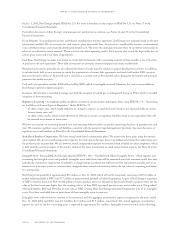

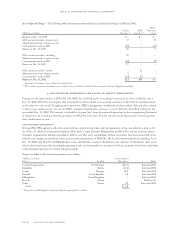

Dec. 31

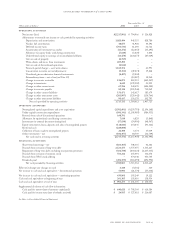

(Thousands of dollars) 2002 2001

long-term debt – continued

Other Subsidiaries’ Long-Term Debt

First Mortgage Bonds – Cheyenne:

Series due April 1, 2003–Jan. 1, 2024, 7.5%–7.875% $ 12,000 $ 12,000

Industrial Development Revenue Bonds, due Sept. 1, 2021–March 1, 2027,

variable rate, 1.7% and 1.8% at Dec. 31, 2002 and 2001 17,000 17,000

Viking Gas Transmission Co. Senior Notes-Series due:

Oct. 31, 2008–Sept. 30, 2014, 6.65%–8.04% 40,421 45,181

Various Eloigne Co. Affordable Housing Project Notes, due 2003–2027, 0.3%–9.91% 41,353 47,856

Other 97,895 35,608

Total 208,669 157,645

Less current maturities 14,431 12,110

Total other subsidiaries’ long-term debt $ 194,238 $ 145,535

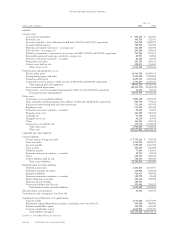

Xcel Energy Inc. Debt

Unsecured senior notes, due Dec. 1, 2010, 7% $ 600,000 $ 600,000

Convertible notes, due Nov. 21, 2007, 7.5% 230,000 –

Unamortized discount (9,837) (3,655)

Total Xcel Energy Inc. debt $ 820,163 $ 596,345

Total long-term debt $6,550,248 $11,555,589

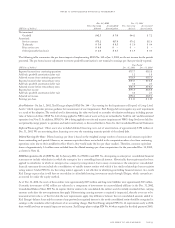

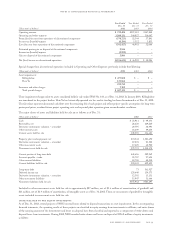

mandatorily redeemable preferred securities of subsidiary trusts

holding as their sole asset the junior subordinated deferrable debentures of:

NSP-Minnesota, due 2037, 7.875% $ 200,000 $ 200,000

PSCo, due 2038, 7.6% 194,000 194,000

SPS, due 2036, 7.85% 100,000 100,000

Total mandatorily redeemable preferred securities of subsidiary trusts $ 494,000 $ 494,000

cumulative preferred stock – authorized 7,000,000 shares of $100 par value;

outstanding shares: 2002, 1,049,800; 2001, 1,049,800

$3.60 series, 275,000 shares $ 27,500 $ 27,500

$4.08 series, 150,000 shares 15,000 15,000

$4.10 series, 175,000 shares 17,500 17,500

$4.11 series, 200,000 shares 20,000 20,000

$4.16 series, 99,800 shares 9,980 9,980

$4.56 series, 150,000 shares 15,000 15,000

Total 104,980 104,980

Capital in excess of par value on preferred stock 340 340

Total preferred stockholders’ equity $ 105,320 $ 105,320

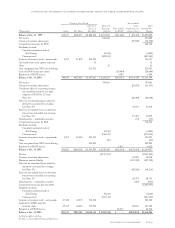

common stockholders’ equity

Common stock – authorized 1,000,000,000 shares of $2.50 par value;

outstanding shares: 2002, 398,714,039; 2001, 345,801,028 $ 996,785 $ 864,503

Capital in excess of par value on common stock 4,038,151 2,969,589

Retained earnings (deficit) (100,942) 2,558,403

Leveraged common stock held by ESOP – shares at cost: 2002, 0; 2001, 783,162 –(18,564)

Accumulated other comprehensive income (loss) (269,010) (179,454)

Total common stockholders’ equity $4,664,984 $ 6,194,477

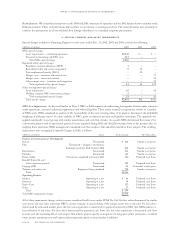

(a) Resource recovery financing

(b) Pollution control financing

See Notes to Consolidated Financial Statements

page 50 xcel energy inc. and subsidiaries

consolidated statements of capitalization