Xcel Energy 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

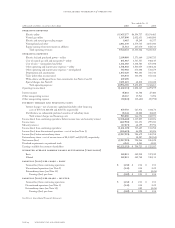

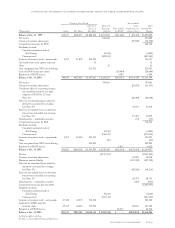

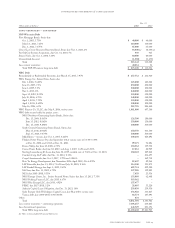

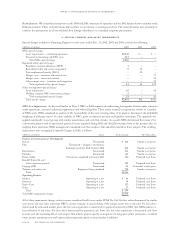

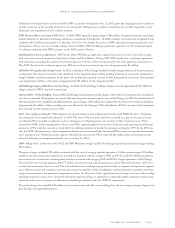

Common Stock Issued Accumulated

Capital in Retained Other Total

Excess of Earnings Shares Held Comprehensive Stockholders’

(Thousands) Shares Par Value Par Value (Deficit) by ESOP Income (Loss) Equity

Balance at Dec. 31, 1999 335,277 $838,193 $ 2,288,254 $ 2,253,800 $(11,606) $ (78,421) $ 5,290,220

Net income 526,828 526,828

Currency translation adjustments (78,508) (78,508)

Comprehensive income for 2000 448,320

Dividends declared:

Cumulative preferred stock of

Xcel Energy (4,241) (4,241)

Common stock (492,183) (492,183)

Issuances of common stock – net proceeds 5,557 13,892 102,785 116,677

Tax benefit from stock options exercised 53 53

Other 16 16

Gain recognized from NRG stock offering 215,933 215,933

Loan to ESOP to purchase shares (20,000) (20,000)

Repayment of ESOP loan(a) 6,989 6,989

Balance at Dec. 31, 2000 340,834 $852,085 $ 2,607,025 $ 2,284,220 $(24,617) $(156,929) $ 5,561,784

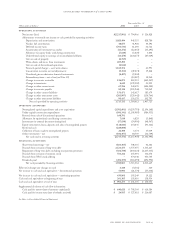

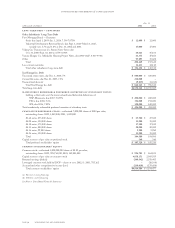

Net income 794,966 794,966

Currency translation adjustments (56,693) (56,693)

Cumulative effect of accounting change –

net unrealized transition loss upon

adoption of SFAS No. 133 (see

Note 17) (28,780) (28,780)

After-tax net unrealized gains related to

derivatives accounted for as hedges

(see Note 17) 43,574 43,574

After-tax net realized losses on derivative

transactions reclassified into earnings

(see Note 17) 19,449 19,449

Unrealized loss – marketable securities (75) (75)

Comprehensive income for 2001 772,441

Dividends declared:

Cumulative preferred stock of

Xcel Energy (4,241) (4,241)

Common stock (516,515) (516,515)

Issuances of common stock – net proceeds 4,967 12,418 120,673 133,091

Other (27) (27)

Gain recognized from NRG stock offering 241,891 241,891

Repayment of ESOP loan(a) 6,053 6,053

Balance at Dec. 31, 2001 345,801 $864,503 $ 2,969,589 $ 2,558,403 $(18,564) $(179,454) $ 6,194,477

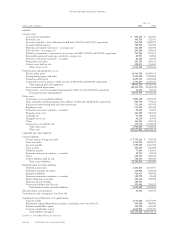

Net loss (2,217,991) (2,217,991)

Currency translation adjustments 30,008 30,008

Minimum pension liability (107,782) (107,782)

After-tax net unrealized losses related to

derivatives accounted for as hedges

(see Note 17) (68,266) (68,266)

After-tax net realized losses on derivative

transactions reclassified into earnings

(see Note 17) 28,791 28,791

Unrealized loss – marketable securities (457) (457)

Comprehensive income (loss) for 2002 (2,335,697)

Dividends declared:

Cumulative preferred stock of

Xcel Energy (4,241) (4,241)

Common stock (437,113) (437,113)

Issuances of common stock – net proceeds 27,148 67,870 513,342 581,212

Acquisition of NRG minority

common shares 25,765 64,412 555,220 28,150 647,782

Repayment of ESOP loan(a) 18,564 18,564

Balance at Dec. 31, 2002 398,714 $996,785 $4,038,151 $ (100,942) $ – $(269,010) $4,664,984

(a) Did not affect cash flows.

See Notes to Consolidated Financial Statements

consolidated statements of common stockholders’equity and other comprehensive income

xcel energy inc. and subsidiaries page 47