Xcel Energy 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

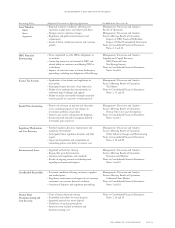

Some of Xcel Energy’s nonregulated subsidiaries have project investments, as listed in Note 14 to the Consolidated Financial Statements,

consisting of minority interests, which may limit the financial risk, but also limit the ability to control the development or operation of

the projects. In addition, significant expenses may be incurred for projects pursued by Xcel Energy’s subsidiaries that do not materialize.

The aggregate effect of these factors creates the potential for volatility in the nonregulated component of Xcel Energy’s earnings.

Accordingly, the historical operating results of Xcel Energy’s nonregulated businesses may not necessarily be indicative of future

operating results.

Inflation Inflation at its current level is not expected to materially affect Xcel Energy’s prices or returns to shareholders. Since late

2001, the Argentine peso has been significantly devalued due to the inflationary Argentine economy. Xcel Energy will continue to

experience related currency translation adjustments through Xcel Energy International.

pending accounting changes

SFAS No. 143 In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 143 – “Accounting for Asset

Retirement Obligations.” This statement will require Xcel Energy to record its future nuclear plant decommissioning obligations as a

liability at fair value with a corresponding increase to the carrying value of the related long-lived asset. The liability will be increased to its

present value each period, and the capitalized cost will be depreciated over the useful life of the related long-lived asset. If at the end of the

asset’s life the recorded liability differs from the actual obligations paid, SFAS No. 143 requires that a gain or loss be recognized at that

time. However, rate-regulated entities may recognize a regulatory asset or liability instead, if the criteria for SFAS No. 71 – “Accounting

for the Effects of Certain Types of Regulation” are met.

Xcel Energy currently follows industry practice by ratably accruing the costs for decommissioning over the approved cost-recovery period

and including the accruals in accumulated depreciation. At Dec. 31, 2002, Xcel Energy recorded and recovered in rates $662 million of

decommissioning obligations and had estimated discounted decommissioning cost obligations of $1.1 billion based on approvals from the

various state commissions, which used a single scenario. However, with the adoption of SFAS No. 143, a probabilistic view of several

decommissioning scenarios was used, resulting in an estimated discounted decommissioning cost obligation of $1.6 billion.

Xcel Energy expects to adopt SFAS No. 143 as required on Jan. 1, 2003. In current estimates for adoption, the initial value of the liability,

including cumulative accretion expense through that date, would be approximately $869 million. This liability would be established by

reclassifying accumulated depreciation of $573 million and by recording two long-term assets totaling $296 million. A gross capitalized

asset of $130 million would be recorded and would be offset by accumulated depreciation of $89 million. In addition, a regulatory asset of

approximately $166 million would be recorded for the cumulative effect adjustment related to unrecognized depreciation and accretion

under the new standard. Management expects that the entire transition amount would be recoverable in rates over time and, therefore,

would support this regulatory asset upon adoption of SFAS No. 143.

Xcel Energy has completed a detailed assessment of the specific applicability and implications of SFAS No. 143 for obligations other

than nuclear decommissioning. Other assets that may have potential asset retirement obligations include ash ponds, any generating

plant with a Part 30 license and electric and natural gas transmission and distribution assets on property under easement agreements.

Easements are generally perpetual and require retirement action only upon abandonment or cessation of use of the property for the

specified purpose. The liability is not estimable because Xcel Energy intends to utilize these properties indefinitely. The asset retirement

obligations for the ash ponds and generating plants cannot be reasonably estimated due to an indeterminate life for the assets associated

with the ponds and uncertain retirement dates for the generating plants. Since the time period for retirement is unknown, no liability

would be recorded. When a retirement date is certain, a liability will be recorded.

SFAS No. 143 also will affect Xcel Energy’s accrued plant removal costs for other generation, transmission and distribution facilities for

its utility subsidiaries. Although SFAS No. 143 does not recognize the future accrual of removal costs as a GAAP liability, long-standing

ratemaking practices approved by applicable state and federal regulatory commissions have allowed provisions for such costs in historical

depreciation rates. These removal costs have accumulated over a number of years based on varying rates as authorized by the appropriate

regulatory entities. Given the long periods over which the amounts were accrued and the changing of rates over time, Xcel Energy has

estimated the amount of removal costs accumulated through historic depreciation expense based on current factors used in the existing

depreciation rates. Accordingly, Xcel Energy has an estimated regulatory liability accrued in accumulated depreciation for future removal

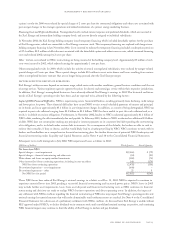

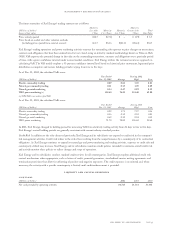

costs of the following amounts at Dec. 31:

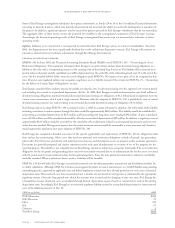

(Millions of dollars) 2002

NSP-Minnesota $304

NSP-Wisconsin 70

PSCo 329

SPS 97

Cheyenne 9

Total Xcel Energy $ 809

page 30 xcel energy inc. and subsidiaries

management’s discussion and analysis