Xcel Energy 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

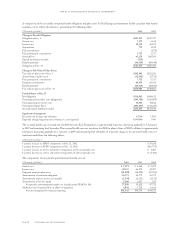

14.equity investments

Xcel Energy’s nonregulated subsidiaries have investments in various international and domestic energy projects, and domestic affordable

housing and real estate projects. We use the equity method of accounting for such investments in affiliates, which include joint ventures

and partnerships, because the ownership structure prevents Xcel Energy from exercising a controlling influence over the operating and

financial policies of the projects. Under this method, Xcel Energy records its portion of the earnings or losses of unconsolidated affiliates

as equity earnings.

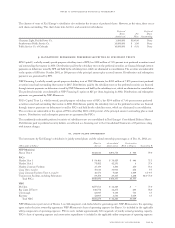

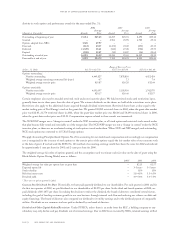

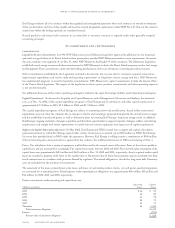

A summary of Xcel Energy’s significant equity method investments is listed in the following table:

Xcel Energy Geographic Dec. 31, 2002

Name Entity Form Owner Functions Area Economic Interest

Loy Yang Power A Partnership None Australia 25.37%

Gladstone Power Station Joint Venture Operator Australia 37.50%

MIBRAG GmbH Partnership None Europe 50.00%

West Coast Power Partnership Operator USA 50.00%

Lanco Kondapalli Power(1) Partnership Operator India 30.00%

Rocky Road Power Partnership Operator USA 50.00%

Schkopau Tenants in Common None Europe 41.67%

ECK Generating(1) Partnership Operator Czech Republic 44.50%

Commonwealth Atlantic USA 50.00%

Mustang Joint Venture None USA 50.00%

Quixx Linden L.P. General/Limited Partnership Operator USA 50.00%

Borger Energy L.P. General/Limited Partnership Operator USA 45.00%

Various affordable housing

limited partnerships Limited Partnerships Various USA 20.00%–99.99%

(1) Pending disposition at Dec. 31, 2002

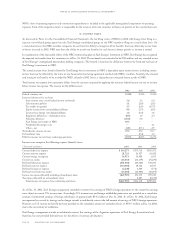

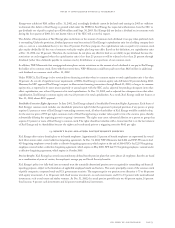

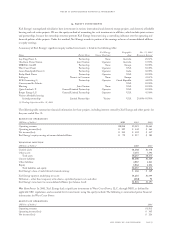

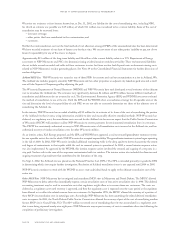

The following table summarizes financial information for these projects, including interests owned by Xcel Energy and other parties for

the years ended Dec. 31:

results of operations

(Millions of dollars) 2002 2001 2000

Operating revenues $2,516 $3,583 $4,664

Operating income (loss) $ 137 $ 442 $ 464

Net income (loss) $ 111 $ 422 $ 447

Xcel Energy’s equity earnings of unconsolidated affiliates $72 $ 217 $ 183

financial position

(Millions of dollars) 2002 2001

Current assets $1,102 $1,478

Other assets 7,155 7,396

Total assets $8,257 $8,874

Current liabilities $1,108 $1,229

Other liabilities 4,087 4,841

Equity 3,062 2,804

Total liabilities and equity $8,257 $8,874

Xcel Energy’s share of undistributed retained earnings $ 466 $ 449

Xcel Energy equity in underlying net assets $1,285 $1,099

Difference – other than temporary write-downs, capitalized project costs and other (284) 98

Xcel Energy’s investment in unconsolidated affiliates (per balance sheet) $1,001 $1,197

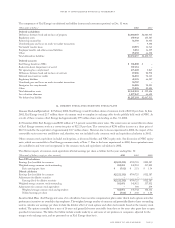

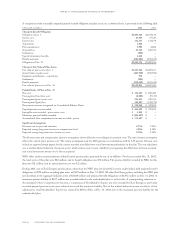

West Coast Power In 2001, Xcel Energy had a significant investment in West Coast Power, LLC, through NRG, as defined by

applicable SEC regulations, and accounted for its investments using the equity method. The following is summarized pretax financial

information for West Coast Power:

results of operations

(Millions of dollars) 2001

Operating revenues $1,562

Operating income (loss) $ 345

Net income (loss) $ 326

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 77