Xcel Energy 2002 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

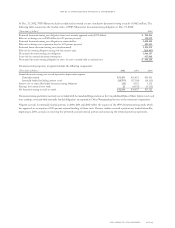

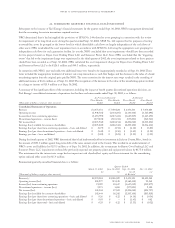

At Dec. 31, 2002, NSP-Minnesota had recorded and recovered in rates cumulative decommissioning accruals of $662 million. The

following table summarizes the funded status of NSP-Minnesota’s decommissioning obligation at Dec. 31, 2002:

(Thousands of dollars) 2002

Estimated decommissioning cost obligation from most recently approved study (1999 dollars) $ 958,266

Effect of escalating costs to 2002 dollars (at 4.35 percent per year) 130,573

Estimated decommissioning cost obligation in current dollars 1,088,839

Effect of escalating costs to payment date (at 4.35 percent per year) 805,435

Estimated future decommissioning costs (undiscounted) 1,894,274

Effect of discounting obligation (using risk-free interest rate) (828,087)

Discounted decommissioning cost obligation 1,066,187

Assets held in external decommissioning trust 617,048

Discounted decommissioning obligation in excess of assets currently held in external trust $ 449,139

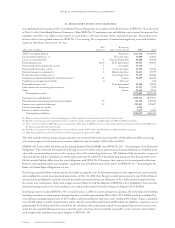

Decommissioning expenses recognized include the following components:

(Thousands of dollars) 2002 2001 2000

Annual decommissioning cost accrual reported as depreciation expense:

Externally funded $51,433 $51,433 $51,433

Internally funded (including interest costs) (18,797) (17,396) (16,111)

Interest cost on externally funded decommissioning obligation (32) 4,535 5,151

Earnings from external trust funds 32 (4,535) (5,151)

Net decommissioning accruals recorded $32,636 $34,037 $35,322

Decommissioning and interest accruals are included with Accumulated Depreciation on the Consolidated Balance Sheet. Interest costs and

trust earnings associated with externally funded obligations are reported in Other Nonoperating Income on the statement of operations.

Negative accruals for internally funded portions in 2000, 2001 and 2002 reflect the impacts of the 1999 decommissioning study, which

has approved an assumption of 100-percent external funding of future costs. Previous studies assumed a portion was funded internally;

beginning in 2000, accruals are reversing the previously accrued internal portion and increasing the external portion prospectively.

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 95