Xcel Energy 2002 Annual Report Download - page 53

Download and view the complete annual report

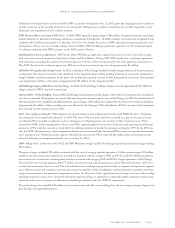

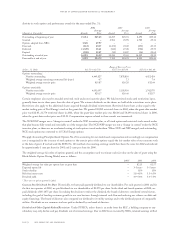

Please find page 53 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gas, Inc. was in default under the loan agreement dated July 6, 1998, due to the failure to meet the insurance requirements under the

loan document. On Jan. 30, 2003, NRG failed to make $2.7 million in payments under certain acquisition agreements. As a result,

NEO Landfill Gas, Inc. failed to make its payment due on Jan. 30, 2003, under the loan agreement and the subsidiaries of NEO

Landfill Gas failed to make their payments pursuant to various agreements.

Northeast Generating LLC In February 2000, NRG Northeast Generating LLC, an indirect, wholly owned subsidiary of NRG, issued

$750 million of project level senior secured bonds to refinance short-term project borrowings and for certain other purposes. The bonds

are jointly and severally guaranteed by each of NRG Northeast’s existing and future subsidiaries. The bonds are secured by a security

interest in NRG Northeast’s membership or other ownership interests in the guarantors and its rights under all intercompany notes

between NRG Northeast and the guarantors. In December 2002, NRG Northeast Generating failed to make $24.7-million interest and

$53.5-million principal payments. NRG Northeast Generating had a 15-day grace period to make payment. On Dec. 27, 2002, NRG

made the $24.7-million interest payment due on the NRG Northeast Generating bonds but failed to make the $53.5-million principal

payment. As a result, the payment default associated with its failure to make principal payments when they come due is currently in

effect. NRG also failed to make a debt service reserve account cash deposit within 30 days of a credit-rating downgrade in July 2002. In

addition, NRG Northeast Generating is also in default of its debt covenants because of the lapse of the 60-day grace period regarding the

necessary dismissal of an involuntary bankruptcy proceeding. For these reasons, NRG Northeast Generating is in default on these notes.

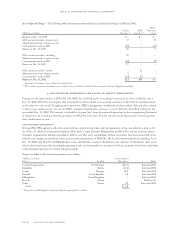

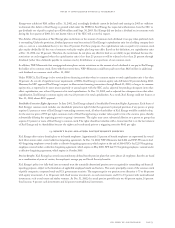

NRG South Central Generating LLC In March 2000, NRG South Central Generating LLC, an indirect, wholly owned subsidiary of

NRG, issued $800 million of senior secured bonds in a two-part offering to finance its acquisition of the Cajun generating facilities.

The bonds are secured by a security interest in NRG Central U.S. LLC’s and South Central Generating Holding LLC’s membership

interests in NRG South Central and NRG South Central’s membership interests in Louisiana Generating and all of the assets related

to the Cajun facilities, including its rights under a guarantor loan agreement and all inter-company notes between it and Louisiana

Generating, and a revenue account and a debt service reserve account. On Sept. 15, 2002, NRG South Central Generating missed a

$47-million principal and interest payment. The 15-day grace period to make payment related to this issue has passed, and NRG South

Central Generating did not make the required payments. In January 2003, the South Central Generating bondholders unilaterally withdrew

$35.6 million from the restricted revenue account, relating to the Sept. 15, 2002, interest payment and fees. On March 17, 2003, South

Central bondholders were paid $34.4 million due in relation to the semi-annual interest payment, and the $12.8 million principal payment

was deferred. NRG South Central remains in default on these notes.

Flinders Power Finance In September 2000, Flinders Power Finance Pty (Flinders Power), an Australian wholly owned subsidiary, entered

into a 12-year AUD $150-million promissory note (US $81.4 million at September 2000). As of Dec. 31, 2002, there remains $80.5 million

outstanding under this facility. In March 2002, Flinders Power entered into a 10-year AUD $165-million (US $85.4 million at March 2002)

floating rate promissory note for the purpose of refurbishing the Flinders Playford generating station. As of Dec. 31, 2002, Flinders Power

had drawn $18.7 million (AUD $33 million) of this facility. Upon NRG’s credit-rating downgrade in 2002, there existed a potential default

under these agreements related to the funding of reserve funds. Flinders continues to work with its lenders subsequent to the downgrade.

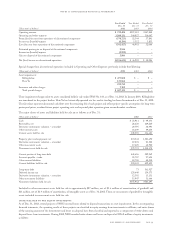

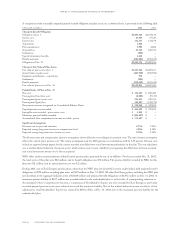

NRG Peaker Finance Company LLC In June 2002, NRG Peaker Finance Co. LLC (NRG Peaker), an indirect, wholly owned subsidiary

of NRG, completed the issuance of $325 million of Series A Floating Rate Senior Secured Bonds, due 2019. The bonds are secured by

a pledge of membership interests in NRG Peaker and a security interest in all of its assets, which initially consisted of notes evidencing

loans to the affiliate project owners. The project owners jointly and severally guaranteed the entire principal amount of the bonds

and interest on such principal amount. The project owner guarantees are secured by a pledge of the membership interest in three of five

project owners and a security interest in substantially all of the project owners’ assets related to the peaker projects, including equipment,

real property rights, contracts and permits. NRG has entered into a contingent guarantee agreement in favor of the collateral agent for

the benefit of the secured parties, under which it agreed to make payments to cover scheduled principal and interest payments on the

bonds and regularly scheduled payments under the interest rate swap agreement, to the extent that the net revenues from the peaker

projects are insufficient to make such payments, in specified circumstances. As a result of cross-default provisions, this facility is in

default. On Dec. 10, 2002, $16.0 million in interest, principal, and swap payments were made from restricted cash accounts. As a

result, $319.4 million in principal remains outstanding as of Dec. 31, 2002.

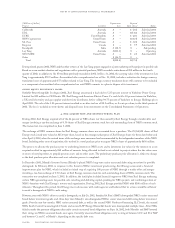

LSP-Pike Energy LLC LSP-Pike Energy LLC received a loan to construct its power generation facility in Pike County, Mississippi,

that was financed by the issuance of industrial revenue bonds (Series 2002). NRG Finance Co. I LLC, an affiliate of LSP-Pike Energy

LLC, purchased the Series 2002 bonds. These bonds are subject to a subordination agreement between NRG Finance Co. I LLC, as

purchaser, and LSP-Pike Energy LLC and Credit Suisse First Boston, as administrative agent to a senior claim. In the case of insolvency

or bankruptcy proceedings, or any receivership, liquidation, reorganization or other similar proceedings, and even in the event of any

proceedings for voluntary liquidation, dissolutions or other winding up of the company, the holders of the senior claims shall be entitled

to receive payment in full or cash equivalents of all principal, interest, charges and fees on all senior claims before the purchaser is entitled

to receive any payment on account of the principal of or interest on these bonds. As of Oct. 17, 2002, the United States Bankruptcy

Court for the Southern District of Mississippi granted an order of relief to the debtor under the U.S. bankruptcy laws, thus forcing

LSP-Pike Energy LLC into default and cessation of all benefits granted under the terms of the loan agreement and issuance of the bonds.

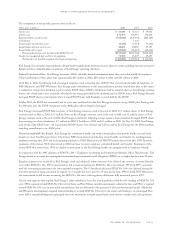

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 67