Xcel Energy 2002 Annual Report Download - page 17

Download and view the complete annual report

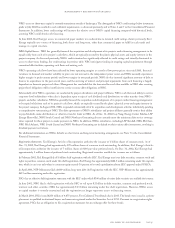

Please find page 17 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SFAS No. 145 In April 2002, the FASB issued SFAS No. 145 – “Rescission of FASB Statements No. 4, 44, and 64, Amendment of

FASB Statement No. 13, and Technical Corrections,” which supercedes previous guidance for the reporting of gains and losses from

extinguishment of debt and accounting for leases, among other things. Adoption of SFAS No. 145 may affect the recognition of

impacts from NRG’s financial improvement and restructuring plan, if existing debt agreements are ultimately renegotiated while NRG

is still a consolidated subsidiary of Xcel Energy. Other impacts of SFAS No. 145 are not expected to be material to Xcel Energy.

SFAS No. 146 In June 2002, the FASB issued SFAS No. 146 – “Accounting for Exit or Disposal Activities,” addressing recognition,

measurement and reporting of costs associated with exit and disposal activities, including restructuring activities. SFAS No. 146 may have

an impact on the timing of recognition of costs related to the implementation of the NRG financial improvement and restructuring plan;

however, such impact is not expected to be material.

SFAS No. 148 In December 2002, the FASB issued SFAS No. 148 – “Accounting for Stock-Based Compensation – Transition and

Disclosure,” amending FASB Statement No. 123 to provide alternative methods of transition for a voluntary change to the fair-value-based

method of accounting for stock-based employee compensation, and requiring disclosure in both annual and interim Consolidated Financial

Statements about the method used and the effect of the method used on results. Xcel Energy continues to account for its stock-based

compensation plans under Accounting Principles Board (APB) Opinion No. 25 - “Accounting for Stock Issued to Employees” and does

not plan at this time to adopt the voluntary provisions of SFAS No. 148.

Emerging Issues Tax Force (EITF) Nos. 02-03 and 98-10 See Note 1 to the Consolidated Financial Statements regarding reporting changes

made in 2002 for the presentation of trading results and pending changes related to accounting for the impacts of trading operations in 2003.

FASB Interpretation No. 45 (FIN No. 45) In November 2002, the FASB issued FIN No. 45 – “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others.” The initial recognition and measurement

provisions of this interpretation are applicable on a prospective basis to guarantees issued or modified after Dec. 31, 2002, irrespective

of the guarantor’s fiscal year-end. The disclosure requirements are effective for financial statements of interim or annual periods ending

after Dec. 15, 2002. The interpretation addresses the disclosures to be made by a guarantor in its interim and annual financial statements

about its obligations under guarantees. The interpretation also clarifies the requirements related to the recognition of a liability by a

guarantor at the inception of the guarantee for the obligations the guarantor has undertaken in issuing the guarantee.

FASB Interpretation No. 46 (FIN No. 46) In January 2003, the FASB issued FIN No. 46, requiring an enterprise’s consolidated financial

statements to include subsidiaries in which the enterprise has a controlling financial interest. Historically, that requirement has been

applied to subsidiaries in which an enterprise has a majority voting interest, but in many circumstances the enterprise’s consolidated

financial statements do not include the consolidations of variable interest entities with which it has similar relationships but no majority

voting interest. Under FIN No. 46, the voting interest approach is not effective in identifying controlling financial interest. As a result,

Xcel Energy expects that it will have to consolidate its affordable housing investments made through Eloigne, which currently are accounted

for under the equity method.

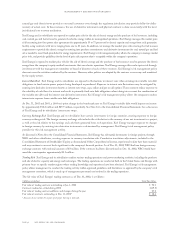

As of Dec. 31, 2002, the assets of these entities were approximately $155 million and long-term liabilities were approximately $87 million.

Currently, investments of $62 million are reflected as a component of investments in unconsolidated affiliates in the Dec. 31, 2002,

Consolidated Balance Sheet. FIN No. 46 requires that for entities to be consolidated, the entities’ assets be initially recorded at their

carrying amounts at the date the new requirement first applies. If determining carrying amounts as required is impractical, then the

assets are to be measured at fair value as of the first date the new requirements apply. Any difference between the net consolidated amounts

added to the Xcel Energy’s balance sheet and the amount of any previously recognized interest in the newly consolidated entity should be

recognized in earnings as the cumulative-effect adjustment of an accounting change. Had Xcel Energy adopted FIN No. 46 requirements

early in 2002, there would have been no material impact to net income. Xcel Energy plans to adopt FIN No. 46 when required in the

third quarter of 2003.

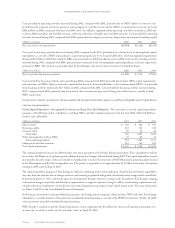

derivatives, risk management and market risk

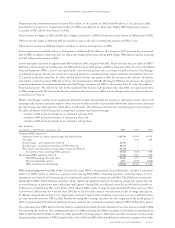

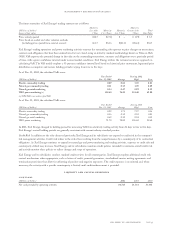

Business and Operational Risk Xcel Energy and its subsidiaries are exposed to commodity price risk in their generation, retail distribution

and energy trading operations. In certain jurisdictions, purchased energy expenses and natural gas costs are recovered on a dollar-for-dollar

basis. However, in other jurisdictions, Xcel Energy and its subsidiaries have limited exposure to market price risk for the purchase and sale

of electric energy and natural gas. In such jurisdictions, electric energy and natural gas expenses are recovered based on fixed price limits

or under established sharing mechanisms.

Xcel Energy manages commodity price risk by entering into purchase and sales commitments for electric power and natural gas, long-term

contracts for coal supplies and fuel oil, and derivative instruments. Xcel Energy’s risk management policy allows the company to manage

the market price risk within each rate-regulated operation to the extent such exposure exists. Management is limited under the policy to

enter into only transactions that manage market price risk where the rate regulation jurisdiction does not already provide for dollar-for-dollar

recovery. One exception to this policy exists in which we use various physical contracts and derivative instruments to reduce the cost of

management’s discussion and analysis

xcel energy inc. and subsidiaries page 31