Xcel Energy 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

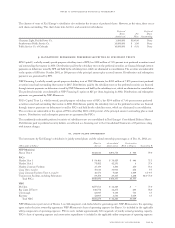

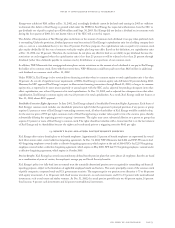

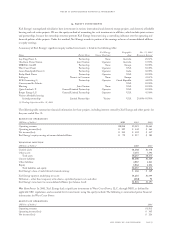

financial position

(Millions of dollars) 2001

Current assets $ 401

Other assets 659

Total assets $1,060

Current liabilities $ 138

Other liabilities 269

Equity 653

Total liabilities and equity $1,060

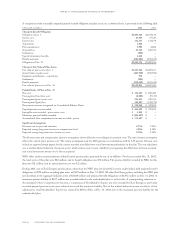

Yorkshire Power During February 2001, Xcel Energy reached an agreement to sell the majority of its investment in Yorkshire Power to

Innogy Holdings plc. As a result of this sales agreement, Xcel Energy did not record any equity earnings from Yorkshire Power after

January 2001. In April 2001, Xcel Energy closed the sale of Yorkshire Power. Xcel Energy had retained an interest of approximately

5.25 percent in Yorkshire Power to comply with pooling-of-interests accounting requirements associated with the merger of NSP and

NCE in 2000. Xcel Energy received approximately $366 million for the sale, which approximated the book value of Xcel Energy’s

investment. On Aug. 28, 2002, Xcel Energy sold its remaining 5.25-percent interest in Yorkshire Power at slightly less than book value.

15.extraordinary items

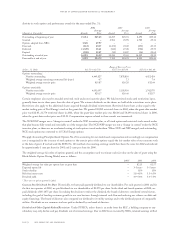

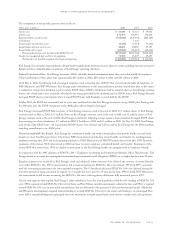

SPS In the second quarter of 2000, SPS discontinued regulatory accounting under SFAS No. 71 for the generation portion of its business

due to the issuance of a written order by the Public Utility Commission of Texas (PUCT) in May 2000, addressing the implementation

of electric utility restructuring. SPS’ transmission and distribution business continued to meet the requirements of SFAS No. 71, as that

business was expected to remain regulated. During the second quarter of 2000, SPS wrote off its generation-related regulatory assets and

other deferred costs, totaling approximately $19.3 million. This resulted in an after-tax extraordinary charge of approximately $13.7 million.

During the third quarter of 2000, SPS recorded an extraordinary charge of $8.2 million before tax, or $5.3 million after tax, related to the

tender offer and defeasance of first mortgage bonds. The first mortgage bonds were defeased to facilitate the legal separation of generation,

transmission and distribution assets, which was expected to eventually occur in 2001 under restructuring requirements in effect in 2000.

In March 2001, the state of New Mexico enacted legislation that amended its Electric Utility Restructuring Act of 1999 and delayed

customer choice until 2007. SPS has requested recovery of its costs incurred to prepare for customer choice in New Mexico. A decision

on this and other matters is pending before the New Mexico Public Regulation Commission. SPS expects to receive future regulatory

recovery of these costs.

In June 2001, the governor of Texas signed legislation postponing the deregulation and restructuring of SPS until at least 2007. This

legislation amended the 1999 legislation, Senate Bill No. 7 (SB-7), which provided for retail electric competition beginning in Texas in

January 2002. Under the amended legislation, prior PUCT orders issued in connection with the restructuring of SPS are considered null

and void. In addition, under the new legislation, SPS is entitled to recover all reasonable and necessary expenditures made or incurred

before Sept. 1, 2001, to comply with SB-7.

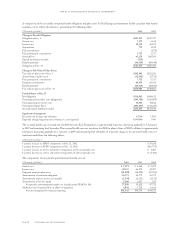

As a result of these recent legislative developments, SPS reapplied the provisions of SFAS No. 71 for its generation business during the

second quarter of 2001. More than 95 percent of SPS’ retail electric revenues are from operations in Texas and New Mexico. Because

of the delays to electric restructuring passed by Texas and New Mexico, SPS’ previous plans to implement restructuring, including the

divestiture of generation assets, have been abandoned. Accordingly, SPS will now continue to be subject to rate regulation under traditional

cost-of-service regulation, consistent with its past accounting and ratemaking practices for the foreseeable future, until at least 2007.

During the fourth quarter of 2001, SPS completed a $500-million, medium-term debt financing with the proceeds used to reduce

short-term borrowings that had resulted from the 2000 defeasance. In its regulatory filings and communications, SPS proposed to

amortize its defeasance costs over the five-year life of the refinancing, consistent with historical ratemaking, and has requested incremental

rate recovery of $25 million of other restructuring costs in Texas and New Mexico. These nonfinancing restructuring costs have been

deferred and are being amortized consistent with rate recovery. Based on these 2001 events, management’s expectation of rate recovery

of prudently incurred costs and the corresponding reduced uncertainty surrounding the financial impacts of the delay in restructuring,

SPS restored certain regulatory assets totaling $17.6 million as of Dec. 31, 2001, and reported related after-tax extraordinary income

of $11.8 million, or 3 cents per share. Regulatory assets previously written off in 2000 were restored only for items currently being

recovered in rates and items where future rate recovery is considered probable.

PSCo During 2001, PSCo’s subsidiary, 1480 Welton, Inc., redeemed its long-term debt and in doing so incurred redemption premiums

and other costs of $2.5 million, or $1.5 million after tax. These items are reported as an Extraordinary Item on Xcel Energy’s Consolidated

Statement of Operations.

page 78 xcel energy inc. and subsidiaries

notes to consolidated financial statements