Xcel Energy 2002 Annual Report Download - page 38

Download and view the complete annual report

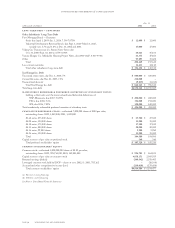

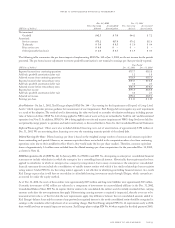

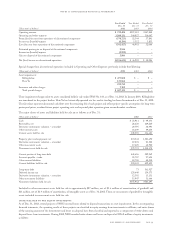

Please find page 38 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PSCo’s electric rates in Colorado are adjusted under the ICA mechanism, which takes into account changes in energy costs and certain

trading revenues and expenses that are shared with the customer. For fuel and purchased energy expense incurred beginning Jan. 1, 2003,

the recovery mechanism shall be determined by the CPUC in the PSCo 2002 general rate case. In the interim, 2003 fuel and purchased

energy expense is recovered through an interim adjustment clause.

NSP-Minnesota’s rates include a cost-of-fuel and cost-of-gas recovery mechanism allowing dollar-for-dollar recovery of the respective

costs, which are trued-up on a two-month and annual basis, respectively.

NSP-Wisconsin’s rates include a cost-of-energy adjustment clause for purchased natural gas, but not for purchased electricity or electric

fuel. In Wisconsin, we can request recovery of those electric costs prospectively through the rate review process, which normally occurs

every two years, and an interim fuel-cost hearing process.

In Colorado, PSCo operates under an electric performance-based regulatory plan, which results in an annual earnings test. NSP-Minnesota’s

and PSCo’s rates include monthly adjustments for the recovery of conservation and energy management program costs, which are

reviewed annually.

SPS’ rates in Texas have fixed fuel factor and periodic fuel filing, reconciling and reporting requirements, which provide cost recovery.

In New Mexico, SPS also has a monthly fuel and purchased power cost recovery factor.

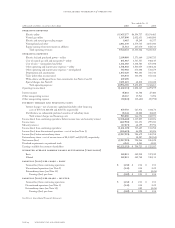

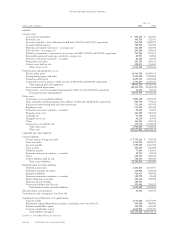

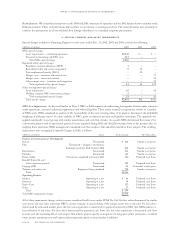

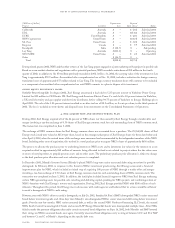

Trading Operations In June 2002, the EITF of the FASB reached a partial consensus on Issue No. 02-03 – “Recognition and Reporting

of Gains and Losses on Energy Trading Contracts” under EITF Issue No. 98-10 - “Accounting for Contracts Involved in Energy Trading

and Risk Management Activities” (EITF No. 02-03). The EITF concluded that all gains and losses related to energy trading activities

within the scope of EITF No. 98-10, whether or not settled physically, must be shown net in the statement of operations, effective for

periods ending after July 15, 2002. Xcel Energy has reclassified revenue from trading activities for all comparable prior periods reported.

Such energy trading activities recorded as a component of Electric and Gas Trading Costs, which have been reclassified to offset Electric

and Gas Trading Revenues to present Electric and Gas Trading Margin on a net basis, were $3.3 billion, $3.1 billion and $2 billion for the

years ended Dec. 31, 2002, 2001 and 2000, respectively. This reclassification had no impact on operating income or reported net income.

On Oct. 25, 2002, the EITF rescinded EITF No. 98-10. With the rescission of EITF No. 98-10, energy trading contracts that do not

also meet the definition of a derivative under SFAS No. 133 must be accounted for as executory contracts. Contracts previously recorded

at fair value under EITF No. 98-10 that are not also derivatives under SFAS No. 133 must be restated to historical cost through a

cumulative effect adjustment. Xcel Energy does not expect the effect of adopting this decision to be material.

Xcel Energy’s commodity trading operations are conducted by NSP-Minnesota (electric), PSCo (electric) and e prime (natural gas).

Pursuant to a joint operating agreement (JOA), approved by the FERC as part of the merger, some of the electric trading activity

conducted at NSP-Minnesota and PSCo is apportioned to the other operating utilities of Xcel Energy. Trading revenue and costs do

not include the revenue and production costs associated with energy produced from Xcel Energy’s generation assets or energy and

capacity purchased to serve native load. Trading results are recorded using the mark-to-market accounting. In addition, trading results

include the impacts of the ICA rate-sharing mechanism. Trading revenue and costs associated with NRG’s operations are included in

nonregulated margins. For more information, see Notes 16 and 17 to the Consolidated Financial Statements.

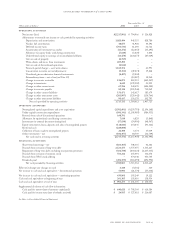

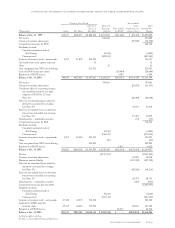

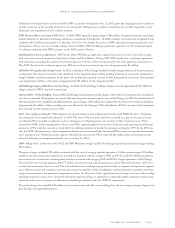

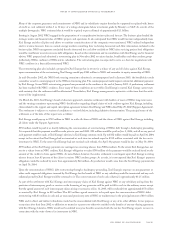

Property, Plant, Equipment and Depreciation Property, plant and equipment is stated at original cost. The cost of plant includes direct

labor and materials, contracted work, overhead costs and applicable interest expense. The cost of plant retired, plus net removal cost, is

charged to accumulated depreciation and amortization. Significant additions or improvements extending asset lives are capitalized, while

repairs and maintenance are charged to expense as incurred. Maintenance and replacement of items determined to be less than units of

property are charged to operating expenses.

Xcel Energy determines the depreciation of its plant by using the straight-line method, which spreads the original cost equally over the

plant’s useful life. Depreciation expense, expressed as a percentage of average depreciable property, was approximately 3.4 percent, 3.1 percent

and 3.3 percent for the years ended Dec. 31, 2002, 2001 and 2000, respectively.

Property, plant and equipment includes approximately $18 million and $25 million, respectively, for costs associated with the engineering

design of the future Pawnee 2 generating station and certain water rights obtained for another future generating station in Colorado.

PSCo is earning a return on these investments based on its weighted average cost of debt in accordance with a CPUC rate order.

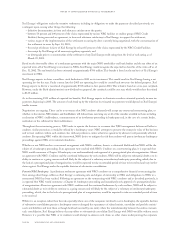

Allowance for Funds Used During Construction (AFDC) and Capitalized Interest AFDC, a noncash item, represents the cost of capital

used to finance utility construction activity. AFDC is computed by applying a composite pretax rate to qualified construction work

in progress. The amount of AFDC capitalized as a utility construction cost is credited to other nonoperating income, for equity capital,

and interest charges, for debt capital. AFDC amounts capitalized are included in Xcel Energy’s rate base for establishing utility service

rates. In addition to construction-related amounts, AFDC also is recorded to reflect returns on capital used to finance conservation

programs in Minnesota. Interest capitalized for all Xcel Energy entities, as AFDC for utility companies, was approximately $83 million

in 2002, $56 million in 2001 and $23 million in 2000.

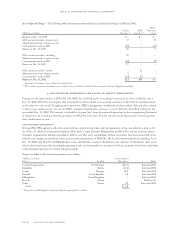

page 52 xcel energy inc. and subsidiaries

notes to consolidated financial statements