Xcel Energy 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

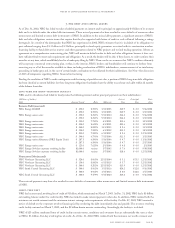

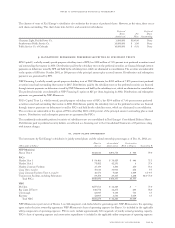

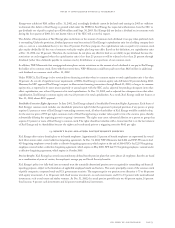

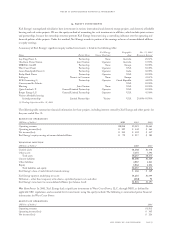

Activity in stock options and performance awards for the years ended Dec. 31:

2002 2001 2000

Average Average Average

(Awards in thousands) Awards Price Awards Price Awards Price

Outstanding at beginning of year 15,214 $25.65 14,259 $25.35 8,490 $25.12

Granted ––2,581 25.98 6,980 25.31

Options adopted from NRG 3,328 29.97 ––––

Exercised (112) 20.27 (1,472) 23.00 (453) 20.33

Forfeited (1,349) 28.43 (142) 27.08 (704) 25.70

Expired (100) 28.87 (12) 24.07 (54) 22.62

Outstanding at end of year 16,981 26.29 15,214 25.65 14,259 25.35

Exercisable at end of year 8,993 $24.78 7,154 $24.78 8,221 $24.46

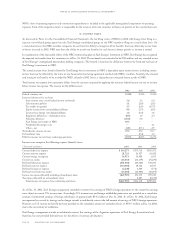

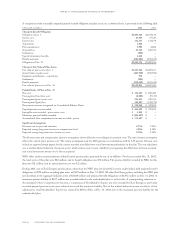

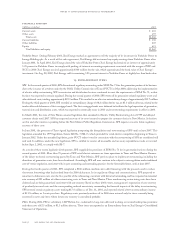

Range of Exercise Prices

At Dec. 31, 2002 $11.50 to $25.50 $25.51 to $27.00 $27.01 to $63.60

Options outstanding:

Number outstanding 4,449,827 7,878,856 4,652,424

Weighted average remaining contractual life (years) 4.7 7.3 7.4

Weighted average exercise price $19.87 $26.29 $32.44

Options exercisable:

Number exercisable 4,091,097 3,158,956 1,742,579

Weighted average exercise price $20.17 $26.46 $32.57

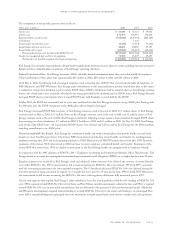

Certain employees also may be awarded restricted stock under our incentive plans. We hold restricted stock until restrictions lapse,

generally from two to three years from the date of grant. We reinvest dividends on the shares we hold while restrictions are in place.

Restrictions also apply to the additional shares acquired through dividend reinvestment. Restricted shares have a value equal to the

market trading price of Xcel Energy’s stock at the grant date. We granted 50,083 restricted shares in 2002, when the grant-date market

price was $22.83, 21,774 restricted shares in 2001, when the grant-date market price was $26.06 and 58,690 restricted shares in 2000,

when the grant-date market price was $19.25. Compensation expense related to these awards was immaterial.

The NCE/NSP merger was a “change in control” under the NSP incentive plan, so all stock option and restricted stock awards under

that plan became fully vested and exercisable as of the merger date. The NCE/NSP merger was not a “change in control” under the NCE

incentive plans, so there was no accelerated vesting of stock options issued under them. When NCE and NSP merged, each outstanding

NCE stock option was converted to 1.55 Xcel Energy options.

We apply Accounting Principles Board Opinion No. 25 in accounting for our stock-based compensation and, accordingly, no compensation

cost is recognized for the issuance of stock options as the exercise price of the options equals the fair-market value of our common stock

at the date of grant. If we had used the SFAS No. 123 method of accounting, earnings would have been the same for 2002 and reduced

by approximately 1 cent per share for 2001 and 2 cents per share for 2000.

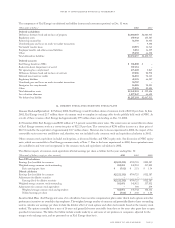

The weighted-average fair value of options granted, and the assumptions used to estimate such fair value on the date of grant using the

Black-Scholes Option Pricing Model, were as follows:

2002*2001 2000

Weighted-average fair value per option share at grant date –$2.13 $2.57

Expected option life –3–5 years 3–5 years

Stock volatility –18% 15%

Risk-free interest rate –3.8–4.8% 5.3–6.5%

Dividend yield –4.9–5.8% 5.4–7.5%

* There were no options granted in 2002.

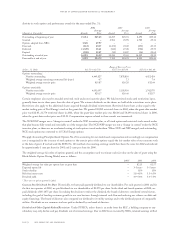

Common Stock Dividends Per Share Historically, we have paid quarterly dividends to our shareholders. For each quarter in 2001 and for

the first two quarters of 2002, we paid dividends to our shareholders of $0.375 per share. In the third and fourth quarters of 2002, we

paid dividends of $0.1875 per share. In making the decision to reduce the dividend, the board of directors considered several factors,

including the goal of funding customer growth in our core business through internal cash flow and reducing our reliance on debt and

equity financings. The board of directors also compared our dividend to its utility earnings and to the dividend payout of comparable

utilities. Dividends on our common stock are paid as declared by our board of directors.

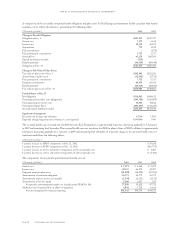

Dividend and Other Capital-Related Restrictions Under PUHCA, unless there is an order from the SEC, a holding company or any

subsidiary may only declare and pay dividends out of retained earnings. Due to 2002 losses incurred by NRG, retained earnings of Xcel

page 72 xcel energy inc. and subsidiaries

notes to consolidated financial statements