Xcel Energy 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NRG Capital Expenditures Management expects NRG’s capital expenditures, which include refurbishments and environmental

compliance, to total approximately $475 million to $525 million in the years 2003 through 2007. NRG anticipates funding its

ongoing capital requirements through committed debt facilities, operating cash flows and existing cash. NRG’s capital expenditure

program is subject to continuing review and modification. The timing and actual amount of expenditures may differ significantly

based upon plant operating history, unexpected plant outages, changes in the regulatory environment and the availability of cash.

The pending financial restructuring or bankruptcy filings of NRG may affect the timing and magnitude of capital resources available

to NRG and, accordingly, the level of capital expenditures NRG can fund.

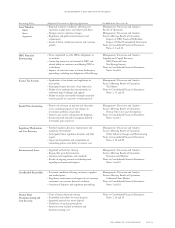

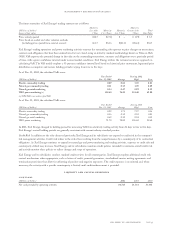

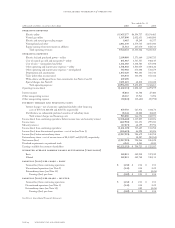

Contractual Obligations and Other Commitments Xcel Energy has a variety of contractual obligations and other commercial commitments

that represent prospective requirements in addition to its capital expenditure programs. The following is a summarized table of contractual

obligations. See additional discussion in the Consolidated Statements of Capitalization and Notes 5, 6, 7, 16 and 18 to the Consolidated

Financial Statements.

(Thousands of dollars) Payments Due by Period

Contractual obligations Total Less than 1 Year 1–3 Years 4–5 Years After 5 Years

Long-term debt $14,311,689 $ 7,756,903 $ 547,796 $1,137,934 $ 4,869,056

Capital lease obligations 688,421 34,422 67,771 66,386 519,842

Operating leases(a) 386,215 66,155 125,031 108,534 86,495

Unconditional purchase obligations 11,240,364 1,317,293 2,214,974 1,817,770 5,890,327

Other long-term obligations 699,248 42,597 64,517 34,594 557,540

Short-term debt 1,541,963 1,541,963–––

Total contractual cash obligations $28,867,900 $10,759,333 $3,020,089 $3,165,218 $11,923,260

(a) Under some leases, we would have to sell or purchase the property that we lease if we chose to terminate before the scheduled lease expiration date. Most of our railcar,

vehicle and equipment, and aircraft leases have these terms. We would then own the equipment and could continue to use it in the normal course of business or sell it.

At Dec. 31, 2002, the amount that we would have to pay if we chose to terminate these leases was approximately $160 million.

Common Stock Dividends Future dividend levels will be dependent upon the statutory limitations discussed further, as well as Xcel Energy’s

results of operations, financial position, cash flows and other factors, and will be evaluated by the Xcel Energy board of directors.

Under the PUHCA, unless there is an order from the SEC, a holding company or any subsidiary may only declare and pay dividends out of

retained earnings. Due to 2002 losses incurred by NRG, retained earnings of Xcel Energy were a deficit of $101 million at Dec. 31, 2002.

Xcel Energy did not declare a dividend on its common stock during the first quarter of 2003. Xcel Energy has requested authorization from

the SEC to pay dividends out of paid-in capital up to $260 million until Sept. 30, 2003. It is not known when or if the SEC will act on this

request. As explained below, Xcel Energy has reached a preliminary settlement agreement with the various NRG creditors. Also, Xcel Energy

could be required to cease including NRG as a consolidated subsidiary for financial reporting purposes, if NRG were to seek protection

under the bankruptcy laws and Xcel Energy ceased to have control over NRG. In the event the tentative settlement is effectuated and

Xcel Energy is required to cease including NRG as a consolidated subsidiary in its financial statements, the financial impact of these

events are expected to positively impact retained earnings and may be sufficient to eliminate the negative retained earnings balance, absent

additional charges at NRG. Xcel Energy cannot predict the precise financial impact of these items at this time. For this reason, Xcel

Energy will continue seeking authorization from the SEC so it is able to pay dividends notwithstanding negative retained earnings.

Xcel Energy intends to make every effort to pay the full common stock dividend of 75 cents per share during 2003.

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay when preferred stock

is outstanding. Under the provisions, dividend payments may be restricted if Xcel Energy’s capitalization ratio (on a holding company basis

only, i.e., not on a consolidated basis) is less than 25 percent. For these purposes, the capitalization ratio is equal to (i) common stock

plus surplus divided by (ii) the sum of common stock plus surplus plus long-term debt. Based on this definition, our capitalization ratio

at Dec. 31, 2002, was 85 percent. Therefore, the restrictions do not place any effective limit on our ability to pay dividends because the

restrictions are only triggered when the capitalization ratio is less than 25 percent or will be reduced to less than 25 percent through

dividends (other than dividends payable in common stock), distributions or acquisitions of our common stock.

capital sources

Xcel Energy expects to meet future financing requirements by periodically issuing long-term debt, short-term debt, common stock and

preferred securities to maintain desired capitalization ratios. As a result of its registration as a holding company under the PUHCA, Xcel

Energy is required to maintain a common equity ratio of 30 percent or higher in its consolidated capital structure.

On Nov. 7, 2002, the SEC issued an order authorizing Xcel Energy to engage in certain financing transactions through March 31, 2003,

so long as its common equity ratio, as reported in its most recent Form 10-K or Form 10-Q and as adjusted for pending subsequent

items that affect capitalization, was at least 24 percent of its total capitalization. Financings of Xcel Energy authorized by the SEC

included the issuance of debt, including convertible debt, to refinance or replace Xcel Energy’s $400-million credit facility that expired

on Nov. 8, 2002, issuance of $450 million of common stock, less any amounts issued as part of the refinancing of the $400-million

management’s discussion and analysis

xcel energy inc. and subsidiaries page 35