Xcel Energy 2002 Annual Report Download - page 76

Download and view the complete annual report

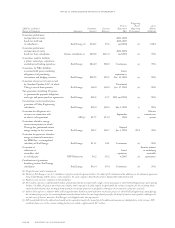

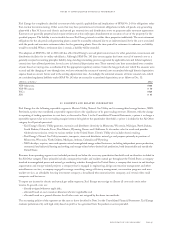

Please find page 76 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Itiquira Energetica NRG’s indirectly controlled Brazilian project company, Itiquira Energetica S.A., the owner of a 156-megawatt hydro

project in Brazil, is currently in arbitration with a former contractor for the project Inepar Industria e Construcoes (Inepar). The dispute

was commenced by Itiquira in September 2002 and pertains to certain matters arising under the agreement with the contractor. Itiquira

principally asserts that Inepar breached the contract and caused damages to Itiquira by (i) failing to meet milestones for substantial

completion; (ii) failing to provide adequate resources to meet such milestones; (iii) failing to pay subcontractors amounts due; and (iv)

being insolvent. Itiquira’s arbitration claim is for approximately $40 million. Inepar has asserted in the arbitration that Itiquira breached

the contact and caused damages to Inepar by failing to recognize events of force majeure as grounds for excused delay and extensions of

scope of services and material under the contract. Inepar’s damage claim is for approximately $10 million. On Nov. 12, 2002, Inepar

submitted its affirmative statement of claim, and Itiquira submitted its response and statement of counterclaims on Dec. 14, 2002.

Inepar replied to Itiquira’s response and counterclaims on Jan. 14, 2003. Itiquira was to submit its reply on March 14, 2003, and a hearing

was held on March 21, 2003. NRG cannot estimate the likelihood of an unfavorable outcome in this dispute.

NRG Bankruptcy On Oct. 17, 2002, a petition commencing an involuntary bankruptcy proceeding pursuant to Chapter 7 of the

Bankruptcy Code was filed against LSP-Pike Energy, LLC, a subsidiary of NRG, by Stone & Webster, Inc. and Shaw Constructors,

Inc., the joining petitioners in the Minnesota involuntary case described previously, in the United States Bankruptcy Court for the

Southern District of Mississippi. In their petition, the joining petitioners sought recovery of allegedly unpaid contractual construction-

related obligations in an aggregate amount of $74 million, which amount LSP-Pike Energy, LLC has disputed. LSP-Pike Energy, LLC

filed an answer to the petition in the Mississippi involuntary case and served various interrogatory and deposition discovery requests on

the joining petitioners. The Mississippi Bankruptcy Court has not entered any order for relief in the Mississippi involuntary case.

On Nov. 22, 2002, five former NRG executives filed an involuntary Chapter 11 petition against NRG in the United States Bankruptcy

Court for the District of Minnesota (Minnesota Bankruptcy Court). Under provisions of federal law, NRG has the full authority to

continue to operate its business as if the involuntary petition had not been filed unless and until a court hearing on the validity of the

involuntary petition is resolved adversely to NRG. NRG responded to the involuntary petition, contesting the petitioners’ claims and

filing a motion to dismiss the case. A hearing was set for April 10, 2003, to consider the motion to dismiss. In their petition, the

petitioners sought recovery of severance and other benefits of approximately $28 million.

NRG and its counsel have been involved in negotiations with the petitioners and their counsel. As a result of these negotiations,NRG

and the petitioners reached an agreement and compromise regarding their respective claims against each other (Settlement Agreement).

In February 2003, the Settlement Agreement was executed, pursuant to which NRG agreed to pay the petitioners an aggregate settlement

in the amount of $12 million.

On Feb. 28, 2003, Stone & Webster, Inc. and Shaw Constructors, Inc. filed a petition alleging that they hold unsecured, non-contingent

claims against NRG in a joint amount of $100 million. The Minnesota Bankruptcy Court has discretion in reviewing and ruling on the

motion to dismiss and the review and approval of the Settlement Agreement. There is a risk that the Minnesota Bankruptcy Court may,

among other things, reject the Settlement Agreement or enter an order for relief under Chapter 11 of Title 11 of the Bankruptcy Code.

See Note 4 for additional discussion of possible NRG bankruptcy.

NRG Energy, Inc. Shareholder Litigation (Delaware); Rosenfeld v. NRG Energy, Inc. (Minnesota) In February 2002, individual stockholders

of NRG filed nine separate, but similar, purported class action complaints in the Delaware Court of Chancery, subsequently consolidated

and with a single amended complaint, against Xcel Energy, NRG and the nine members of NRG’s board of directors. In March 2002,

a similar class action lawsuit was filed in the state trial court for Hennepin County, Minnesota. Each of the actions challenged the proposed

purchase by Xcel Energy, via exchange offer and follow-up merger, of the approximately 26 percent of the outstanding shares of NRG that

it did not already own; contained various allegations of wrongdoing on the part of the defendants in connection with the proposed purchase,

including violations of fiduciary duties of loyalty and candor; and sought injunctive and damage relief and an award of fees and expenses. In

April 2002, counsel for the parties to the consolidated action in the Delaware Court of Chancery and the Minnesota action entered into a

memorandum of understanding setting forth an agreement in principle to settle the actions based on the increase by Xcel Energy of the

exchange ratio in the offer and merger to 0.5000 but subject to confirmatory discovery, definitive documentation and court approval. The

Minnesota action has subsequently been dismissed without prejudice. As to the Delaware actions, the settlement has not been documented,

approved or consummated, and, in light of developments in the litigation that is described under the heading immediately below, it is

uncertain whether the settlement will proceed.

Xcel Energy Inc. Securities Litigation On July 31, 2002, a lawsuit purporting to be a class action on behalf of purchasers of Xcel Energy’s

common stock between Jan. 31, 2001, and July 26, 2002, was filed in the United States District Court for the District of Minnesota.

The complaint named Xcel Energy; Wayne H. Brunetti, chairman, president and chief executive officer; Edward J. McIntyre, former

vice president and chief financial officer; and former chairman James J. Howard as defendants. Among other things, the complaint alleged

violations of Section 10(b) of the Securities Exchange Act and Rule 10(b-5) related to allegedly false and misleading disclosures concerning

various issues, including but not limited to “round trip” energy trades, the nature, extent and seriousness of liquidity and credit difficulties

at NRG, and the existence of cross-default provisions (with NRG credit agreements) in certain of Xcel Energy’s credit agreements.

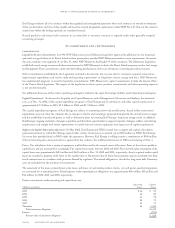

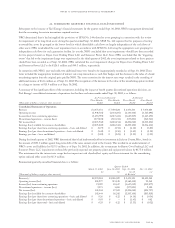

page 90 xcel energy inc. and subsidiaries

notes to consolidated financial statements