Xcel Energy 2002 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xcel Energy has completed a detailed assessment of the specific applicability and implications of SFAS No. 143 for obligations other

than nuclear decommissioning. Other assets that may have potential asset retirement obligations include ash ponds, any generating

plant with a Part 30 license and electric and natural gas transmission and distribution assets on property under easement agreements.

Easements are generally perpetual and require retirement action only upon abandonment or cessation of use of the property for the

specified purpose. The liability is not estimable because Xcel Energy intends to utilize these properties indefinitely. The asset retirement

obligations for the ash ponds and generating plants cannot be reasonably estimated due to an indeterminate life for the assets associated

with the ponds and uncertain retirement dates for the generating plants. Since the time period for retirement is unknown, no liability

would be recorded. When a retirement date is certain, a liability will be recorded.

The adoption of SFAS No. 143 in 2003 will also affect Xcel Energy’s accrued plant removal costs for other generation, transmission and

distribution facilities for its utility subsidiaries. Although SFAS No. 143 does not recognize the future accrual of removal costs as a

generally accepted accounting principles liability, long-standing ratemaking practices approved by applicable state and federal regulatory

commissions have allowed provisions for such costs in historical depreciation rates. These removal costs have accumulated over a number

of years based on varying rates as authorized by the appropriate regulatory entities. Given the long periods over which the amounts were

accrued and the changing of rates through time, we have estimated the amount of removal costs accumulated through historic depreciation

expense based on current factors used in the existing depreciation rates. Accordingly, the estimated amounts of future removal costs, which

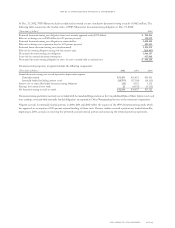

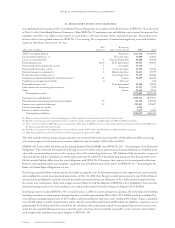

are considered regulatory liabilities under SFAS No. 143 that are accrued in accumulated depreciation, are as follows at Dec. 31:

(Millions of dollars) 2002

NSP-Minnesota $304

NSP-Wisconsin $70

PSCo $329

SPS $97

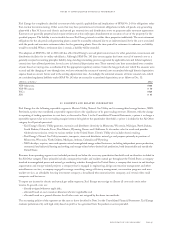

21. segments and related information

Xcel Energy has the following reportable segments: Electric Utility, Natural Gas Utility and its nonregulated energy business, NRG.

Previously, e prime was considered a reportable segment due to the significance of its gross trading revenues. However, with the change

in reporting of trading operations to a net basis, as discussed in Note 1 to the Consolidated Financial Statements, e prime is no longer a

reportable segment due to its net trading margins/revenue being below the quantitative thresholds. e prime is included in the All Other

category for all periods presented.

– Xcel Energy’s Electric Utility generates, transmits and distributes electricity in Minnesota, Wisconsin, Michigan, North Dakota,

South Dakota, Colorado, Texas, New Mexico, Wyoming, Kansas and Oklahoma. It also makes sales for resale and provides

wholesale transmission service to various entities in the United States. Electric Utility also includes electric trading.

– Xcel Energy’s Natural Gas Utility transmits, transports, stores and distributes natural gas and propane primarily in portions of

Minnesota, Wisconsin, North Dakota, Michigan, Arizona, Colorado and Wyoming.

– NRG develops, acquires, owns and operates several nonregulated energy-related businesses, including independent power production,

commercial and industrial heating and cooling, and energy-related refuse-derived fuel production, both domestically and outside the

United States.

Revenues from operating segments not included previously are below the necessary quantitative thresholds and are therefore included in

the All Other category. Those primarily include a company that trades and markets natural gas throughout the United States; a company

involved in nonregulated power and natural gas marketing activities throughout the United States; a company that invests in and develops

cogeneration and energy-related projects; a company that is engaged in engineering, design construction management and other

miscellaneous services; a company engaged in energy consulting, energy efficiency management, conservation programs and mass

market services; an affordable housing investment company; a broadband telecommunications company; and several other small

companies and businesses.

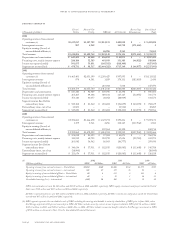

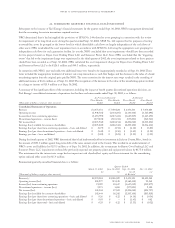

To report net income for electric and natural gas utility segments, Xcel Energy must assign or allocate all costs and certain other

income. In general, costs are:

– directly assigned wherever applicable;

– allocated based on cost causation allocators wherever applicable; and

– allocated based on a general allocator for all other costs not assigned by the above two methods.

The accounting policies of the segments are the same as those described in Note 1 to the Consolidated Financial Statements. Xcel Energy

evaluates performance by each legal entity based on profit or loss generated from the product or service provided.

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 97