Xcel Energy 2002 Annual Report Download - page 43

Download and view the complete annual report

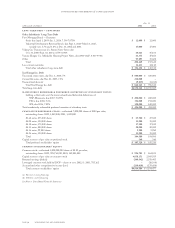

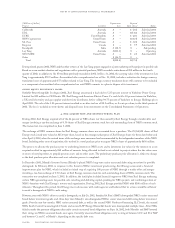

Please find page 43 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additional asset impairments may be recorded by NRG in periods subsequent to Dec. 31, 2002, given the changing business conditions

and the resolution of the pending financial restructuring plan. Management is unable to determine the possible magnitude of any

additional asset impairments, but it could be material.

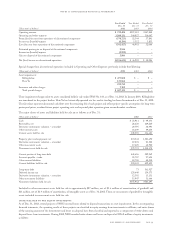

NRG Financial Restructuring and NEO Costs In 2002, NRG expensed a pretax charge of $26 million for expected severance and related

benefits related to its financial restructuring and business realignment. Through Dec. 31, 2002, severance costs have been recognized for all

employees who had been terminated as of that date. See Note 4 for further discussion of NRG financial restructuring activities and

developments. These costs also include a charge related to NRG’s NEO landfill gas generation operations for the estimated impact

of a dispute settlement with NRG’s partner on the NEO project, Fortistar.

2002 Regulatory Recovery Adjustment – SPS In late 2001, SPS filed an application requesting recovery of costs incurred to comply

with transition to retail competition legislation in Texas and New Mexico. During 2002, SPS entered into a settlement agreement

with intervenors regarding the recovery of restructuring costs in Texas, which was approved by the state regulatory commission in

May 2002. Based on the settlement agreement, SPS wrote off pretax restructuring costs of approximately $5 million.

2002 Other Nonregulated Asset Impairments In 2002, a subsidiary of Xcel Energy decided it would no longer fund one of its power projects

in Argentina. This decision resulted in the shutdown of the Argentina plant facility, pending financing of a necessary maintenance

outage. Updated cash flow projections for the plant were insufficient to provide recovery of Xcel International’s investment. Nonregulated

asset impairments include a write-down of approximately $13 million for this Argentina facility.

2002 Holding Company NRG Restructuring Charges In 2002, the Xcel Energy holding company incurred approximately $5 million for

charges related to NRG’s financial restructuring.

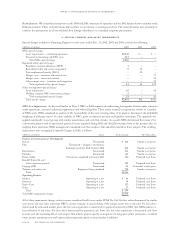

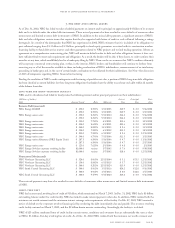

2002 and 2001 – Utility Restaffing During 2001, Xcel Energy expensed pretax special charges of $39 million for expected staff consolidation

costs for an estimated 500 employees in several utility operating and corporate support areas of Xcel Energy. In 2002, the identification of

affected employees was completed and additional pretax special charges of $9 million were expensed for the final costs of staff consolidations.

Approximately $6 million of these restaffing costs were allocated to Xcel Energy’s Utility Subsidiaries. All 564 of accrued staff terminations

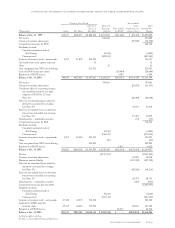

have occurred. See the summary of costs below.

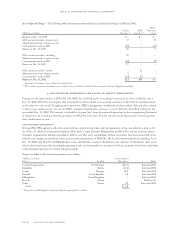

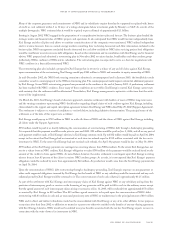

2001 – Post-employment Benefits PSCo adopted accrual accounting for post-employment benefits under SFAS No. 112 – “Employers

Accounting for Post-employment Benefits” in 1994. The costs of these benefits had been recorded on a pay-as-you-go basis and,

accordingly, PSCo recorded a regulatory asset in anticipation of obtaining future rate recovery of these transition costs. PSCo

recovered its FERC jurisdictional portion of these costs. PSCo requested approval to recover its Colorado retail natural gas jurisdictional

portion in a 1996 retail rate case and its retail electric jurisdictional portion in the electric earnings test filing for 1997.In the 1996 rate

case, the CPUC allowed recovery of post-employment benefit costs on an accrual basis, but denied PSCo’s request to amortize the transition

costs’ regulatory asset. Following various appeals, which proved unsuccessful, PSCo wrote off $23 million pretax of regulatory assets

related to deferred post-employment benefit costs as of June 30, 2001.

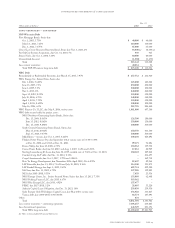

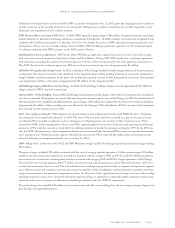

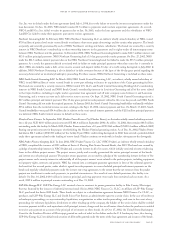

2000 – Merger Costs At the time of the NCE and NSP-Minnesota merger in 2000, Xcel Energy expensed pretax special charges totaling

$241 million.

The pretax charges included $199 million associated with the costs of merging regulated operations. Of these pretax charges, $52 million

related to one-time, transaction-related costs incurred in connection with the merger of NSP and NCE, and $147 million pertained to

incremental costs of transition and integration activities associated with merging NSP and NCE to begin operations as Xcel Energy.

The transition costs include approximately $77 million for severance and related expenses associated with staff reductions. All 721 of

accrued staff terminations have occurred. The staff reductions were nonbargaining positions mainly in corporate and operations support

areas. Other transition and integration costs include amounts incurred for facility consolidation, systems integration, regulatory transition,

merger communications and operations integration assistance. An allocation of the regulated portion of merger costs was made to utility

operating companies using a basis consistent with prior regulatory filings, in proportion to expected merger savings by company and

consistent with service company cost allocation methodologies utilized under the PUHCA requirements.

The pretax charges also included $42 million of asset impairments and other costs resulting from the post-merger strategic alignment of

Xcel Energy’s nonregulated businesses.

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 57