Xcel Energy 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the minimum interest coverage ratio requirements of the facility. Accordingly, the facility is in default. NRG had $110 million and

$170 million in outstanding letters of credit as of Dec. 31, 2002 and 2001, respectively.

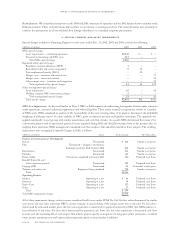

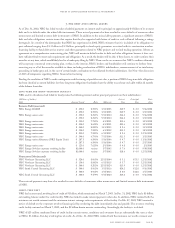

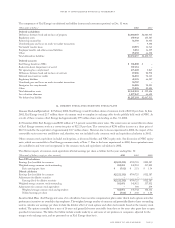

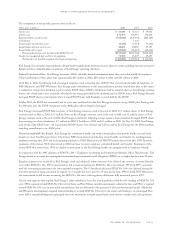

long-term debt – corporate debt

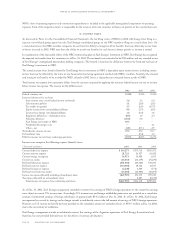

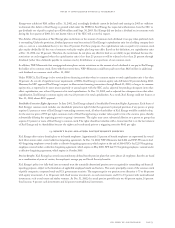

Equity Units and Debentures In 2001, NRG completed the sale of 11.5 million equity units for an initial price of $25 per unit. Each equity

unit initially consists of a corporate unit comprising a $25 principal amount of NRG’s senior debentures and an obligation to acquire shares

of NRG common stock no later than May 18, 2004, at a price ranging from between $27.00 and $32.94. Approximately $4.1 million of the

gross proceeds have been recorded as additional paid in capital to reflect the value of the obligation to purchase NRG’s common stock. As a

result of the merger by Xcel Energy of NRG, holders of the equity units are no longer obligated to purchase shares of NRG common stock

under the purchase contracts. Instead, holders of the equity units are now obligated to purchase a number of shares of Xcel Energy common

stock upon settlement of the purchase contracts equal to the adjusted “settlement rate” or the adjusted “early settlement rate” as applicable. As

a result of the short-form merger, the adjusted settlement rate is 0.4630, resulting in a settlement price of approximately $55 per Xcel Energy

common share, and the adjusted early settlement rate is 0.3795, resulting in a settlement price of approximately $65 per Xcel Energy

common share, subject to the terms and conditions of the purchase contracts set forth in a purchase contract agreement. In October 2002,

NRG announced it would not make the November 2002 quarterly interest payment on the 6.50-percent senior unsecured debentures due in

2006, which trade with the associated equity units. The 30-day grace period to make payment ended Dec. 16, 2002, and NRG did not make

payment. As a result, this issue is in default. In addition, NRG did not make the Feb. 17, 2003, quarterly interest payment. In the event of an

NRG bankruptcy, the obligation to purchase shares of Xcel Energy stock terminates.

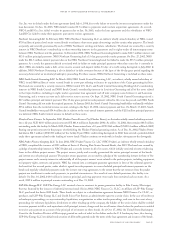

Senior Unsecured Notes The NRG $125-million, $250-million, $300-million, $350-million and $240-million senior notes are unsecured

and are used to support equity requirements for projects acquired and in development. The interest is paid semi-annually. The 30-day grace

period to make payment related to these issues has passed. NRG did not make the required payments and is in default on these notes.

Remarketable or Redeemable Securities The $240-million NRG senior notes due Nov. 1, 2013, are remarketable or redeemable securities

(ROARS). Nov. 1, 2003, is the first remarketing date for these notes. Interest is payable semi-annually on May 1 and Nov. 1 of each

year through 2003, and then at intervals and interest rates as discussed in the indenture. On the remarketing date, the notes must

either be mandatorily tendered to and purchased by Credit Suisse Financial Products or mandatorily redeemed by NRG at prices discussed

in the indenture. The notes are unsecured debt that rank senior to all of NRG’s existing and future subordinated indebtedness. On

Oct. 16, 2002, NRG entered into a termination agreement with the agent that terminated the remarketing agreement. A termination

payment of $31.4 million due on Oct. 17, 2002, has not been paid.

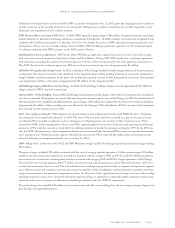

In March 2000, an NRG sponsored non-consolidated pass-through trust issued $250 million of 8.70-percent certificates due March 15,

2005. Each certificate represents a fractional undivided beneficial interest in the assets of the trust. Interest is payable on the certificates

semi-annually on March 15 and Sept. 15 of each year through 2005. The sole assets of the trust consist of £160 million, approximately $250

million on the date of issuance, principal amount 7.97 percent Reset Senior Notes due March 15, 2020, issued by NRG. The Reset

Senior Notes were used principally to finance NRG’s acquisition of the Killingholme facility. Interest is payable semi-annually on the

Reset Senior Notes on March 15 and Sept. 15 through March 15, 2005, and then at intervals and interest rates established in a

remarketing process. If the Reset Senior Notes are not remarketed on March 15, 2005, they must be mandatorily redeemed by NRG on

such date. On Sept. 16, 2002, NRG Pass-through Trust I failed to make a $10.9-million interest payment due on the $250 million bonds,

as a consequence of NRG failing to pay interest due on £160 million of 7.97-percent debt. The 30-day grace period to make payment

related to this issue has passed and NRG did not make the required payments. NRG is in default on these bonds.

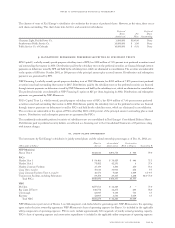

Audrain Capital Lease In connection with NRG’s acquisition of the Audrain facilities, NRG recognized a capital lease on its balance

sheet within long-term debt in the amount of $239.9 million, as of Dec. 31, 2002 and 2001. The capital lease obligation is recorded at

the net present value of the minimum lease obligation payable. The lease terminates in May 2023. During the term of the lease, only

interest payments are due. No principal is due until the end of the lease. In addition, NRG has recorded in notes receivable an amount

of approximately $239.9 million, which represents its investment in the bonds that the county of Audrain issued to finance the project.

During December 2002, NRG received a notice of a waiver of a $24.0-million interest payment due on the capital lease obligation.

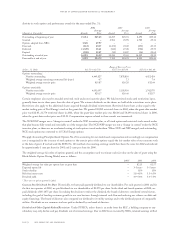

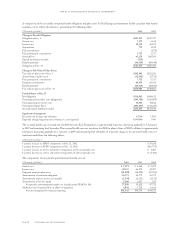

long-term debt – subsidiary

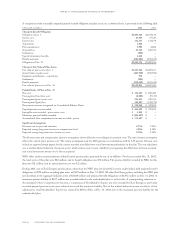

NEO Corp. The various NEO notes are term loans. The loans are secured principally by long-term assets of NEO Landfill Gas collection

system. NEO Landfill Gas is required to maintain compliance with certain covenants primarily related to incurring debt, disposing of

the NEO Landfill Gas assets and affiliate transactions. On Oct. 30, 2002, NRG failed to make $3.1 million in payments under certain

non-operating interest acquisition agreements. As a result, NEO Corp., a direct, wholly owned subsidiary of NRG, and NEO Landfill

Gas, Inc., an indirect, wholly owned subsidiary of NRG, failed to make approximately $1.4 million in loan payments. Also, the subsidiaries

of NEO Corp. and NEO Landfill Gas, Inc. failed to make approximately $2 million in payments pursuant to various agreements. NRG

received an extension until November 2002 with respect to NEO Landfill Gas, Inc. to make payments under such agreements, and such

payments were made during the extension period. The payments relating to NEO Corp. were not made, and the loan was due and payable

on Dec. 20, 2002. A letter of credit was drawn to pay the NEO Corp. loan in full on Dec. 23, 2002. As of Dec. 31, 2002, NEO Landfill

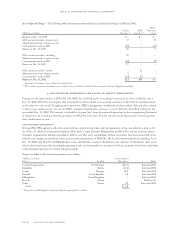

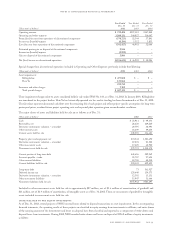

page 66 xcel energy inc. and subsidiaries

notes to consolidated financial statements