Xcel Energy 2002 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the event that NRG’s financial situation ultimately results in a bankruptcy filing, there may be additional impacts on Xcel Energy’s

financial condition and results of operations. See the Xcel Energy Impacts under the Other Liquidity and Capital Resource Considerations

section later in Management’s Discussion and Analysis, and Note 4 to the Consolidated Financial Statements for further discussion

of the possible effects of an NRG bankruptcy filing on Xcel Energy.

General Economic Conditions The slower U.S. economy, and the global economy to a lesser extent, may have a significant impact on

Xcel Energy’s operating results. Current economic conditions have resulted in a decline in the forward price curve for energy and

decreased commodity-trading margins. In addition, certain operating costs, such as insurance and security, have increased due to the

economy, terrorist activity and war. Management cannot predict the impact of a continued economic slowdown, fluctuating energy

prices or war. However, Xcel Energy could experience a material adverse impact to its results of operations, future growth or ability to

raise capital due to a weakened economy or war.

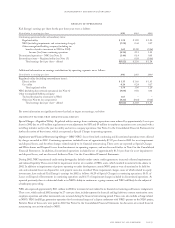

Sales Growth In addition to weather impacts, customer sales levels in Xcel Energy’s regulated utility businesses can vary with economic

conditions, customer usage patterns and other factors. Weather-normalized sales growth for retail electric utility customers was estimated

to be 1.8 percent in 2002 compared with 2001, and 1.0 percent in 2001 compared with 2000. Weather-normalized sales growth for firm

natural gas utility customers was estimated to be approximately the same in 2002 compared with 2001, and 2.6 percent in 2001 compared

with 2000. We are projecting that 2003 weather-normalized sales growth in 2003 compared with 2002 will be 1.5 to 2.0 percent for

retail electric utility customers and 2.5 to 3.0 percent for firm natural gas utility customers.

Utility Industry Changes The structure of the electric and natural gas utility industry has been subject to change. Merger and acquisition

activity over the past few years has been significant as utilities combine to capture economies of scale or establish a strategic niche in

preparing for the future. Some regulated utilities are divesting generation assets. All utilities are required to provide nondiscriminatory

access to the use of their transmission systems.

In December 2001, the FERC approved Midwest Independent Transmission System Operator, Inc. (MISO) as the Midwest independent

system operator responsible for operating the wholesale electric transmission system. Accordingly, in compliance with the FERC’s

Order No. 2000, Xcel Energy turned over operational control of its transmission system to the MISO in January 2002.

Some states had begun to allow retail customers to choose their electricity supplier, and many other states were considering retail access

proposals. However, the experience of the state of California in instituting competition, as well as the bankruptcy filing of Enron, have

caused indefinite delays in most industry restructuring.

Xcel Energy cannot predict the outcome of restructuring proceedings in the electric utility jurisdictions it serves at this time. The

resolution of these matters may have a significant impact on Xcel Energy’s financial position, results of operations and cash flows.

California Power Market NRG operates in the wholesale power market in California. See Note 18 to the Consolidated Financial

Statements for a description of lawsuits against NRG and other power producers and marketers involving the California electricity

markets. Xcel Energy and NRG have fully reserved for their uncollected receivables related to the California power market.

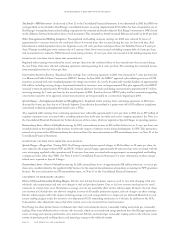

Critical Accounting Policies Preparation of the Consolidated Financial Statements and related disclosures in compliance with generally

accepted accounting principles (GAAP) requires the application of appropriate technical accounting rules and guidance, as well as the

use of estimates. The application of these policies necessarily involves judgments regarding future events, including the likelihood of

success of particular projects, legal and regulatory challenges and anticipated recovery of costs. These judgments, in and of themselves,

could materially impact the Consolidated Financial Statements and disclosures based on varying assumptions, which may be appropriate

to use. In addition, the financial and operating environment also may have a significant effect, not only on the operation of the business,

but on the results reported through the application of accounting measures used in preparing the Consolidated Financial Statements

and related disclosures, even if the nature of the accounting policies applied have not changed. The following is a list of accounting

policies that are most significant to the portrayal of Xcel Energy’s financial condition and results, and that require management’s

most difficult, subjective or complex judgments. Each of these has a higher likelihood of resulting in materially different reported

amounts under different conditions or using different assumptions.

page 24 xcel energy inc. and subsidiaries

management’s discussion and analysis