Xcel Energy 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pension Plan Costs and Assumptions Xcel Energy’s pension costs are based on an actuarial calculation that includes a number of key

assumptions, most notably the annual return level that pension investment assets will earn in the future, and the interest rate used to

discount future pension benefit payments to a present value obligation for financial reporting. In addition, the actuarial calculation uses

an asset-smoothing methodology to reduce the volatility of varying investment performance over time. Note 13 to the Consolidated

Financial Statements discusses the rate of return and discount rate used in the calculation of pension costs and obligations in the

accompanying financial statements.

Pension costs have been increasing in recent years, and are expected to increase further over the next several years, due to lower than

expected investment returns experienced and decreases in interest rates used to discount benefit obligations. Investment returns in 2000

and 2001 were below the assumed level of 9.5 percent, and interest rates have declined from the 7.5-percent to 8-percent levels used in

1999 and 2000 cost determinations to 7.25 percent used in 2002. Xcel Energy continually reviews its pension assumptions, and in 2003,

expects to change the investment return assumption to 9.25 percent and the discount rate assumption to 6.75 percent.

Xcel Energy bases its investment return assumption on expected long-term performance for each of the investment types included in its

pension asset portfolio. These include equity investments, such as corporate common stocks; fixed-income investments, such as corporate

bonds; and U.S. Treasury securities and nontraditional investments, such as timber or real estate partnerships. In reaching a return

assumption, Xcel Energy considers the actual historical returns achieved by its asset portfolio over the past 20-year or longer period, as

well as the long-term return levels projected and recommended by investment experts in the marketplace. The historical weighted average

annual return for the past 20 years for the Xcel Energy portfolio of pension investments is 12.6 percent, in excess of the current assumption

level. The pension cost determinations assume the continued current mix of investment types over the long term. The target and 2002

mix of assets among these portfolio components is discussed in Note 13 to the Consolidated Financial Statements. The Xcel Energy

portfolio is heavily weighted toward equity securities, and includes nontraditional investments that can provide a higher-than-average

return. However, as is the experience in recent years, a higher weighting in equity investments can increase the volatility in the return

levels actually achieved by pension assets in any year. Xcel Energy lowered the 2003 pension investment return assumptions to reflect

the changing expectations of investment experts in the marketplace.

The investment gains or losses resulting from the difference between the expected pension returns assumed on smoothed or “market-related”

asset levels and actual returns earned is deferred in the year the difference arises and recognized over the subsequent five-year period.

This gain or loss recognition occurs by using a five-year moving-average value of pension assets to measure expected asset returns in the

cost determination process, and by amortizing deferred investment gains or losses over the subsequent five-year period. Based on the

use of average market-related asset values, and considering the expected recognition of past investment gains and losses over the next

five years, achieving the assumed rate of asset return of 9.25 percent in each future year and holding other assumptions constant, we

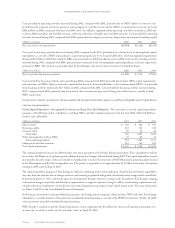

currently project that the pension costs recognized by Xcel Energy for financial reporting purposes will increase from a credit,or negative

expense, of $84 million in 2002 to a credit of $45 million in 2003, a credit of $20 million in 2004, and a net expense of $20 million

in 2005. Pension costs are currently a credit due to the recognized investment asset returns exceeding the other pension cost components,

such as benefits earned for current service and interest costs for the effects of the passage of time on discounted obligations.

Xcel Energy bases its discount rate assumption on benchmark interest rates quoted by an established credit rating agency, Moody’s Investors

Service (Moody’s), and has consistently benchmarked the interest rate used to derive the discount rate to the movements in the long-term

corporate bond indices for bonds rated AAA through BAA by Moody’s, which have a period to maturity comparable to our projected benefit

obligations. At Dec. 31, 2002, the annualized Moody’s Aa index rate, roughly in the middle of the AAA and BAA range, was 6.63 percent,

which when rounded to the nearest quarter-percent rate, as is our policy, resulted in our 6.75-percent pension discount rate at year-end 2002.

This rate was used to value the actuarial benefit obligations at that date, and will be used in 2003 pension cost determinations.

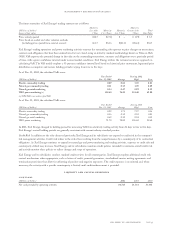

If Xcel Energy were to use alternative assumptions for pension cost determinations, a 1-percent change would result in the following

impacts on the estimated pension costs recognized by Xcel Energy for financial reporting purposes:

– a 1-percent higher rate of return, 10.25 percent, would decrease 2003 pension costs by $22 million

– a 1-percent lower rate of return, 8.25 percent, would increase 2003 pension costs by $22 million

– a 1-percent higher discount rate, 7.75 percent, would decrease 2003 pension costs by $8 million

– a 1-percent lower discount rate, 5.75 percent, would increase 2003 pension costs by $12 million

Alternative assumptions would also change the expected future cash funding requirements for the pension plans. Cash funding requirements

can be impacted by changes to actuarial assumptions, actual asset levels and other pertinent calculations prescribed by the funding

requirements of income tax and other pension-related regulations. These regulations did not require cash funding in recent years for

Xcel Energy’s pension plans, and do not require funding in 2003. Assuming future asset return levels equal the actuarial assumption of

9.25 percent for the years 2003-2005, then under current funding regulations we project that no cash funding would be required for

2004, $35 million in funding would be required for 2005 and $54 million in funding would be required for 2006. Actual performance

can affect these funding requirements significantly. If the actual return level is 0 percent in 2003 and 2004, which assumes a continued

downturn in the financial markets, and 9.25 percent in 2005 then the 2004 cash-funding requirement would still be zero. However, the

page 26 xcel energy inc. and subsidiaries

management’s discussion and analysis