Xcel Energy 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

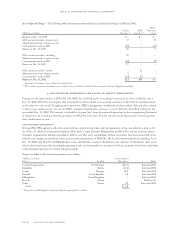

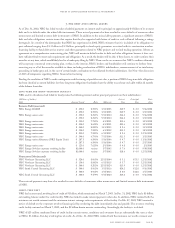

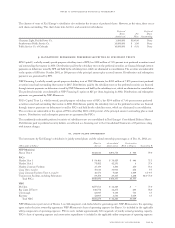

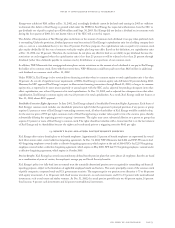

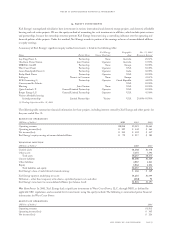

long-term debt – credit facilities

NRG has several credit facilities used for long-term financing:

(Thousands of dollars) Available Recourse Outstanding Rate at

Facility Line of Credit to NRG End Date Dec. 31, 2002 Dec. 31, 2002

Revolving lines of credit

NRG Finance Co. I LLC $2,000,000 Yes May 2006 $1,081,000 4.92%

Term loan facilities

Mid-Atlantic $580,000 No November 2005 $409,200 3.30%

LSP Kendall Energy $554,200 No September 2005 $495,800 3.19%

Brazos Valley $180,000 No June 2008 $194,400 4.41%

McClain $296,000 No November 2006 $157,300 4.57%

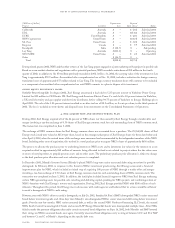

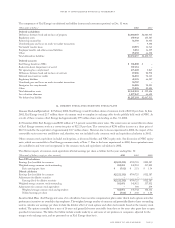

NRG Financing Co. I LLC The NRG Finance Co. I LLC facility has been used to finance the acquisition, development and construction

of power generating plants located in the United States, and to finance the acquisition of turbines for such facilities. The facility is

nonrecourse to NRG other than its obligation to contribute equity at certain times in respect of projects and turbines financed under the

facility. NRG estimates the obligations to contribute equity to be approximately $819 million as of Dec. 31, 2002. At Dec. 31, 2002,

interest and fees due in September 2002 were not paid, and NRG has suspended required equity contributions to the projects. Supporting

construction and other contracts associated with NRG’s Pike and Nelson projects were violated by NRG in September and October 2002,

respectively. In November 2002, lenders to NRG accelerated the approximately $1.08 billion of debt under the construction revolver

facility, rendering the debt immediately due and payable. Thus, this facility is currently in default.

LSP Kendall Energy As part of NRG’s acquisition of the LS Power assets in January 2001, NRG, through its wholly owned subsidiary

LSP Kendall Energy LLC, has acquired a $554.2-million credit facility. On Jan. 10, 2003, NRG received a notice of default from LSP

Kendall’s lenders indicating that certain events of default have taken place. By issuing this notice of default, the lenders have preserved all

of their rights and remedies under the credit agreement and other credit documents. NRG is negotiating a waiver to this default notice

with the creditors to LSP Kendall.

Brazos Valley In June 2001, NRG, through its wholly owned subsidiaries Brazos Valley Energy LP and Brazos Valley Technology LP,

entered into a $180-million nonrecourse construction credit facility to fund the construction of the 600-megawatt Brazos Valley gas-fired,

combined-cycle merchant generation facility, located in Texas. On Jan. 31, 2003, NRG consented to the foreclosure of its Brazos Valley

project by its lenders. As consequence of foreclosure, NRG no longer has any interest in the Brazos Valley project. However, NRG may

be obligated to infuse additional capital to fund a debt service reserve account that had never been funded, and may be obligated to make

an equity infusion to satisfy a contingent equity agreement. As of Dec. 31, 2002, NRG recorded $24 million for the potential obligations.

McClain In August 2001, NRG entered into a 364-day term loan of up to $296 million. The credit facility was structured as a senior

unsecured loan and was partially nonrecourse to NRG. The proceeds were used to finance the McClain generating facility acquisition.

In November 2001, the credit facility was repaid from the proceeds of a $181.0-million term loan and $8.0-million working capital

facility entered into by NRG McClain LLC with Westdeutsche Landesbank Girozentrale, nonrecourse to NRG. On Sept. 17, 2002,

NRG McClain LLC received notice from the agent bank that the project loan was in default as a result of the downgrade of NRG and

of defaults on material obligations.

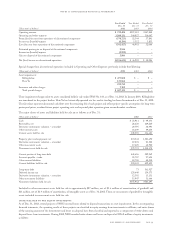

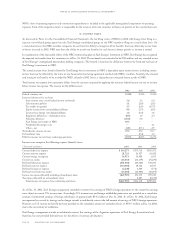

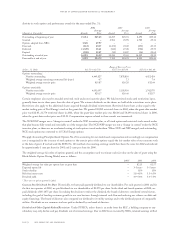

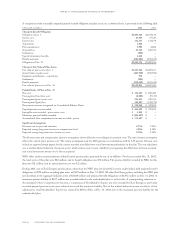

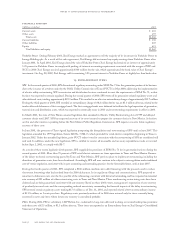

8. preferred stock

At Dec. 31, 2002, Xcel Energy had six series of preferred stock outstanding, which were callable at its option at prices ranging from

$102.00 to $103.75 per share plus accrued dividends. Xcel Energy can only pay dividends on its preferred stock from retained earnings

absent approval of the SEC under PUHCA. See Note 12 for a description of such restrictions.

The holders of the $3.60 series preferred stock are entitled to three votes for each share held. The holders of the other preferred stocks

are entitled to one vote per share. While dividends payable on the preferred stock of any series outstanding is in arrears in an amount

equal to four quarterly dividends, the holders of preferred stocks, voting as a class, are entitled to elect the smallest number of directors

necessary to constitute a majority of the board of directors, and the holders of common stock, voting as a class, are entitled to elect the

remaining directors.

page 68 xcel energy inc. and subsidiaries

notes to consolidated financial statements