Xcel Energy 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

natural gas and electricity we provide to our retail customers even though the regulatory jurisdiction may provide dollar-for-dollar

recovery of actual costs. In these instances, the use of derivative instruments and physical contracts is done consistently with the local

jurisdictional cost recovery mechanism.

Xcel Energy and its subsidiaries are exposed to market price risk for the sale of electric energy and the purchase of fuel resources, including

coal, natural gas and fuel oil used to generate the electric energy within its nonregulated operations. Xcel Energy manages this market price

risk by entering into firm power sales agreements for approximately 55 to 75 percent of its electric capacity and energy from each generation

facility, using contracts with terms ranging from one to 25 years. In addition, we manage the market price risk covering the fuel resource

requirements to provide the electric energy by entering into purchase commitments and derivative instruments for coal, natural gas and fuel

oil as needed to meet fixed-priced electric energy requirements. Xcel Energy’s risk management policy allows the company to manage market

price risks, and provides guidelines for the level of price risk exposure that is acceptable within the company’s operations.

Xcel Energy is exposed to market price risk for the sale of electric energy and the purchase of fuel resources used to generate the electric

energy from the company’s equity method investments that own electric operations. Xcel Energy manages this market price risk through

involvement with the management committee or board of directors of each of these ventures. Xcel Energy’s risk management policy

does not cover the activities conducted by the ventures. However, other policies are adopted by the ventures as necessary and mandated

by the equity owners.

Interest Rate Risk Xcel Energy and its subsidiaries are exposed to fluctuations in interest rates when entering into variable rate debt

obligations to fund certain power projects being developed or purchased. Exposure to interest rate fluctuations may be mitigated by

entering into derivative instruments known as interest rate swaps, caps, collars and put or call options. These contracts reduce exposure to

the volatility of cash flows for interest and result in primarily fixed-rate debt obligations when taking into account the combination of

the variable rate debt and the interest rate derivative instrument. Xcel Energy’s risk management policy allows the company to reduce

interest rate exposure from variable-rate debt obligations.

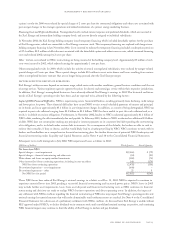

At Dec. 31, 2002 and 2001, a 100-basis point change in the benchmark rate on Xcel Energy’s variable debt would impact net income

by approximately $52.2 million and $29.9 million, respectively. See Note 16 to the Consolidated Financial Statements for a discussion

of Xcel Energy and its subsidiaries’ interest rate swaps.

Currency Exchange Risk Xcel Energy and its subsidiaries have certain investments in foreign countries, creating exposure to foreign

currency exchange risk. The foreign currency exchange risk includes the risk relative to the recovery of our net investment in a project,

as well as the risk relative to the earnings and cash flows generated from such operations. Xcel Energy manages exposure to changes

in foreign currency by entering into derivative instruments as determined by management. Xcel Energy’s risk management policy

provides for this risk management activity.

As discussed in Note 21 to the Consolidated Financial Statements, Xcel Energy has substantial investments in foreign projects, through

NRG and other subsidiaries, creating exposure to currency translation risk. Cumulative translation adjustments, included in the

Consolidated Statement of Stockholders’ Equity as Accumulated Other Comprehensive Income, experienced to date have been material

and may continue to occur at levels significant to the company’s financial position. As of Dec. 31, 2002, NRG had two foreign currency

exchange contracts with notional amounts of $3 million. If the contracts had been discontinued on Dec. 31, 2002, NRG would have

owed the counterparties approximately $0.3 million.

Trading Risk Xcel Energy and its subsidiaries conduct various trading operations and power marketing activities, including the purchase

and sale of electric capacity and energy and natural gas. The trading operations are conducted both in the United States and Europe with

primary focus on specific market regions where trading knowledge and experience have been obtained. Xcel Energy’s risk management

policy allows management to conduct the trading activity within approved guidelines and limitations as approved by the company’s risk

management committee, which is made up of management personnel not involved in the trading operations.

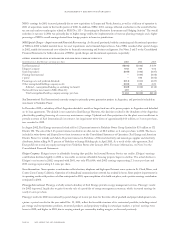

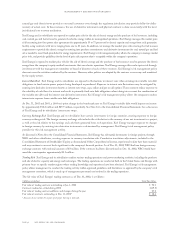

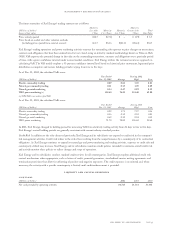

The fair value of Xcel Energy’s trading contracts as of Dec. 31, 2002, is as follows:

(Millions of dollars) Total Fair Value

Fair value of trading contracts outstanding at Jan. 1, 2002 $ 90.1

Contracts realized or settled during 2002 (139.5)

Fair value of trading contract additions and changes during the year 87.8

Fair value of contracts outstanding at Dec. 31, 2002* $ 38.4

* Amounts do not include the impact of ratepayer sharing in Colorado.

page 32 xcel energy inc. and subsidiaries

management’s discussion and analysis