Xcel Energy 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

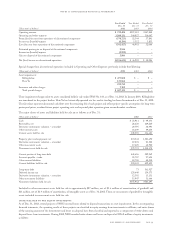

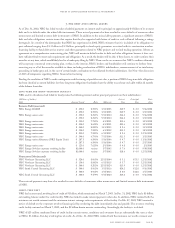

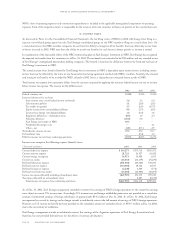

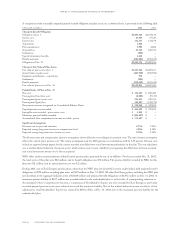

The charters of some of Xcel Energy’s subsidiaries also authorize the issuance of preferred shares. However, at this time, there are no

such shares outstanding. This chart shows data for first- and second-tier subsidiaries:

Preferred Preferred

Shares Par Shares

Authorized Value Outstanding

Cheyenne Light, Fuel & Power Co. 1,000,000 $100.00 None

Southwestern Public Service Co. 10,000,000 $ 1.00 None

Public Service Co. of Colorado 10,000,000 $ 0.01 None

9. mandatorily redeemable preferred securities of subsidiary trusts

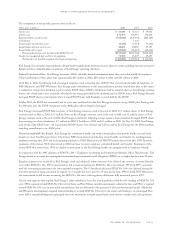

SPS Capital I, a wholly owned, special-purpose subsidiary trust of SPS, has $100 million of 7.85-percent trust preferred securities issued

and outstanding that mature in 2036. Distributions paid by the subsidiary trust on the preferred securities are financed through interest

payments on debentures issued by SPS and held by the subsidiary trust, which are eliminated in consolidation. The securities are redeemable

at the option of SPS after October 2001, at 100 percent of the principal amount plus accrued interest. Distributions and redemption

payments are guaranteed by SPS.

NSP Financing I, a wholly owned, special-purpose subsidiary trust of NSP-Minnesota, has $200 million of 7.875-percent trust preferred

securities issued and outstanding that mature in 2037. Distributions paid by the subsidiary trust on the preferred securities are financed

through interest payments on debentures issued by NSP-Minnesota and held by the subsidiary trust, which are eliminated in consolidation.

The preferred securities are redeemable at NSP Financing I’s option at $25 per share, beginning in 2002. Distributions and redemption

payments are guaranteed by NSP-Minnesota.

PSCo Capital Trust I, a wholly owned, special-purpose subsidiary trust of PSCo, has $194 million of 7.60-percent trust preferred

securities issued and outstanding that mature in 2038. Distributions paid by the subsidiary trust on the preferred securities are financed

through interest payments on debentures issued by PSCo and held by the subsidiary trust, which are eliminated in consolidation.

The securities are redeemable at the option of PSCo after May 2003 at 100 percent of the principal amount outstanding plus accrued

interest. Distributions and redemption payments are guaranteed by PSCo.

The mandatorily redeemable preferred securities of subsidiary trusts are consolidated in Xcel Energy’s Consolidated Balance Sheets.

Distributions paid to preferred security holders are reflected as a financing cost in the Consolidated Statements of Operations,along

with interest charges.

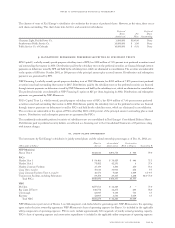

10. joint plant ownership

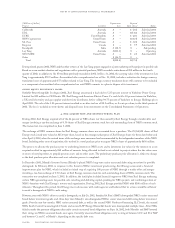

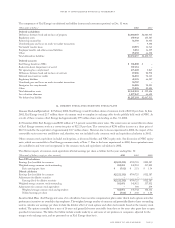

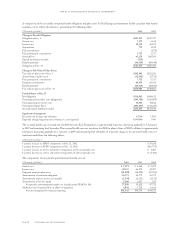

The investments by Xcel Energy’s subsidiaries in jointly owned plants and the related ownership percentages as of Dec. 31, 2002, are:

Plant in Accumulated Construction

(Thousands of dollars) Service Depreciation Work in Progress Ownership %

NSP-Minnesota

Sherco Unit 3 $612,643 $291,754 $ 943 59.0

PSCo

Hayden Unit 1 $ 84,486 $ 38,429 $ 446 75.5

Hayden Unit 2 79,882 42,291 6 37.4

Hayden Common Facilities 27,339 3,300 250 53.1

Craig Units 1 and 2 59,636 31,963 258 9.7

Craig Common Facilities Units 1, 2 and 3 18,473 9,029 3,409 6.5–9.7

Transmission Facilities, including Substations 89,254 29,365 1,208 42.0–73.0

Total PSCo $359,070 $154,377 $5,577

NRG

McClain $277,566 $ 12,329 $ – 77.0

Big Cajun II Unit 3 188,758 12,275 244 58.0

Conemaugh 62,045 4,134 766 3.7

Keystone 52,905 3,543 5,039 3.7

Total NRG $581,274 $ 32,281 $6,049

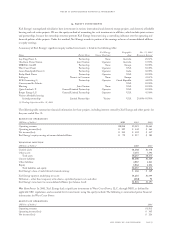

NSP-Minnesota is part owner of Sherco 3, an 860-megawatt, coal-fueled electric generating unit. NSP-Minnesota is the operating

agent under the joint ownership agreement. NSP-Minnesota’s share of operating expenses for Sherco 3 is included in the applicable

utility components of operating expenses. PSCo’s assets include approximately 320 megawatts of jointly owned generating capacity.

PSCo’s share of operating expenses and construction expenditures is included in the applicable utility components of operating expenses.

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 69