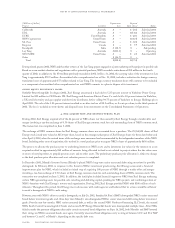

Xcel Energy 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

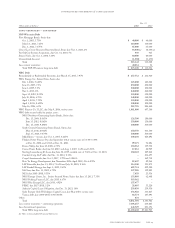

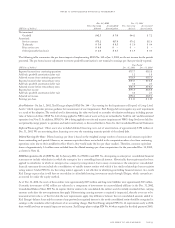

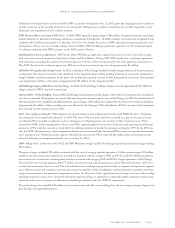

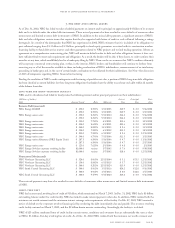

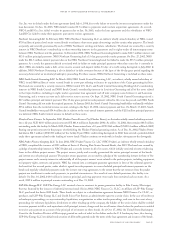

Accrued Special Charges – The following table summarizes activity related to accrued special charges in 2002 and 2001:

Merger

Utility NRG Transition

(Millions of dollars) Severance * Severance ** Costs *

Balance at Dec. 31, 1999 $ – $ – $ –

2000 accruals recorded – merger costs 77 – 70

Adjustments/revisions to prior accruals – – –

Cash payments made in 2000 (29) – (63)

Balance at Dec. 31, 2000 48–7

2001 accruals recorded – restaffing 39 – –

Adjustments/revisions to prior accruals - – –

Cash payments made in 2001 (50) – (7)

Balance at Dec. 31, 2001 37––

2002 accruals recorded – various –23 –

Adjustments/revisions to prior accruals 9 – –

Cash payments made in 2002 (33) (5) –

Balance at Dec. 31, 2002 $13 $18 $ –

*Reported on the balance sheet in Other Current Liabilities.

** $15.5 million reported on the balance sheet in Other Current Liabilities and $2.5 million reported in Benefit Obligations and Other.

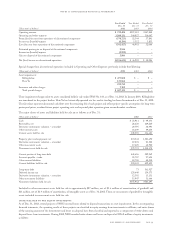

3. discontinued operations and losses on equity investments

Pursuant to the requirements of SFAS No. 144, NRG has classified and is accounting for certain of its assets as held for sale at

Dec. 31, 2002. SFAS No. 144 requires that assets held for sale be valued on an asset-by-asset basis at the lower of carrying amount

or fair value less costs to sell. In applying those provisions, NRG’s management considered cash flow analyses, bids and offers related

to those assets and businesses. As a result, NRG recorded estimated after-tax losses on assets held for sale of $5.8 million for the

year ended Dec. 31, 2002. This amount is included in Income (loss) from discontinued operations in the accompanying Statement

of Operations. In accordance with the provisions of SFAS No. 144, assets held for sale will not be depreciated commencing with

their classification as such.

discontinued operations

During 2002, NRG agreed to sell certain assets and has entered into purchase and sale agreements or has committed to a plan to sell.

As of Dec. 31, 2002, five international projects (Bulo Bulo, Csepel, Entrade, Killingholme and Hsin Yu) and one domestic project

(Crockett Cogeneration) had been classified as held for sale. The assets and liabilities of these six projects have been reclassified to the

held-for-sale category on the balance sheet and meet the requirements of SFAS No. 144 for discontinued operations reporting. As of

Dec. 31, 2002, only Hsin Yu and Killingholme’s assets and liabilities remain in the held-for-sale categories of the balance sheet as the

other entities have been sold. Accordingly, operating results and estimated losses on disposal of these six projects have been reclassified

to discontinued operations for current and prior periods.

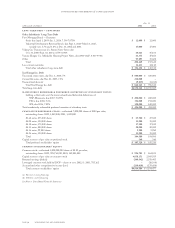

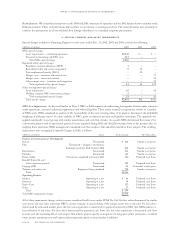

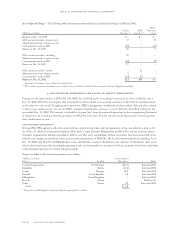

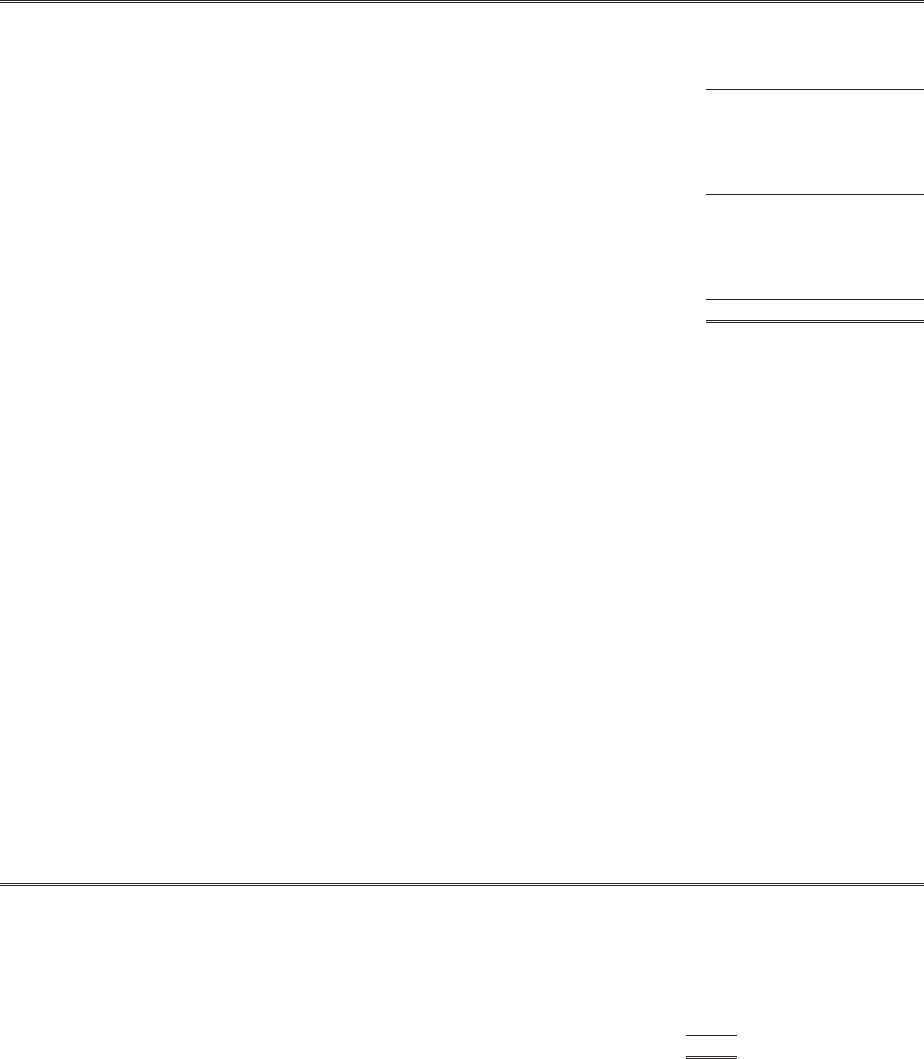

Projects included in discontinued operations are as follows:

(Millions of dollars) Pretax Disposal

Project Location Gain (Loss) Status

Crockett Cogeneration United States $(11.5) Sale final 2002

Bulo Bulo Bolivia (10.6) Sale final 2002

Csepel Hungary 21.2 Sale final 2002

Entrade Czech Republic 2.8 Sale final 2002

Killingholme* United Kingdom – Sale final 2003

Hsin Yu Taiwan – Held for sale

Other Various 0.9 Sales final 2002

Total $ 2.8

*The foreclosure of Killingholme in January 2003 for a gain of $182.3 million

page 58 xcel energy inc. and subsidiaries

notes to consolidated financial statements