Xcel Energy 2002 Annual Report Download - page 75

Download and view the complete annual report

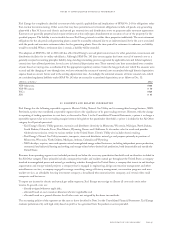

Please find page 75 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.California Litigation NRG and other power generators and power traders have been named as defendants in a multi-district litigation

proceeding. These cases were all filed in late 2000 and 2001 in various state courts throughout California. They allege unfair competition,

market manipulation and price fixing. All the cases were removed to the appropriate United States District Courts, and were thereafter

made the subject of a petition to the multi-district litigation panel. The cases were ultimately assigned to Judge Whaley. In December

2002, Judge Whaley issued an opinion finding that federal jurisdiction was absent in the district court, and remanded the cases to state

court. On Feb. 20, 2003, however, the Ninth Circuit stayed the remand order and accepted jurisdiction to hear an appeal of the remand

order. NRG anticipates that filed-rate/federal preemption pleading challenges will once again be filed once the remand appeal is decided.

A notice of bankruptcy filing regarding NRG has also been filed in this action, providing notice of the involuntary petition.

Although the complaints contain a number of allegations, the basic claim is that by underbidding forward contracts and exporting

electricity to surrounding markets, the defendants, acting in collusion, were able to drive up wholesale prices on the Real Time and

Replacement Reserve markets, through the Western Coordinating Council and otherwise. The complaints allege that the conduct violated

California antitrust and unfair competition laws. NRG does not believe that it has engaged in any illegal activities, and intends to vigorously

defend these lawsuits. These six civil actions brought against NRG and other power generators and power traders in California have

been consolidated in the San Diego County Superior Court, and the plaintiffs in these six consolidated civil actions filed a master

amended complaint reiterating the allegations contained in their complaints and alleging that the defendants’ anti-competitive conduct

damaged the general public and class members in an amount in excess of $1.0 billion. Two of the defendants in these actions, Reliant

and Duke, subsequently filed cross-complaints naming additional market participants, some of whom removed the actions to the United

States District Court for the Southern District of California federal court. Now under advisement in that court is the plaintiffs’ motion

to remand the cases to state court and motions by the cross-defendants to dismiss the cases against them.

In addition, Public Utility District No. 1 of Snohomish County, Washington, has filed a suit against NRG, Xcel Energy and several

other market participants in United States District Court for the Central District of California contending that some of its trading

strategies, as reported to the FERC in response to that agency’s investigation of trading strategies discussed above, violated the California

Business and Professions Code. Public Utility District No. 1 of Snohomish County contends that the effect of those strategies was

to increase amounts that it paid for wholesale power in the spot market in the Pacific Northwest. Judge Whaley granted a motion

to dismiss on the grounds of federal preemption and filed-rate doctrine, which the plaintiffs have appealed.

Separate class action lawsuits alleging unfair competition similar to those filed in California, as discussed previously, have been filed in

Oregon and Washington. These lawsuits have named both Xcel Energy and NRG as respondents.

California Attorney General In addition to the litigation described above, the California Attorney General has undertaken an investigation

into actions affecting electricity prices in California. In connection with this investigation, the Attorney General has issued subpoenas

and requested other information from Dynegy and NRG. NRG responded to the interrogatories as requested. Management cannot

make any evaluation of the likelihood of an unfavorable outcome or an estimate of the amount or range of potential loss in the above-

referenced private actions at this time. NRG knows of no evidence implicating NRG in plaintiffs’ allegations of collusion.

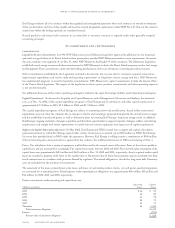

FirstEnergy Arbitration Claim In August 2002, FirstEnergy terminated the purchase agreements pursuant to which NRG had agreed

to purchase four generating stations for approximately $1.5 billion. FirstEnergy’s cited rationale for terminating the agreements was an

alleged anticipatory breach by NRG. FirstEnergy notified NRG that it is reserving the right to pursue legal action against NRG and

Xcel Energy for damages. On Feb. 21, 2003, FirstEnergy submitted filings with the United States Bankruptcy Court in Minnesota

seeking permission to file a demand for arbitration against NRG. On Feb. 26, 2002, FirstEnergy commenced the arbitration proceedings

against NRG, but have yet to quantify their damage claim. NRG cannot presently predict the outcome of this dispute.

General Electric Company and Siemens Westinghouse Turbine Purchase Disputes NRG and/or its affiliates have entered into several turbine

purchase agreements with affiliates of General Electric Company (GE) and Siemens. GE and Siemens have notified NRG that it is in

default under certain of those contracts, terminated such contracts and demanded that NRG pay the termination fees set forth in such

contracts. GE’s claim amounts to $120 million and Siemens’ approximately $45 million in cumulative termination charges. NRG has

recorded a liability for the amounts they believe they owe under the contracts and termination provisions. NRG cannot estimate the

likelihood of unfavorable outcomes in these disputes.

Fortistar Litigation On Feb. 26, 2003, Fortistar Capital, Inc. and Fortistar Methane, LLC filed a $1-billion lawsuit in the Federal District

Court for the Northern District of New York against Xcel Energy Inc. and five former NRG or NEO Corp. employees. In the lawsuit,

Fortistar claims that the defendants violated the Racketeer Influenced and Corrupt Organizations Act (RICO) and committed fraud by

engaging in a pattern of negotiating and executing agreements “they intended not to comply with” and “made false statements later to

conceal their fraudulent promises.” The allegations against Xcel Energy are, for the most part, limited to purported activities related to the

contract for the Pike Energy power facility in Mississippi and statements related to an “equity infusion” into NRG by Xcel Energy. The

plaintiffs allege damages of some $350 million and also assert entitlement to a trebling of these damages under the provisions of the

RICO. The present and former NRG and NEO officers and employees have requested indemnity from NRG, which requests NRG is

now examining. Xcel Energy cannot at this time estimate the likelihood of an unfavorable outcome to the defendants in this lawsuit.

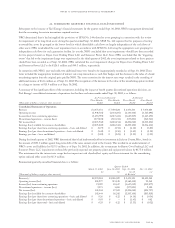

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 89