Xcel Energy 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

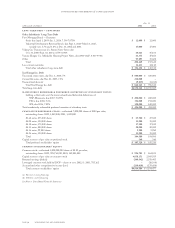

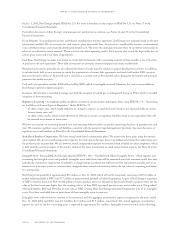

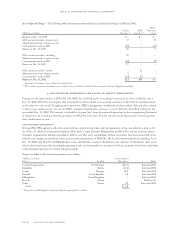

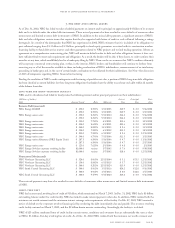

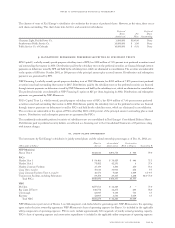

(Millions of dollars) Impairment Disposal

Project Location Loss Gain (Loss) Status

Collinsville Australia $ – $ (3.6) Sale final 2002

EDLAustralia $ – $(14.2) Sale final 2002

ECKG Czech Republic $ – $ (2.1) Sale final 2003

SRW Cogeneration United States $ – $(48.4) Sale final 2002

Mt. Poso United States $ – $ (1.0) Sale final 2002

Kingston Canada $ – $ 9.9 Sale final 2002

Kondapalli India $ (12.7) $ – Sale pending

Loy Yang Australia $(111.4) $ – Operating

NEO MESI United States $ – $ 2.0 Sale final 2002

Other $(14.7) $ –

Total $(138.8) $(57.4)

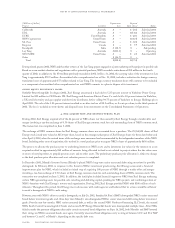

During fourth quarter 2002, NRG and the other owners of the Loy Yang project engaged in a joint marketing of the project for possible sale.

Based on a new market valuation and negotiations with a potential purchaser, NRG recorded a write-down of $58 million in the fourth

quarter of 2002, in addition to the $54 million previously recorded in 2002. At Dec. 31, 2002, the carrying value of the investment in Loy

Yang is approximately $72.9 million. Accumulated other comprehensive loss at Dec. 31, 2002, includes a reduction for foreign currency

translation losses of approximately $77 million related to Loy Yang. The foreign currency translation losses will continue to be included

as a component of accumulated other comprehensive loss until NRG commits to a plan to dispose of its investment.

other equity investment losses

Yorkshire Power Group Sale In August 2002, Xcel Energy announced it had sold its 5.25-percent interest in Yorkshire Power Group

Limited for $33 million to CE Electric UK. Xcel Energy and American Electric Power Co. each held a 50-percent interest in Yorkshire,

a UK retail electricity and gas supplier and electricity distributor, before selling 94.75 percent of Yorkshire to Innogy Holdings plc in

April 2001. The sale of the 5.25-percent interest resulted in an after-tax loss of $8.3 million, or 2 cents per share, in the third quarter of

2002. The loss is included in write-downs and disposal losses from investments on the Consolidated Statements of Operations.

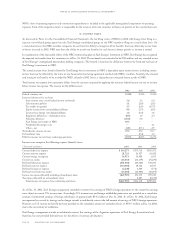

4. nrg acquisition and restructuring plan

During 2002, Xcel Energy acquired all of the 26 percent of NRG shares not then owned by Xcel Energy through a tender offer and

merger involving a tax-free exchange of 0.50 shares of Xcel Energy common stock for each outstanding share of NRG common stock.

The transaction was completed on June 3, 2002.

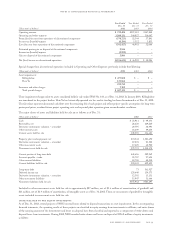

The exchange of NRG common shares for Xcel Energy common shares was accounted for as a purchase. The 25,764,852 shares of Xcel

Energy stock issued were valued at $25.14 per share, based on the average market price of Xcel Energy shares for three days before and

after April 4, 2002, when the revised terms of the exchange were announced and recommended by the independent members of the NRG

board. Including other costs of acquisition, this resulted in a total purchase price to acquire NRG’s shares of approximately $656 million.

The process to allocate the purchase price to underlying interests in NRG assets and to determine fair values for the interests in assets

acquired resulted in approximately $62 million of amounts being allocated to fixed assets related to projects where the fair values were

in excess of carrying values, to prepaid pension assets and to other assets. The preliminary purchase price allocation is subject to change

as the final purchase price allocation and asset valuation process is completed.

In December 2001, Moody’s Investor Service (Moody’s) placed NRG’s long-term senior unsecured debt rating on review for possible

downgrade. In February 2002, in response to this threat to NRG’s investment grade rating, Xcel Energy announced a financial

improvement plan for NRG, which included an initial step of acquiring 100 percent of NRG through a tender offer and merger

involving a tax-free exchange of 0.50 shares of Xcel Energy common stock for each outstanding share of NRG common stock. The

transaction was completed on June 3, 2002. In addition, the initial plan included financial support to NRG from Xcel Energy, marketing

certain NRG generating assets for possible sale, canceling and deferring capital spending for NRG projects and combining certain of

NRG’s functions with Xcel Energy’s systems and organization. During 2002, Xcel Energy provided NRG with $500 million of cash

infusions. Throughout this period, Xcel Energy was in discussions with credit agencies and believed that its actions would be sufficient

to avoid a downgrade of NRG’s credit rating.

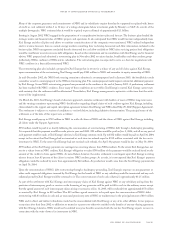

However, even with NRG’s efforts to avoid a downgrade, on July 26, 2002, Standard & Poor’s (S&P) downgraded NRG’s senior unsecured

bonds below investment grade, and, three days later, Moody’s also downgraded NRG’s senior unsecured debt rating below investment

grade. Over the next few months, NRG senior unsecured debt, as well as the secured NRG Northeast Generating LLC bonds, the secured

NRG South Central Generating LLC bonds and secured LSP Energy (Batesville) bonds were downgraded multiple times. After NRG

failed to make the payment obligations due under certain unsecured bond obligations on Sept. 16, 2002, both Moody’s and S&P lowered

their ratings on NRG’s unsecured bonds once again. Currently, unsecured bond obligations carry a rating of between CCC and D at S&P

and between Ca and C at Moody’s, depending on the specific debt issue.

page 60 xcel energy inc. and subsidiaries

notes to consolidated financial statements