Xcel Energy 2002 Annual Report Download - page 4

Download and view the complete annual report

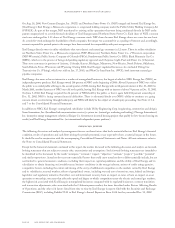

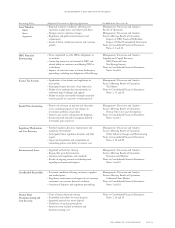

Please find page 4 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tax Benefit – NRG Investment As discussed in Note 11 to the Consolidated Financial Statements, it was determined in 2002 that NRG was

no longer likely to be included in Xcel Energy’s consolidated income tax group. Approximately $706 million has been recognized at one of

Xcel Energy’s nonregulated intermediate holding companies for the estimated tax benefits related to Xcel Energy’s investment in NRG, based

on the difference between book and tax bases of such investment. This estimated tax benefit increased 2002 annual results by $1.85 per share.

Other Nonregulated and Holding Companies Nonregulated and holding company earnings for 2002 were reduced by losses of

approximately 6 cents per share for the combined effects of unusual items that occurred during the year. As discussed later, Xcel

International recorded impairment losses for Argentina assets of 3 cents per share and disposal losses for Yorkshire Power of 2 cents per

share, Planergy recorded gains from contract sales of 2 cents per share, losses were incurred on holding company debt of 2 cents per share,

and incremental costs related to NRG financial restructuring activities of 1 cent per share were incurred at the holding company level.

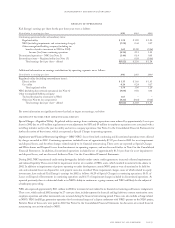

significant factors that impacted 2001 results

Regulated utility earnings were reduced by a net 1 cent per share from the combined effects of four unusual items that occurred during

the year. Three of the items affected continuing operations, reducing earnings by 4 cents per share. The remaining item increased income

from extraordinary items by 3 cents per share.

Conservation Incentive Recovery Regulated utility earnings from continuing operations in 2001 were increased by 7 cents per share due

to a Minnesota Public Utilities Commission (MPUC) decision. In June 2001, the MPUC approved a plan allowing recovery of 1998

incentives associated with state-mandated programs for energy conservation. As a result, the previously recorded liabilities of approximately

$41 million, including carrying charges, for potential refunds to customers were no longer required. The plan approved by the MPUC

increased revenue by approximately $34 million and increased allowance for funds used during construction by approximately $7 million,

increasing earnings by 7 cents per share for the second quarter of 2001. Based on the new MPUC policy and less uncertainty regarding

conservation incentives to be approved, conservation incentives are being recorded on a current basis beginning in 2001.

Special Charges – Postemployment Benefits and Restaffing Costs Regulated utility earnings from continuing operations in 2001 were

decreased by 4 cents per share due to a Colorado Supreme Court decision that resulted in a pretax write-off of $23 million of a regulatory

asset related to deferred postemployment benefit costs at PSCo.

Also, regulated utility earnings from continuing operations were reduced by approximately 7 cents per share in 2001 due to $39 million of

employee separation costs associated with a restaffing initiative late in the year for utility and service company operations. See Note 2 to

the Consolidated Financial Statements for further discussion of these items, which are reported as Special Charges in operating expenses.

Extraordinary Items – Electric Utility Restructuring In 2001, extraordinary income of $18 million before tax, or 3 cents per share, was

recorded related to the regulated utility business to reflect the impacts of industry restructuring developments for SPS. This represents a

reversal of a portion of the 2000 extraordinary loss discussed later. For more information on SPS extraordinary items, see Note 15 to the

Consolidated Financial Statements.

significant factors that impacted 2000 results

Special Charges – Merger Costs During 2000, Xcel Energy expensed pretax special charges of $241 million, or 52 cents per share, for

costs related to the merger between NSP and NCE. Of these special charges, approximately 44 cents per share were associated with the

costs of merging regulated utility operations and 8 cents per share were associated with merger impacts on nonregulated and holding

company activities other than NRG. See Note 2 to the Consolidated Financial Statements for more information on these merger-

related costs reported as Special Charges.

Extraordinary Items – Electric Utility Restructuring In 2000, extraordinary losses of approximately $28 million before tax, or 6 cents per

share, were recorded related to the regulated utility business for the expected discontinuation of regulatory accounting for SPS’generation

business. For more information on SPS extraordinary items, see Note 15 to the Consolidated Financial Statements.

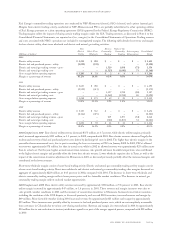

statement of operations analysis

Electric Utility and Commodity Trading Margins Electric fuel and purchased power expenses tend to vary with changing retail and

wholesale sales requirements and unit cost changes in fuel and purchased power. Due to fuel cost recovery mechanisms for retail

customers in several states, most fluctuations in energy costs do not materially affect electric utility margin. However, the fuel clause

cost recovery in Colorado does not allow for complete recovery of all variable production expense, and cost changes can affect earnings.

Electric utility margins reflect the impact of sharing energy costs and savings relative to a target cost per delivered kilowatt-hour and

certain trading margins under the incentive cost adjustment (ICA) ratemaking mechanism in Colorado. In addition to the ICA,

Colorado has other adjustment clauses that allow certain costs to be recovered from retail customers.

Xcel Energy has three distinct forms of wholesale sales: short-term wholesale, electric commodity trading and natural gas commodity

trading. Short-term wholesale refers to electric sales for resale, which are associated with energy produced from Xcel Energy’s generation

assets or energy and capacity purchased to serve native load. Electric and natural gas commodity trading refers to the sales for resale

activity of purchasing and reselling electric and natural gas energy to the wholesale market.

page 18 xcel energy inc. and subsidiaries

management’s discussion and analysis