Xcel Energy 2002 Annual Report Download - page 14

Download and view the complete annual report

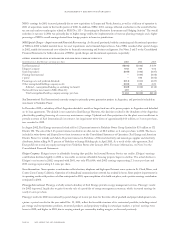

Please find page 14 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As part of the merger approval process in Texas, SPS agreed to:

– guarantee annual merger savings credits of approximately $4.8 million and amortize merger costs through 2005;

– retain the current fuel-recovery mechanism to pass along fuel-cost savings to retail customers; and

– comply with various service quality and reliability standards, covering service installations and upgrades, light replacements,

customer service call centers and electric service reliability.

As part of the merger approval process in New Mexico, SPS agreed to:

– guarantee annual merger savings credits of approximately $780,000 and amortize merger costs through December 2004;

– share net non-fuel operating and maintenance savings equally among retail customers and shareholders;

– retain the current fuel recovery mechanism to pass along fuel cost savings to retail customers; and

– not pass along any negative rate impacts of the merger.

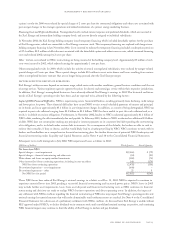

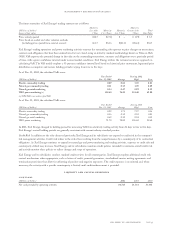

PSCo Performance-Based Regulatory Plan The Colorado Public Utilities Commission (CPUC) established an electric PBRP under

which PSCo operates. The major components of this regulatory plan include:

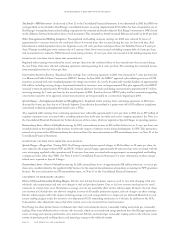

– an annual electric earnings test with the sharing between customers and shareholders of earnings in excess of the following limits:

– all earnings above 10.5-percent return on equity for 2002;

– no earnings sharing for 2003; and

– an annual electric earnings test with the sharing of earnings in excess of the return on equity set in the 2002 rate case for 2004

through 2006;

– an electric QSP that provides for bill credits to customers if PSCo does not achieve certain performance targets relating to

electric reliability and customer service through 2006;

– a natural gas QSP that provides for bill credits to customers if PSCo does not achieve certain performance targets relating to

natural gas leak repair time and customer service through 2007; and

– an ICA that provides for the sharing of energy costs and savings relative to an annual baseline cost per kilowatt-hour generated or

purchased. According to the terms of the merger rate agreement in Colorado, the annual baseline cost will be reset in 2002, based

on a 2001 test year. Pursuant to a stipulation approved by the CPUC, the ICA remains in effect through March 31, 2005, to recover

allowed ICA costs from 2001 and 2002. The recovery of fuel and purchased energy expense that began Jan. 1, 2003, will be decided

in the PSCo 2002 general rate case. In the interim period until the conclusion of the general rate case, 2003 fuel and purchased

energy expense is recovered through the interim adjustment clause (IAC).

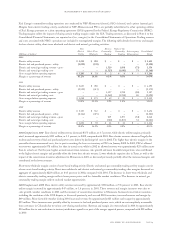

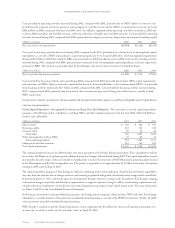

PSCo regularly monitors and records as necessary an estimated customer refund obligation under the earnings test. In April of each year

following the measurement period, PSCo files its proposed rate adjustment under the PBRP. The CPUC conducts proceedings to review

and approve these rate adjustments annually. During 2002, PSCo filed that its electric department earnings were below the 11-percent

return-on-equity threshold. PSCo has estimated no customer refund obligation for 2002 under the earnings test, the electric QSP or the

natural gas QSP. PSCo has estimated no customer refund obligation for 2001 under the earnings test. The 2001 earnings test filing has

not been approved. A hearing is scheduled for May 2003.

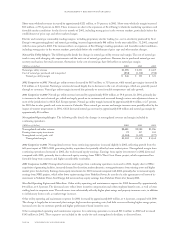

PSCo 2002 General Rate Case In May 2002, PSCo filed a combined general retail electric, natural gas and thermal energy base rate case

with the CPUC to address increased costs for providing services to Colorado customers. This filing was required as part of the Xcel

Energy merger stipulation and agreement previously approved by the CPUC. Among other things, the case includes establishing an

electric energy recovery mechanism, elimination of the qualifying facilities capacity cost adjustment (QFCCA), new depreciation

rates and recovery of additional plant investment. PSCo requested an increase to its authorized rate of return on equity to 12 percent for

electricity and 12.25 percent for natural gas. In early 2003, PSCo filed its rebuttal testimony in this rate case. At this point in the

rate proceeding, PSCo is now requesting an overall annual increase to electric revenue of approximately $233 million. This is based

on a $186-million increase for fuel and purchased energy expense and a $47-million electric base rate increase. PSCo is requesting an

annual base rate decrease in natural gas revenue of approximately $21 million. The rebuttal case incorporates several adjustments to the

original filing, including lower depreciation expense, higher fuel and energy expense and various corrections to the original filing.

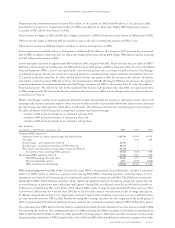

Intervenors, including the CPUC staff and the Colorado Office of Consumer Council (OCC), have filed testimony requesting

both electric and natural gas base rate decreases and increases in fuel and energy revenues that are less than the amounts requested

by PSCo. On Feb. 19, 2003, the CPUC postponed the scheduled hearings for 30 days to allow parties to pursue a comprehensive

settlement of all issues in this proceeding. PSCo filed a joint motion on March 14, 2003, extending the filing date of the settlement

agreement until April 1, 2003. New rates are expected to be effective during the second quarter of 2003. A final decision on the

recovery of fuel and energy costs will be applied retroactive to Jan. 1, 2003. Until such time, PSCo is billing customers under the

IAC, assuming 100-percent pass-through cost recovery.

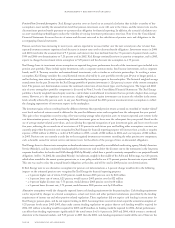

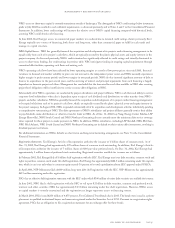

Tax Matters As discussed further in Note 18, the Internal Revenue Service (IRS) issued a Notice of Proposed Adjustment proposing

to disallow interest expense deductions taken in tax years 1993 through 1997 related to corporate-owned life insurance (COLI) policy

loans of PSR Investments, Inc. (PSRI), a wholly owned subsidiary of PSCo. Late in 2001, Xcel Energy received a technical advice

page 28 xcel energy inc. and subsidiaries

management’s discussion and analysis