Xcel Energy 2002 Annual Report Download - page 23

Download and view the complete annual report

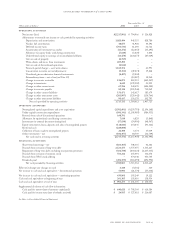

Please find page 23 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NRG’s access to short-term capital is currently nonexistent outside of bankruptcy. The downgrade of NRG’s credit ratings below investment

grade in July 2002 has resulted in cash collateral requirements, as discussed previously and in Notes 4 and 7 to the Consolidated Financial

Statements. In addition, lower credit ratings will increase the relative cost of NRG’s capital financing compared with historical levels,

assuming NRG could obtain such financing.

In June 2002, Xcel Energy’s access to commercial paper markets was reduced due to lowered credit ratings, shown previously. Xcel

Energy typically uses sources of financing, both short- and long-term, other than commercial paper to fulfill its cash needs and

manage its capital structure.

NRG Capital Sources NRG has generally financed the acquisition and development of its projects under financing arrangements to be

repaid solely from each of its project’s cash flows, which are typically secured by the plant’s physical assets and equity interests in the

project company. As discussed previously, NRG’s credit situation has significantly affected its credit ratings and virtually eliminated its

access to short-term funding. See credit ratings in previous table. NRG anticipates funding its ongoing capital requirements through

committed debt facilities, operating cash flows and existing cash.

NRG’s operating cash flows have been affected by lower operating margins as a result of low power prices since mid-2001. Seasonal

variations in demand and market volatility in prices are not unusual in the independent power sector, and NRG normally experiences

higher margins in peak summer periods and lower margins in non-peak periods. NRG also has incurred significant amounts of debt to

finance its acquisitions in the past several years, and the servicing of interest and principal repayments from such financing is largely

dependent on domestic project cash flows. Management has concluded that the forecasted free cash flow available to NRG after servicing

project-level obligations will be insufficient to service recourse debt obligations at NRG.

Substantially all of NRG’s operations are conducted by project subsidiaries and project affiliates. NRG’s cash flow and ability to service

corporate-level indebtedness when due is dependent upon receipt of cash dividends and distributions or other transfers from NRG’s

projects and other subsidiaries. NRG has generally financed the acquisition and development of its projects under financing arrangements

to be repaid solely from each of its project’s cash flows, which are typically secured by the plant’s physical assets and equity interests in

the project company. In August 2002, NRG suspended substantially all of its acquisition and development activities indefinitely, pending

a comprehensive restructuring of NRG. The debt agreements of NRG’s subsidiaries and project affiliates generally restrict their ability

to pay dividends, make distributions or otherwise transfer funds to NRG. As of Dec. 31, 2002, Loy Yang, Energy Center Kladno, LSP

Energy (Batesville), NRG South Central and NRG Northeast Generating do not currently meet the minimum debt service coverage

ratios required for these projects to make payments to NRG. In addition, NRG’s subsidiaries, including LSP Kendall, NRG McClain,

NRG Mid-Atlantic, NRG South Central and NRG Northeast Generating are in default on their various debt instruments, resulting in

dividend payment restrictions.

For additional information on NRG’s defaults on short-term and long-term borrowing arrangements, see Note 7 to the Consolidated

Financial Statements.

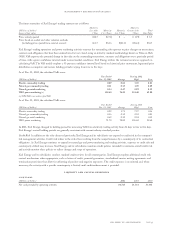

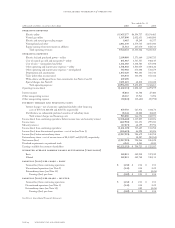

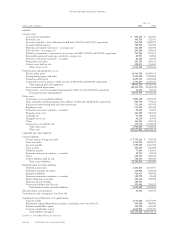

Registration Statements Xcel Energy’s Articles of Incorporation authorize the issuance of 1 billion shares of common stock. As of

Dec. 31, 2002, Xcel Energy had approximately 399 million shares of common stock outstanding. In addition, Xcel Energy’s Articles

of Incorporation authorize the issuance of 7 million shares of $100 par value preferred stock. On Dec. 31, 2002, Xcel Energy had

approximately 1 million shares of preferred stock outstanding. Registered securities available for issuance are as follows:

In February 2002, Xcel Energy filed a $1-billion shelf registration with the SEC. Xcel Energy may issue debt securities, common stock and

rights to purchase common stock under this shelf registration. Xcel Energy has approximately $482.5 million remaining under this registra-

tion, which it can issue only when its common equity exceeds 30 percent of its total capitalization absent SEC approval under PUHCA.

In April 2001, NSP-Minnesota filed a $600-million, long-term debt shelf registration with the SEC. NSP-Minnesota has approximately

$415 million remaining under this registration.

PSCo has an effective shelf registration statement with the SEC under which $300 million of senior debt securities are available for issuance.

In June 2001, NRG filed a shelf registration with the SEC to sell up to $2 billion in debt securities, common and preferred stock,

warrants and other securities. NRG has approximately $1.5 billion remaining under this shelf registration. However, NRG’s access

to capital markets is severely constrained and the registration no longer represents access to financing sources.

In March 2003, PSCo issued $250 million of 4.875-percent, First Collateral Trust Bonds due in 2013. The bonds were issued in a private

placement to qualified institutional buyers and were not registered under the Securities Act of 1933. Pursuant to a registration rights

agreement, PSCo has an obligation to file a registration statement for an exchange offer for these bonds.

management’s discussion and analysis

xcel energy inc. and subsidiaries page 37