Xcel Energy 2002 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

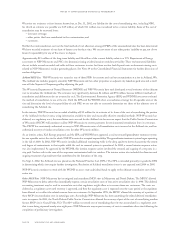

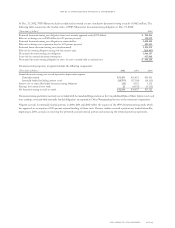

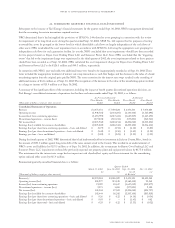

20. regulatory assets and liabilities

Our regulated businesses prepare their Consolidated Financial Statements in accordance with the provisions of SFAS No. 71, as discussed

in Note 1 to the Consolidated Financial Statements. Under SFAS No. 71, regulatory assets and liabilities can be created for amounts that

regulators may allow us to collect, or may require us to pay back to customers in future electric and natural gas rates. Any portion of our

business that is not regulated cannot use SFAS No. 71 accounting. The components of unamortized regulatory assets and liabilities

shown on the balance sheet at Dec. 31 were:

Note Remaining

(Thousands of dollars) Reference Amortization Period 2002 2001

AFDC recorded in plant(a) Plant lives $154,158 $149,591

Conservation programs(a) (e) Up to five years 53,860 65,825

Losses on reacquired debt 1 Term of related debt 85,888 95,394

Environmental costs 18, 19 To be determined 30,974 20,169

Unrecovered electric production costs(d) 127 months 67,709 –

Unrecovered natural gas costs(b) 1One to two years 11,950 11,316

Deferred income tax adjustments 1 Mainly plant lives 18,611 17,799

Nuclear decommissioning costs(c) Up to eight years 53,567 68,484

Employees’ postretirement benefits other than pension 13 10 years 38,899 42,942

Employees’ postemployment benefits 2 One year –119

Renewable resource costs To be determined 26,000 17,500

State commission accounting adjustments(a) Plant lives 19,157 7,578

Other Various 15,630 5,725

Total regulatory assets $576,403 $502,442

Investment tax credit deferrals $109,571 $117,257

Unrealized gains from decommissioning investments 19 112,145 149,041

Pension costs-regulatory differences 13 287,615 215,687

Interest on income tax refunds 6,569 –

Fuel costs, refunds and other 2,527 1,957

Total regulatory liabilities $518,427 $483,942

(a) Earns a return on investment in the ratemaking process. These amounts are amortized consistent with recovery in rates.

(b) Excludes current portion with expected rate recovery within 12 months of $12 million and $22 million for 2002 and 2001, respectively.

(c) These costs do not relate to NSP-Minnesota’s nuclear plants. They relate to DOE assessments, as discussed previously, and unamortized costs for PSCo’s Fort

St. Vrain nuclear plant decommissioning.

(d) Excludes current portion with expected rate recovery within 12 months of $54 million and $0 million for 2002 and 2001, respectively.

(e) 2001 amount includes accrued conservation incentives expected to be approved for 2001.

This table excludes deferred energy charges expected to be recovered within the next 12 months of $28 million for 2002, and energy

cost recovery expected to be returned to customers within the next 12 months of $26 million for 2001.

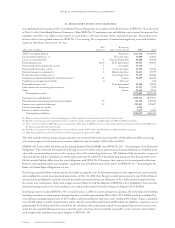

SFAS No. 143 In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 143 – “Accounting for Asset Retirement

Obligations.” This statement will require Xcel Energy to record its future nuclear plant decommissioning obligations as a liability at fair

value with a corresponding increase to the carrying value of the related long-lived asset. The liability will be increased to its present

value each period, and the capitalized cost will be depreciated over the useful life of the related long-lived asset. If at the end of the asset’s

life the recorded liability differs from the actual obligations paid, SFAS No. 143 requires that a gain or loss be recognized at that time.

However, rate-regulated entities may recognize a regulatory asset or liability instead, if the criteria for SFAS No. 71 – “Accounting for the

Effects of Certain Types of Regulation” are met.

Xcel Energy currently follows industry practice by ratably accruing the costs for decommissioning over the approved cost recovery period

and including the accruals in accumulated depreciation. At Dec. 31, 2002, Xcel Energy recorded and recovered in rates $662 million of

decommissioning obligations and had estimated discounted decommissioning cost obligations of $1.1 billion based on approvals from

the various state commissions, which used a single scenario. However, with the adoption of SFAS No. 143, a probabilistic view of several

decommissioning scenarios was used, resulting in an estimated discounted decommissioning cost obligation of $1.6 billion.

Xcel Energy expects to adopt SFAS No. 143 as required on Jan. 1, 2003. In current estimates for adoption, the initial value of the liability,

including cumulative accretion expense through that date, would be approximately $869 million. This liability would be established by

reclassifying accumulated depreciation of $573 million and by recording two long-term assets totaling $296 million. A gross capitalized

asset of $130 million would be recorded and would be offset by accumulated depreciation of $89 million. In addition, a regulatory asset of

approximately $166 million would be recorded for the cumulative effect adjustment related to unrecognized depreciation and accretion

under the new standard. Management expects that the entire transition amount would be recoverable in rates over time and, therefore,

would support this regulatory asset upon adoption of SFAS No. 143.

page 96 xcel energy inc. and subsidiaries

notes to consolidated financial statements