Xcel Energy 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

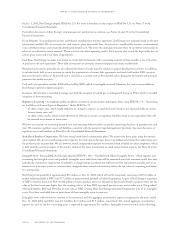

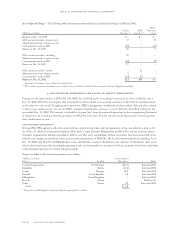

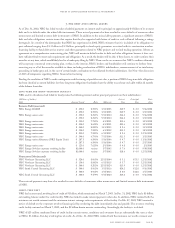

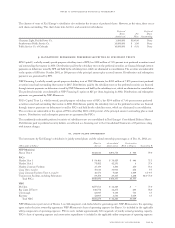

5. short-term borrowings

Notes Payable and Commercial Paper Information regarding notes payable and commercial paper for the years ended Dec. 31, 2002

and 2001, is:

(Millions of dollars, except interest rates) 2002 2001

Notes payable to banks $1,542 $ 835

Commercial paper –1,390

Total short-term debt $1,542 $2,225

Weighted average interest rate at year-end 4.33% 3.41%

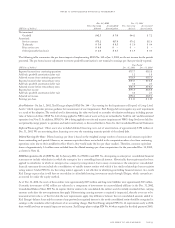

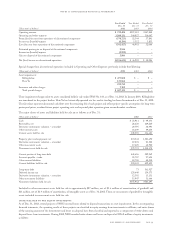

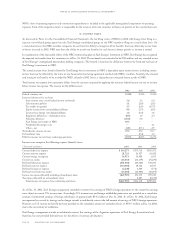

Credit Facilities As of Dec. 31, 2002, Xcel Energy had the following credit facilities available:

Maturity Term Credit Line

Xcel Energy November 2005 5 years $400 million

NSP-Minnesota August 2003 364 days $300 million

PSCo June 2003 364 days $530 million

SPS February 2003 364 days $250 million

Other subsidiaries Various Various $ 55 million

The lines of credit provide short-term financing in the form of bank loans and letters of credit and, depending on credit ratings, provide

support for commercial paper borrowings. At Dec. 31, 2002, there were $399 million of loans outstanding under the Xcel Energy line of

credit and $88 million for PSCo. The borrowing rates under these lines of credit are based on the applicable London Interbank Offered

Rate (LIBOR) plus an applicable spread, a euro dollar rate margin and the amount of money borrowed. At Dec. 31, 2002, the weighted

average interest rate would have been 2.70 percent and 2.42 percent, respectively. See discussion of NRG short-term debt at Note 7.

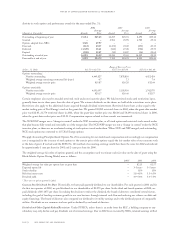

On Jan. 22, 2003, Xcel Energy entered into an agreement with Perry Capital and King Street Capital to provide Xcel Energy with a

nine-month, $100-million term loan facility. The facility carries a 9-percent per annum coupon rate and fees for early termination,

prepayment and extensions within the nine-month period. Xcel Energy has no current need to draw on the facility, but sought the

additional liquidity to provide financing flexibility. Xcel Energy, absent SEC approval under PUHCA, can only draw on this facility

when its common equity exceeds 30 percent of total capitalization.

The SPS $250-million facility expired in February 2003 and was replaced with a $100-million unsecured, 364-day credit agreement.

The NSP-Minnesota and PSCo credit facilities are secured by first mortgages and first collateral trust bonds, respectively.

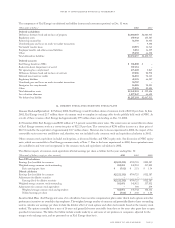

6. long-term debt

Except for SPS and other minor exclusions, all property of our utility subsidiaries is subject to the liens of their first mortgage indentures,

which are contracts between the companies and their bondholders. In addition, certain SPS payments under its pollution-control

obligations are pledged to secure obligations of the Red River Authority of Texas.

The utility subsidiaries’ first mortgage bond indentures provide for the ability to have sinking-fund requirements. These annual

sinking-fund requirements are 1 percent of the highest principal amount of the series of first mortgage bonds at any time outstanding.

Sinking-fund requirements at NSP-Wisconsin, PSCo and Cheyenne are $2.8 million and are for one series of first mortgage bonds

each. Such sinking-fund requirements may be satisfied with property additions or cash. NSP-Minnesota and SPS have no sinking-

fund requirements.

NSP-Minnesota’s 2011 series bonds are redeemable upon seven-days notice at the option of the bondholder. Because of the terms that

allow the holders to redeem these bonds on short notice, we include them in the current portion of long-term debt reported under current

liabilities on the balance sheets.

See discussion of NRG long-term debt at Note 7.

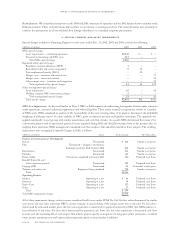

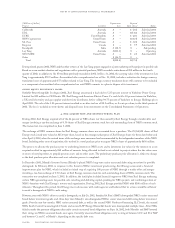

Maturities and sinking fund requirements of long-term debt are:

2003 $7,759 million

2004 $ 239 million

2005 $ 313 million

2006 $ 722 million

2007 $ 420 million

page 64 xcel energy inc. and subsidiaries

notes to consolidated financial statements