Xcel Energy 2002 Annual Report Download - page 39

Download and view the complete annual report

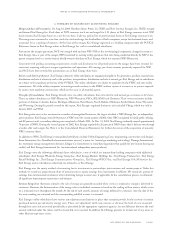

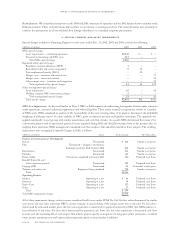

Please find page 39 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Decommissioning Xcel Energy accounts for the future cost of decommissioning – or permanently retiring – its nuclear generating plants

through annual depreciation accruals using an annuity approach designed to provide for full rate recovery of the future decommissioning

costs. Our decommissioning calculation covers all expenses, including decontamination and removal of radioactive material, and extends

over the estimated lives of the plants. The calculation assumes that NSP-Minnesota and NSP-Wisconsin will recover those costs through

rates. For more information on nuclear decommissioning, see Note 19 to the Consolidated Financial Statements.

PSCo also previously operated a nuclear generating plant, which has been decommissioned and repowered using natural gas. PSCo’s

costs associated with decommissioning were deferred and are being amortized consistent with regulatory recovery.

Nuclear Fuel Expense Nuclear fuel expense, which is recorded as our nuclear generating plants use fuel, includes the cost of fuel used in

the current period, as well as future disposal costs of spent nuclear fuel. In addition, nuclear fuel expense includes fees assessed by the

U.S. Department of Energy (DOE) for NSP-Minnesota’s portion of the cost of decommissioning the DOE’s fuel enrichment facility.

Environmental Costs We record environmental costs when it is probable Xcel Energy is liable for the costs and we can reasonably

estimate the liability. We may defer costs as a regulatory asset based on our expectation that we will recover these costs from customers

in future rates. Otherwise, we expense the costs. If an environmental expense is related to facilities we currently use, such as pollution-

control equipment, we capitalize and depreciate the costs over the life of the plant, assuming the costs are recoverable in future rates

or future cash flow.

We record estimated remediation costs, excluding inflationary increases and possible reductions for insurance coverage and rate recovery.

The estimates are based on our experience, our assessment of the current situation and the technology currently available for use in the

remediation. We regularly adjust the recorded costs as we revise estimates and as remediation proceeds. If we are one of several designated

responsible parties, we estimate and record only our share of the cost. We treat any future costs of restoring sites where operation may

extend indefinitely as a capitalized cost of plant retirement. The depreciation expense levels we can recover in rates include a provision

for these estimated removal costs.

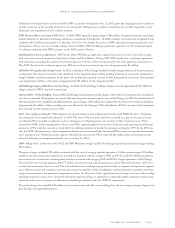

Income Taxes Xcel Energy and its domestic subsidiaries, other than NRG and its domestic subsidiaries, file consolidated federal income

tax returns. NRG and its domestic subsidiaries were included in Xcel Energy’s consolidated federal income tax returns prior to NRG’s

March 2001 public equity offering, but filed consolidated federal income tax returns, with NRG as the common parent, separate and apart

from Xcel Energy for the periods of March 13, 2001, through Dec. 31, 2001, and Jan. 1, 2002, through June 3, 2002. Since becoming

wholly owned indirect subsidiaries of Xcel Energy on June 3, 2002, NRG and its domestic subsidiaries have not been reconsolidated

with Xcel Energy for federal income tax purposes, and each of NRG and its domestic subsidiaries will file separate federal income tax

returns as a result of their inclusion in the Xcel Energy consolidated federal income tax return within the last five years. Xcel Energy

and its domestic subsidiaries file combined and separate state income tax returns. NRG and one or more of its domestic subsidiaries will

be included in some, but not all, of these combined returns in 2002. Federal income taxes paid by Xcel Energy, as parent of the Xcel

Energy consolidated group, are allocated to the Xcel Energy subsidiaries based on separate company computations of tax. A similar allocation

is made for state income taxes paid by Xcel Energy in connection with combined state filings. In accordance with PUHCA requirements,

the holding company also allocates its own net income tax benefits to its direct subsidiaries based on the positive tax liability of each

company. Xcel Energy defers income taxes for all temporary differences between pretax financial and taxable income, and between the book

and tax bases of assets and liabilities. Xcel Energy uses the tax rates that are scheduled to be in effect when the temporary differences

are expected to turn around, or reverse.

Due to the effects of past regulatory practices, when deferred taxes were not required to be recorded, we account for the reversal of some

temporary differences as current income tax expense. We defer investment tax credits and spread their benefits over the estimated lives

of the related property. Utility rate regulation also has created certain regulatory assets and liabilities related to income taxes, which we

summarize in Note 20 to the Consolidated Financial Statements. We discuss our income tax policy for international operations in Note 11

to the Consolidated Financial Statements.

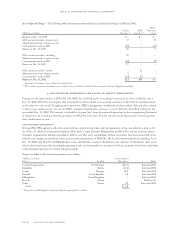

Foreign Currency Translation Xcel Energy’s foreign operations generally use the local currency as their functional currency in translating

international operating results and balances to U.S. currency. Foreign currency denominated assets and liabilities are translated at the

exchange rates in effect at the end of a reporting period. Income, expense and cash flows are translated at weighted-average exchange rates

for the period. We accumulate the resulting currency translation adjustments and report them as a component of Other Comprehensive

Income in common stockholders’ equity. When we convert cash distributions made in one currency to another currency, we include those

gains and losses in the results of operations as a component of Other Nonoperating Income. Currency exchange transactions resulted in

a pretax gain (loss) of $30 million in 2002, $(57) million in 2001 and $(79) million in 2000.

Derivative Financial Instruments Xcel Energy and its subsidiaries utilize a variety of derivatives, including interest rate swaps and locks,

foreign currency hedges and energy contracts, to reduce exposure to corresponding risks. The energy contracts are both financial- and

commodity-based in the energy trading and energy nontrading operations. These contracts consist mainly of commodity futures and options,

index or fixed price swaps and basis swaps.

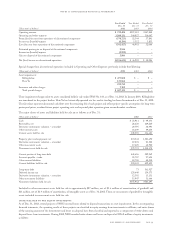

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 53