Xcel Energy 2002 Annual Report Download - page 67

Download and view the complete annual report

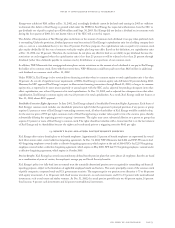

Please find page 67 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Xcel Energy may be required to provide credit enhancements in the form of cash collateral, letters of credit or other security to satisfy

part or potentially all of these exposures, in the event that Standard & Poor’s or Moody’s downgrade Xcel Energy’s credit rating below

investment grade. In the event of a downgrade, Xcel Energy would expect to meet its collateral obligations with a combination of cash

on hand and, upon receipt of an SEC order permitting such actions, utilization of credit facilities and the issuance of securities in the

capital markets.

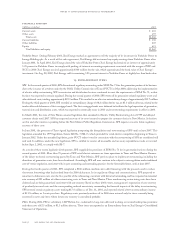

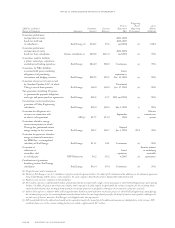

NRG is directly liable for the obligations of certain of its project affiliates and other subsidiaries pursuant to guarantees relating to

certain of their indebtedness, equity and operating obligations. In addition, in connection with the purchase and sale of fuel emission

credits and power generation products to and from third parties with respect to the operation of some of NRG’s generation facilities

in the United States, NRG may be required to guarantee a portion of the obligations of certain of its subsidiaries. As of Dec. 31, 2002,

NRG’s obligations pursuant to its guarantees of the performance, equity and indebtedness obligations of its subsidiaries totaled

approximately $374 million.

In addition, Xcel Energy provides indemnity protection for bonds issued for itself and its subsidiaries. The total amount of bonds with

this indemnity outstanding as of Dec. 31, 2002, was approximately $342.7 million, of which $6.4 million relates to NRG. The total

exposure of this indemnification cannot be determined at this time. Xcel Energy believes the exposure to be significantly less than the

total indemnification.

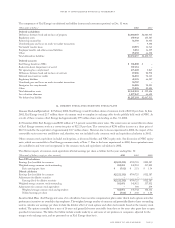

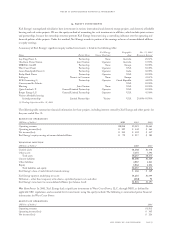

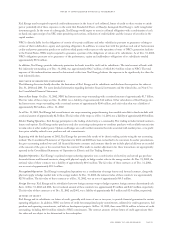

fair value of derivative instruments

The following discussion briefly describes the derivatives of Xcel Energy and its subsidiaries and discloses the respective fair values at

Dec. 31, 2002 and 2001. For more detailed information regarding derivative financial instruments and the related risks, see Note 17 to

the Consolidated Financial Statements.

Interest Rate Swaps On Dec. 31, 2002, NRG had interest rate swaps outstanding with a notional amount of approximately $1.7 billion.

The fair value of those swaps on Dec. 31, 2002, was a liability of approximately $41 million. Other subsidiaries of Xcel Energy also

had interest rate swaps outstanding with a notional amount of approximately $100 million, and a fair value that was a liability of

approximately $12 million, at Dec. 31, 2002.

As of Dec. 31, 2001, Xcel Energy had several interest rate swaps converting project financing from variable-rate debt to fixed-rate debt with

a notional amount of approximately $2.5 billion. The fair value of the swaps as of Dec. 31, 2001, was a liability of approximately $92 million.

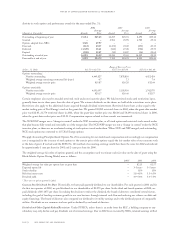

Electric Trading Operations Xcel Energy participates in the trading of electricity as a commodity. This trading includes forward contracts,

futures and options. Xcel Energy makes purchases and sales at existing market points or combines purchases with available transmission

to make sales at other market points. Options and hedges are used to either minimize the risks associated with market prices, or to profit

from price volatility related to our purchase and sale commitments.

Beginning with the third quarter of 2002, Xcel Energy has presented the results of its electric trading activity using the net accounting

method. The Consolidated Statements of Operations for 2001 and 2000 have been reclassified to be consistent. In earlier presentations,

the gross accounting method was used. All financial derivative contracts and contracts that do not include physical delivery are recorded

at the amount of the gain or loss received from the contract. The mark-to-market adjustments for these transactions are appropriately

reported in the Consolidated Statements of Operations in Electric and Gas Trading Revenues.

Regulated Operations Xcel Energy’s regulated energy marketing operation uses a combination of electricity and natural gas purchase

for resale futures and forward contracts, along with physical supply, to hedge market risks in the energy market. At Dec. 31, 2002, the

notional value of these contracts was a liability of approximately $64.3 million. The fair value of these contracts as of Dec. 31,2002,

was an asset of approximately $33.3 million.

Nonregulated Operations Xcel Energy’s nonregulated operations use a combination of energy futures and forward contracts, along with

physical supply, to hedge market risks in the energy market. At Dec. 31, 2002, the notional value of these contracts was approximately

$253.8 million. The fair value of these contracts as of Dec. 31, 2002, was an asset of approximately $69.3 million.

Foreign Currency Xcel Energy and its subsidiaries have two foreign currency swaps to hedge or protect foreign currency denominated cash

flows. At Dec. 31, 2002 and 2001, the net notional amount of these contracts was approximately $3 million and $46.3 million, respectively.

The fair value of these contracts as of Dec. 31, 2002 and 2001, was a liability of approximately $0.3 million and $2.4 million, respectively.

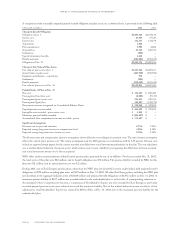

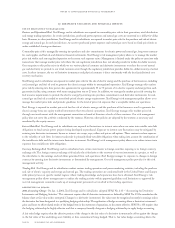

letters of credit

Xcel Energy and its subsidiaries use letters of credit, generally with terms of one or two years, to provide financial guarantees for certain

operating obligations. In addition, NRG uses letters of credit for nonregulated equity commitments, collateral for credit agreements, fuel

purchase and operating commitments, and bids on development projects. At Dec. 31, 2002, there were $154.6 million in letters of credit

outstanding, including $110.0 million related to NRG commitments. The contract amounts of these letters of credit approximate their

fair value and are subject to fees determined in the marketplace.

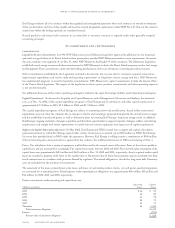

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 81