Xcel Energy 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Xcel Energy’s obligations under the tentative settlement, including its obligations to make the payments set for the above, are contingent

upon, among other things, the following:

– definitive documentation, in form and substance satisfactory to the parties;

– between 50 percent and 100 percent of the claims represented by various NRG facilities or creditor groups (NRG Credit Facilities)

having executed an agreement, in form and substance satisfactory to Xcel Energy, to support the settlement;

– various stages of the implementation of the settlement occurring by dates currently being negotiated, with the consummation of

the settlement to occur by Sept. 30, 2003;

– the receipt of releases in favor of Xcel Energy by at least 85 percent of the claims represented by the NRG Credit Facilities;

– the receipt by Xcel Energy of all necessary regulatory approvals; and

– no downgrade prior to consummation of the settlement of any Xcel Energy credit rating from the level of such rating as of March

25, 2003.

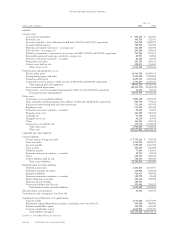

Based on the foreseeable effects of a settlement agreement with the major NRG noteholders and bank lenders and the tax effect of an

expected write-off of Xcel Energy’s investment in NRG, Xcel Energy would recognize the expected tax benefits of the write-off as of

Dec. 31, 2002. The tax benefit has been estimated at approximately $706 million. This benefit is based on the tax basis of Xcel Energy’s

investment in NRG.

Xcel Energy expects to claim a worthless stock deduction in 2003 on its investment. This would result in Xcel Energy having a net

operating loss for the year. Under current law, this 2003 net operating loss could be carried back two years for federal purposes.Xcel

Energy expects to file for a tax refund of approximately $355 million in first quarter 2004. This refund is based on a two-year carryback.

However, under the Bush administration’s new dividend tax proposal, the carryback could be one year, which would reduce the refund

to $125 million.

As to the remaining $351 million of expected tax benefits, Xcel Energy expects to eliminate or reduce estimated quarterly income tax

payments, beginning in 2003. The amount of cash freed up by the reduction in estimated tax payments would depend on Xcel Energy’s

taxable income.

While it is an exception rather than the rule, especially where one of the companies involved is not in bankruptcy, the equitable doctrine

of substantive consolidation permits a bankruptcy court to disregard the separateness of related entities, consolidate and pool the entities’

assets and liabilities and treat them as though held and incurred by one entity where the interrelationship between the entities warrants

such consolidation. In the event the settlement described previously is not effectuated, Xcel Energy believes that any effort to substan-

tively consolidate Xcel Energy with NRG would be without merit. However, it is possible that NRG or its creditors would attempt to

advance such claims, or other claims under piercing the corporate veil, alter ego or related theories, should an NRG bankruptcy

proceeding commence, particularly in the absence of a prenegotiated plan of reorganization, and Xcel Energy cannot be certain how a

bankruptcy court would resolve these issues. One of the creditors of the NRG project Pike, as discussed in Note 18 to the

Consolidated Financial Statements, has already filed involuntary bankruptcy proceedings against that project and has included claims

against both NRG and Xcel Energy. Also, as discussed in Note 18 to the Consolidated Financial Statements, a group of former

executives of NRG have commenced an involuntary bankruptcy proceeding against NRG related to the payments of certain benefits

and deferred compensation amounts claimed to be due them. If a bankruptcy court were to allow substantive consolidation of Xcel

Energy and NRG, it would have a material adverse effect on Xcel Energy.

The accompanying Consolidated Financial Statements do not reflect any conditions or matters that would arise if NRG were in bankruptcy.

If NRG were to file for bankruptcy, and the necessary actions were taken by Xcel Energy to fully relinquish its effective control over

NRG, Xcel Energy anticipates that NRG would no longer be included in Xcel Energy’s consolidated financial statements, prospectively

from the date such actions were taken. Such de-consolidation of NRG would encompass a change in Xcel Energy’s accounting for

NRG to the equity method, under which Xcel Energy would continue to record its interest in NRG’s income or losses until Xcel

Energy’s investment in NRG (under the equity method) reached the level of obligations that Xcel Energy had either guaranteed on

behalf of NRG or was otherwise committed to in the form of financial assistance to NRG. Prior to completion of a bankruptcy proceeding,

a prenegotiated plan of reorganization or other settlement reached with NRG’s creditors would be the determining factors in assessing

whether a commitment to provide financial assistance to NRG existed at the time of de-consolidation.

At Dec. 31, 2002, Xcel Energy’s pro forma investment in NRG, calculated under the equity method if applied at that date, was a negative

$625 million. If the amount of guarantees or other financial assistance committed to NRG by Xcel Energy exceeded that level after

de-consolidation of NRG, then NRG’s losses would continue to be included in Xcel Energy’s results until the amount of negative

investment in NRG reaches the amount of guarantees and financial assistance committed to by Xcel Energy. As of Dec. 31, 2002,

the estimated guarantee exposure that Xcel Energy had related to NRG liabilities was $96 million, as discussed in Note 16 to the

Consolidated Financial Statements, and potential financial assistance was committed in the form of a support and capital subscription

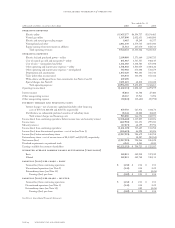

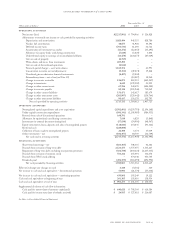

page 40 xcel energy inc. and subsidiaries

management’s discussion and analysis