Xcel Energy 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Xcel Energy’s obligations under the tentative settlement, including its obligations to make the payments described previously, are

contingent upon, among other things, the following:

– definitive documentation, in form and substance satisfactory to the parties;

– between 50 percent and 100 percent of the claims represented by various NRG facilities or creditor groups (NRG Credit

Facilities) having executed an agreement, in form and substance satisfactory to Xcel Energy, to support the settlement;

– various stages of the implementation of the settlement occurring by dates currently being negotiated, with the consummation of

the settlement to occur by Sept. 30, 2003;

– the receipt of releases in favor of Xcel Energy by at least 85 percent of the claims represented by the NRG Credit Facilities;

– the receipt by Xcel Energy of all necessary regulatory approvals; and

– no downgrade prior to consummation of the settlement of any Xcel Energy credit rating from the level of such rating as of

March 25, 2003.

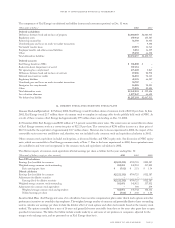

Based on the foreseeable effects of a settlement agreement with the major NRG noteholders and bank lenders and the tax effect of an

expected write-off of Xcel Energy’s investment in NRG, Xcel Energy would recognize the expected tax benefits of the write-off as of

Dec. 31, 2002. The tax benefit has been estimated at approximately $706 million. This benefit is based on the tax basis of Xcel Energy’s

investment in NRG.

Xcel Energy expects to claim a worthless stock deduction in 2003 on its investment. This would result in Xcel Energy having a net

operating loss for the year. Under current law, this 2003 net operating loss could be carried back two years for federal purposes.Xcel

Energy expects to file for a tax refund of approximately $355 million in first quarter 2004. This refund is based on a two-year carryback.

However, under the Bush administration’s new dividend tax proposal, the carryback could be one year, which would reduce the refund

to $125 million.

As to the remaining $351 million of expected tax benefits, Xcel Energy expects to eliminate or reduce estimated quarterly income tax

payments, beginning in 2003. The amount of cash freed up by the reduction in estimated tax payments would depend on Xcel Energy’s

taxable income.

Negotiations are ongoing. There can be no assurance that NRG creditors ultimately will accept any consensual restructuring plan, or

whether, in the interim, NRG lenders and bondholders will forbear from exercising any or all of the remedies available to them, including

acceleration of NRG’s indebtedness, commencement of an involuntary proceeding in bankruptcy and, in the case of a certain lender,

realization on the collateral for their indebtedness.

Throughout the restructuring process, NRG seeks to operate the business in a manner that NRG management believes will offer to

creditors similar protection as would be offered by a bankruptcy court. NRG attempts to preserve the enterprise value of the business

and to treat creditors within each creditor class without preference, unless otherwise agreed to by advisors to all potentially affected

creditors. By operating NRG within this framework, NRG desires to mitigate the risk that creditors will pursue involuntary bankruptcy

proceedings against NRG or its material subsidiaries.

Whether or not NRG reaches a consensual arrangement with NRG’s creditors, there is a substantial likelihood that NRG will be the

subject of a bankruptcy proceeding. If an agreement were reached with NRG’s Creditors on a restructuring plan, it is expected that

NRG would commence a Chapter 11 bankruptcy case and immediately seek approval of a prenegotiated plan of reorganization. Absent

an agreement with NRG’s Creditors and the continued forbearance by such creditors, NRG will be subject to substantial doubt as to its

ability to continue as a going concern and will likely be the subject of a voluntary or involuntary bankruptcy proceeding, which,due to

the lack of a prenegotiated plan of reorganization, would be expected to take an extended period of time to be resolved and may involve

claims against Xcel Energy under the equitable doctrine of substantive consolidation.

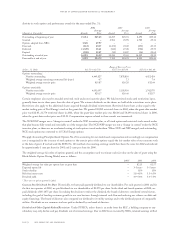

Potential NRG Bankruptcy A preliminary settlement agreement with NRG’s creditors on a comprehensive financial restructuring plan

that, among other things, addresses Xcel Energy’s continuing role and degree of ownership in NRG and obligations to NRG in a

restructured NRG has been reached. Following an agreement on the restructuring with NRG’s creditors and as described previously, it

is expected that NRG would commence a Chapter 11 bankruptcy proceeding and immediately seek approval of a prenegotiated plan

of reorganization. Absent an agreement with NRG’s creditors and the continued forbearance by such creditors, NRG will be subject to

substantial doubt as to its ability to continue as a going concern and will likely be the subject of a voluntary or involuntary bankruptcy

proceeding, which, due to the lack of a prenegotiated plan of reorganization, would be expected to take an extended period of time

to be resolved.

While it is an exception rather than the rule, especially where one of the companies involved is not in bankruptcy, the equitable doctrine

of substantive consolidation permits a bankruptcy court to disregard the separateness of related entities, consolidate and pool the entities’

assets and liabilities and treat them as though held and incurred by one entity where the interrelationship between the entities warrants

such consolidation. Xcel Energy believes that any effort to substantively consolidate Xcel Energy with NRG would be without merit.

However, it is possible that NRG or its creditors would attempt to advance such claims or other claims under piercing the corporate

page 62 xcel energy inc. and subsidiaries

notes to consolidated financial statements