Xcel Energy 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

credit facility, and the renewal of guarantees for various trading obligations of NRG’s power marketing subsidiary. The SEC reserved

authorizing additional securities issuances by Xcel Energy through June 30, 2003, while its common equity ratio is below 30 percent.

For this purpose, common equity, including minority interest, at Dec. 31, 2002, was 23 percent of total capitalization. As a result,

Xcel Energy may experience constraints on available capital sources that may be affected by factors including earnings levels, project

acquisitions and the financing actions of our subsidiaries. In the event that NRG were to seek protection under bankruptcy laws and

Xcel Energy ceased to have control over NRG, NRG would no longer be a consolidated subsidiary of Xcel Energy for financial

reporting purposes, and Xcel Energy’s common equity ratio under the SEC’s method of calculation would exceed 30 percent.

In December 2002, Xcel Energy filed a request for additional financing authorization with the SEC. Xcel Energy requested an increase

from $2 billion to $2.5 billion in the aggregate amount of securities that it may issue during the period through Sept. 30, 2003. In addition,

the request proposed that common equity will be at least 30 percent of total consolidated capitalization, provided that in any event the

30-percent common equity requirement is not met, Xcel Energy may issue common stock. The notice period expired with no comments.

SEC action on the request is pending. As a result, Xcel Energy at the present time cannot finance, either on a short-term or long-term

basis, without SEC approval unless its common equity is at least 30 percent of total capitalization.

With approval of the request currently pending before the SEC, further described below, management believes it will have adequate

authority under SEC orders and regulations to conduct business as proposed during 2003 and will seek additional authorization

when necessary.

Short-Term Funding Sources Historically, Xcel Energy has used a number of sources to fulfill short-term funding needs, including

operating cash flow, notes payable, commercial paper and bank lines of credit. The amount and timing of short-term funding needs

depend in large part on financing needs for utility construction expenditures and nonregulated project investments. Another significant

short-term funding need is the dividend payment requirement, as discussed previously in Common Stock Dividends.

Operating cash flow as a source of short-term funding is reasonably likely to be affected by such operating factors as weather; regulatory

requirements, including rate recovery of costs, environmental regulation compliance and industry deregulation; changes in the trends for

energy prices and supply; and operational uncertainties that are difficult to predict. See further discussion of such factors under Statement

of Operations Analysis and Factors Affecting Results of Operations.

Short-term borrowing as a source of funding is affected by regulatory actions and access to reasonably priced capital markets. This varies

based on financial performance and existing debt levels. These factors are evaluated by credit-rating agencies that review Xcel Energy and

its subsidiary operations on an ongoing basis. NRG’s credit situation has affected Xcel Energy’s credit ratings and access to short-term

funding. As a result of a decline in its credit ratings, Xcel Energy has been unable to utilize the commercial paper market to satisfy

any short-term funding needs. For additional information on Xcel Energy’s short-term borrowing arrangements, see Note 5 to the

Consolidated Financial Statements.

Access to reasonably priced capital markets is also dependent in part on credit agency reviews. In the past year, our credit ratings and

those of our subsidiaries have been adversely affected by NRG’s credit contingencies, despite what management believes is a reasonable

separation of NRG’s operations and credit risk from our utility operations and corporate financing activities. These ratings reflect

the views of Moody’s and Standard & Poor’s. A security rating is not a recommendation to buy, sell or hold securities and is subject to

revision or withdrawal at any time by the rating company. As of Feb. 10, 2003, the following represents the credit ratings assigned

to various Xcel Energy companies:

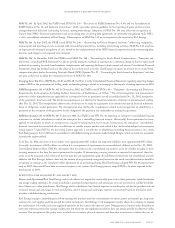

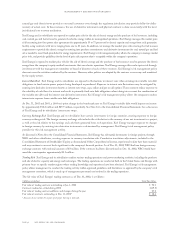

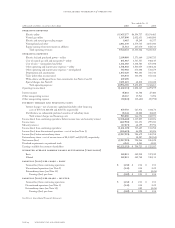

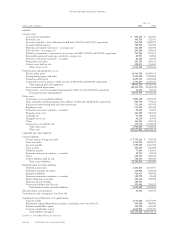

Company Credit Type Moody’s* Standard & Poor’s

Xcel Energy Senior Unsecured Debt Baa3 BBB-

Xcel Energy Commercial Paper NP A3

NSP-Minnesota Senior Unsecured Debt Baa1 BBB-

NSP-Minnesota Senior Secured Debt A3 BBB+

NSP-Minnesota Commercial Paper P2 A3

NSP-Wisconsin Senior Unsecured Debt Baa1 BBB

NSP-Wisconsin Senior Secured Debt A3 BBB+

PSCo Senior Unsecured Debt Baa2 BBB-

PSCo Senior Secured Debt Baa1 BBB+

PSCo Commercial Paper P2 A3

SPS Senior Unsecured Debt Baa1 BBB

SPS Commercial Paper P2 A3

NRG Corporate Credit Rating Caa3** D**

*Negative credit watch/negative outlook

** Below investment grade

page 36 xcel energy inc. and subsidiaries

management’s discussion and analysis