Xcel Energy 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NRG’s earnings for 2001 increased primarily due to new acquisitions in Europe and North America, as well as a full year of operation in

2001 of acquisitions made in the fourth quarter of 2000. In addition, NRG’s 2001 earnings reflected a reduction in the overall effective

tax rate and mark-to-market gains related to SFAS No. 133 – “Accounting for Derivative Instruments and Hedging Activity.” The overall

reduction in tax rates in 2001 was primarily due to higher energy credits, the implementation of state tax planning strategies and a higher

percentage of NRG’s overall earnings derived from foreign projects in lower tax jurisdictions.

NRG Special Charges – Impairments and Financial Restructuring As discussed previously, both the continuing and discontinued operations

of NRG in 2002 included material losses for asset impairments and estimated disposal losses. Also, NRG recorded other special charges

in 2002, mainly for incremental costs related to its financial restructuring and business realignment. See Notes 2 and 3 to the Consolidated

Financial Statements for further discussion of NRG’s special charges and discontinued operations, respectively.

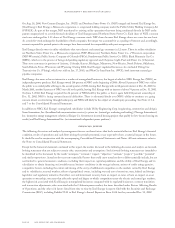

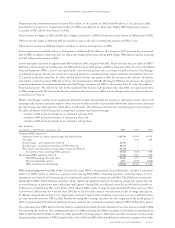

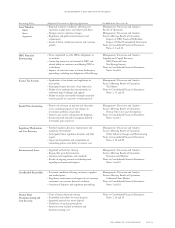

other nonregulated subsidiaries and holding company results

Contribution to Xcel Energy’s earnings per share 2002 2001 2000

Xcel International $(0.05) $(0.02) $ 0.09

Eloigne Company 0.02 0.03 0.02

Seren Innovations (0.07) (0.08) (0.07)

Planergy International –(0.04) (0.08)

e prime –0.02 (0.02)

Financing costs and preferred dividends (0.11) (0.11) (0.07)

Other nonregulated/holding company results (0.01) 0.02 0.01

Subtotal – nonregulated/holding co. excluding tax benefit (0.22) (0.18) (0.12)

Tax benefit from investment in NRG (Note 11) 1.85 ––

Total nonregulated/holding company earnings per share $1.63 $(0.18) $(0.12)

Xcel International Xcel International currently comprises primarily power generation projects in Argentina, and previously included an

investment in Yorkshire Power.

In December 2002, a subsidiary of Xcel Argentina decided it would no longer fund one of its power projects in Argentina and defaulted

on its loan agreements. The default is not material to Xcel Energy. However, this decision resulted in the shutdown of the Argentina

plant facility, pending financing of a necessary maintenance outage. Updated cash flow projections for the plant were insufficient to

provide recovery of Xcel International’s investment. An impairment write-down of approximately $13 million, or 3 cents per share,

was recorded in 2002.

In August 2002, Xcel Energy announced it had sold its 5.25-percent interest in Yorkshire Power Group Limited for $33 million to CE

Electric UK. The sale of the 5.25-percent interest resulted in an after-tax loss of $8.3 million, or 2 cents per share, in 2002. The loss is

included in write-downs and disposal losses from investments on the Consolidated Statements of Operations. Xcel Energy and American

Electric Power Co. initially each held a 50-percent interest in Yorkshire, a UK retail electricity and natural gas supplier and electricity

distributor, before selling 94.75 percent of Yorkshire to Innogy Holdings plc in April 2001. As a result of this sales agreement, Xcel

Energy did not record any equity earnings from Yorkshire Power after January 2001. For more information, see Note 3 to the

Consolidated Financial Statements.

Eloigne Company Eloigne invests in affordable housing that qualifies for Internal Revenue Service tax credits. Eloigne’s earnings

contribution declined slightly in 2002 as tax credits on mature affordable housing projects began to decline. The actual decline in

Eloigne’s net income in 2002, compared with 2001, was only $716,000, with 2002 earnings representing 2.1 cents per share and

2001 earnings representing 2.5 cents per share.

Seren Innovations Seren operates a combination cable television, telephone and high-speed Internet access system in St. Cloud, Minn., and

Contra Costa County, California. Operation of its broadband communications network has resulted in losses. Seren projects improvement in

its operating results with positive cash flow anticipated in 2005, upon completion of its build-out phase, and a positive earnings contribution

anticipated in 2008.

Planergy International Planergy, a wholly owned subsidiary of Xcel Energy, provides energy management services. Planergy’s results

for 2002 improved, largely due to gains from the sale of a portfolio of energy management contracts, which increased earnings by

nearly 2 cents per share.

Planergy’s results for 2000 were reduced by special charges of 4 cents per share for the write-offs of goodwill and project development costs.

e prime e prime’s results for the year ended Dec. 31, 2001, reflect the favorable structure of its contractual portfolio, including natural

gas storage and transportation positions, structured products and proprietary trading in natural gas markets. e prime’s earnings were

lower in 2002, and higher in 2001, due to varying natural gas commodity trading margins, as discussed previously.

page 22 xcel energy inc. and subsidiaries

management’s discussion and analysis