Xcel Energy 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

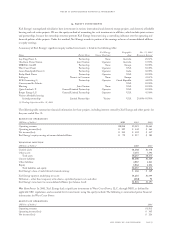

Technology Agreement We have a contract that extends through 2011 with International Business Machines Corp. (IBM) for information

technology services. The contract is cancelable at our option, although there are financial penalties for early termination. In 2002, we paid

IBM $131.9 million under the contract and $26 million for other project business. The contract also commits us to pay a minimum

amount each year from 2002 through 2011.

Fuel Contracts Xcel Energy has contracts providing for the purchase and delivery of a significant portion of its current coal, nuclear fuel

and natural gas requirements. These contracts expire in various years between 2003 and 2025. In total, Xcel Energy is committed to the

minimum purchase of approximately $2.3 billion of coal, $122.2 million of nuclear fuel and $1.6 billion of natural gas, including $1.2 billion

of natural gas storage and transportation, or to make payments in lieu thereof, under these contracts. In addition, Xcel Energy is required

to pay additional amounts depending on actual quantities shipped under these agreements. Xcel Energy’s risk of loss, in the form of

increased costs, from market price changes in fuel is mitigated through the cost-of-energy adjustment provision of the ratemaking

process, which provides for recovery of most fuel costs.

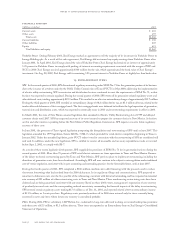

Purchased Power Agreements The utility and nonregulated subsidiaries of Xcel Energy have entered into agreements with utilities and

other energy suppliers for purchased power to meet system load and energy requirements, replace generation from company-owned units

under maintenance and during outages, and meet operating reserve obligations. NSP-Minnesota, PSCo, SPS and certain nonregulated

subsidiaries have various pay-for-performance contracts with expiration dates through the year 2050. In general, these contracts provide

for capacity payments, subject to meeting certain contract obligations, and energy payments based on actual power taken under the

contracts. Most of the capacity and energy costs are recovered through base rates and other cost-recovery mechanisms.

NSP-Minnesota has a 500-megawatt participation power purchase commitment with Manitoba Hydro, which expires in 2005. The

cost of this agreement is based on 80 percent of the costs of owning and operating NSP-Minnesota’s Sherco 3 generating plant,

adjusted to 1993 dollars. This agreement was extended through a new agreement during 2002 to include the period starting May 2005

through April 2015. The cost of the agreement for this extended period is based on a base price, which was established from May 2001

through April 2002 and will be escalated by the change in the United States gross national product to reflect the current year. In

addition, NSP-Minnesota and Manitoba Hydro have seasonal diversity exchange agreements, and there are no capacity payments for the

diversity exchanges. These commitments represent about 17 percent of Manitoba Hydro’s system capacity and account for approximately

9 percent of NSP-Minnesota’s 2002 electric system capability. The risk of loss from nonperformance by Manitoba Hydro is not considered

significant, and the risk of loss from market price changes is mitigated through cost-of-energy rate adjustments.

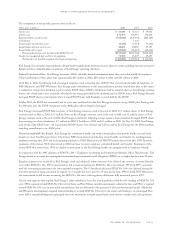

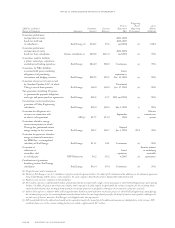

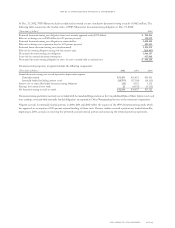

At Dec. 31, 2002, the estimated future payments for capacity that the utility and nonregulated subsidiaries of Xcel Energy are obligated

to purchase, subject to availability, are as follows:

(Thousands of dollars) Total

2003 $ 528,978

2004 548,173

2005 549,261

2006 540,245

2007 and thereafter 5,067,551

Total $7,234,208

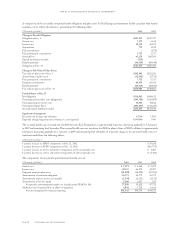

environmental contingencies

We are subject to regulations covering air and water quality, land use, the storage of natural gas and the storage and disposal of hazardous

or toxic wastes. We continuously assess our compliance. Regulations, interpretations and enforcement policies can change, which may

impact the cost of building and operating our facilities. This includes NRG, which is subject to regional, federal and international

environmental regulation.

Site Remediation We must pay all or a portion of the cost to remediate sites where past activities of our subsidiaries and some other

parties have caused environmental contamination. At Dec. 31, 2002, there were three categories of sites:

– third-party sites, such as landfills, to which we are alleged to be a potentially responsible party (PRP) that sent hazardous materials

and wastes;

– the site of a former federal uranium enrichment facility; and

– sites of former manufactured gas plants (MGPs) operated by our subsidiaries or predecessors.

We record a liability when we have enough information to develop an estimate of the cost of environmental remediation and revise the

estimate as information is received. The estimated remediation cost may vary materially.

To estimate the cost to remediate these sites, we may have to make assumptions when facts are not fully known. For instance, we might

make assumptions about the nature and extent of site contamination, the extent of required cleanup efforts, costs of alternative cleanup

methods and pollution-control technologies, the period over which remediation will be performed and paid for, changes in environmental

remediation and pollution-control requirements, the potential effect of technological improvements, the number and financial strength

of other PRPs and the identification of new environmental cleanup sites.

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 85