Xcel Energy 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

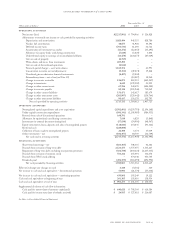

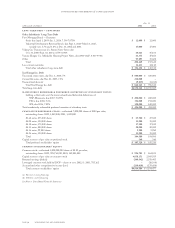

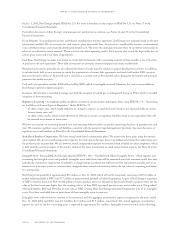

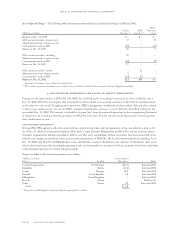

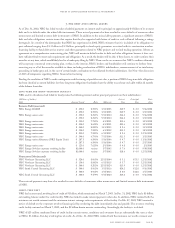

Dec. 31, 2002 Dec. 31, 2001

Gross Carrying Accumulated Gross Carrying Accumulated

(Millions of dollars) Amount Amortization Amount Amortization

Not amortized:

Goodwill $42.5 $ 7.0 $44.1 $ 7.2

Amortized:

Service contracts $73.2 $17.9 $76.2 $15.6

Trademarks $5.0 $ 0.5 $ 5.0 $ 0.4

Prior service costs $6.9 $ – $– $–

Other (primarily franchises) $2.0 $ 0.5 $ 1.9 $ 0.4

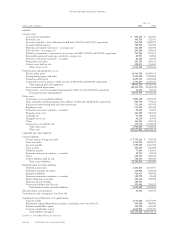

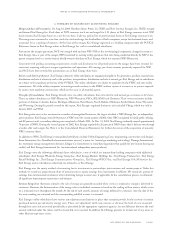

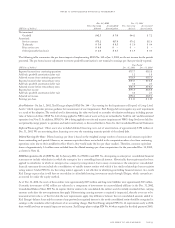

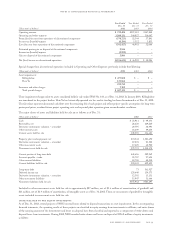

The following table summarizes the pro forma impact of implementing SFAS No. 142 at Jan. 1, 2000, on the net income for the periods

presented. The pro forma income adjustment to remove goodwill amortization is not material to earnings per share previously reported.

Year Ended

(Millions of dollars) Dec. 31, 2001 Dec. 31, 2000

Reported income from continuing operations $737.7 $513.8

Add back: goodwill amortization (after tax) 1.2 1.8

Adjusted income from continuing operations $738.9 $515.6

Reported income before extraordinary items $784.7 $545.8

Add back: goodwill amortization (after tax) 3.2 2.5

Adjusted income before extraordinary items $787.9 $548.3

Reported net income $795.0 $526.8

Add back: goodwill amortization (after tax) 3.2 2.5

Adjusted net income $798.2 $529.3

Earnings per share $ 2.31 $ 1.55

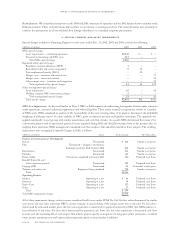

Asset Valuation On Jan. 1, 2002, Xcel Energy adopted SFAS No. 144 – “Accounting for the Impairment or Disposal of Long-Lived

Assets,” which supercedes previous guidance for measurement of asset impairments. Xcel Energy did not recognize any asset impairments

as a result of the adoption. The method used in determining fair value was based on a number of valuation techniques, including present

value of future cash flows. SFAS No. 144 is being applied to NRG’s sale of assets as they are reclassified to “held for sale” and discontinued

operations (see Note 3). In addition, SFAS No. 144 is being applied to test for and measure impairment of NRG’s long-lived assets held for

use (primarily energy projects in operation and under construction), as discussed further in Note 2 to the Consolidated Financial Statements.

Deferred Financing Costs Other assets also included deferred financing costs, net of amortization, of approximately $198 million at

Dec. 31, 2002. We are amortizing these financing costs over the remaining maturity periods of the related debt.

Diluted Earnings Per Share Diluted earnings per share is based on the weighted average number of common and common equivalent

shares outstanding each period. However, no common equivalent shares are included in the computation when a loss from continuing

operations exists due to their antidilutive effect (that is, they would make the loss per share smaller). Therefore, common equivalent

shares of approximately 5.4 million were excluded from the diluted earnings-per-share computations for the year ended Dec. 31, 2002,

as shown in Note 12.

FASB Interpretation No. 46 (FIN No. 46) In January 2003, the FASB issued FIN No. 46 requiring an enterprise’s consolidated financial

statements to include subsidiaries in which the enterprise has a controlling financial interest. Historically, that requirement has been

applied to subsidiaries in which an enterprise has a majority voting interest, but in many circumstances the enterprise’s consolidated

financial statements do not include the consolidations of variable interest entities with which it has similar relationships but no majority

voting interest. Under FIN No. 46, the voting interest approach is not effective in identifying controlling financial interest. As a result,

Xcel Energy expects that it will have to consolidate its affordable housing investments made through Eloigne, which currently are

accounted for under the equity method.

As of Dec. 31, 2002, the assets of these entities were approximately $155 million and long-term liabilities were approximately $87 million.

Currently, investments of $62 million are reflected as a component of investments in unconsolidated affiliates in the Dec. 31, 2002,

Consolidated Balance Sheet. FIN No. 46 requires that for entities to be consolidated, the entities’ assets be initially recorded at their carrying

amounts at the date the new requirement first apply. If determining carrying amounts as required is impractical, then the assets are to be

measured at fair value as of the first date the new requirements apply. Any difference between the net consolidated amounts added to

Xcel Energy’s balance sheet and the amount of any previously recognized interest in the newly consolidated entity should be recognized in

earnings as the cumulative effect adjustment of an accounting change. Had Xcel Energy adopted FIN No. 46 requirements early in 2002,

there would have been no material impact to net income. Xcel Energy plans to adopt FIN No. 46 when required in the third quarter of 2003.

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 55