Xcel Energy 2002 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

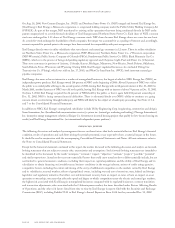

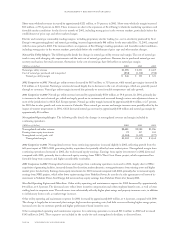

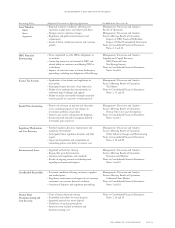

Xcel Energy’s commodity trading operations are conducted by NSP-Minnesota (electric), PSCo (electric) and e prime (natural gas).

Margins from electric trading activity, conducted at NSP-Minnesota and PSCo, are partially redistributed to other operating utilities

of Xcel Energy, pursuant to a joint operating agreement (JOA) approved by the Federal Energy Regulatory Commission (FERC).

Trading margins reflect the impact of sharing certain trading margins under the ICA. Trading revenues, as discussed in Note 1 to the

Consolidated Financial Statements, are reported net (i.e., margins) in the Consolidated Statements of Operations. Trading revenue

and costs associated with NRG’s operations are included in nonregulated margins. The following table details the revenue and margin

for base electric utility, short-term wholesale and electric and natural gas trading activities.

Base Electric Natural Gas

Electric Short-Term Commodity Commodity Intercompany Consolidated

(Millions of dollars) Utility Wholesale Trading Trading Eliminations Totals

2002

Electric utility revenue $ 5,232 $ 203 $ – $ – $ – $ 5,435

Electric fuel and purchased power – utility (2,029) (170) – – – (2,199)

Electric and natural gas trading revenue – gross ––1,529 1,898 (71) 3,356

Electric and natural gas trading costs ––(1,527) (1,892) 71 (3,348)

Gross margin before operating expenses $ 3,203 $ 33 $ 2 $ 6 $ – $ 3,244

Margin as a percentage of revenue 61.2% 16.3% 0.1% 0.3% – 36.9%

2001

Electric utility revenue $ 5,607 $ 788 $ – $ – $ – $ 6,395

Electric fuel and purchased power – utility (2,559) (613) – – – (3,172)

Electric and natural gas trading revenue – gross – – 1,337 1,938 (88) 3,187

Electric and natural gas trading costs – – (1,268) (1,918) 88 (3,098)

Gross margin before operating expenses $ 3,048 $ 175 $ 69 $ 20 $ – $ 3,312

Margin as a percentage of revenue 54.4% 22.2% 5.2% 1.0% – 34.6%

2000

Electric utility revenue $ 5,107 $ 567 $ – $ – $ – $ 5,674

Electric fuel and purchased power – utility (2,106) (475) – – – (2,581)

Electric and natural gas trading revenue – gross – – 819 1,297 (54) 2,062

Electric and natural gas trading costs – – (788) (1,287) 54 (2,021)

Gross margin before operating expenses $ 3,001 $ 92 $ 31 $ 10 $ – $ 3,134

Margin as a percentage of revenue 58.8% 16.2% 3.8% 0.8% – 40.5%

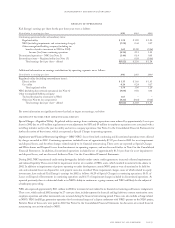

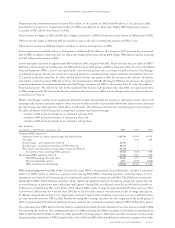

2002 Comparison to 2001 Base electric utility revenue decreased $375 million, or 6.7 percent, while electric utility margins, primarily

retail, increased approximately $155 million, or 5.1 percent, in 2002, compared with 2001. Base electric revenues decreased largely due

to decreased recovery of fuel and purchased power costs driven by declining fuel costs in 2002. The higher base electric margins in the

year reflect lower unrecovered costs, due in part to resetting the base-cost recovery at PSCo in January 2002. In 2001, PSCo’s allowed

recovery was approximately $78 million less than its actual costs, while in 2002 its allowed recovery was approximately $29 million more

than its actual cost. For the year, higher accrued conservation revenues, sales growth and more favorable temperatures also contributed

to the higher electric margins and partially offset the lower base electric revenue. Lower wholesale capacity sales in Texas, as well as the

impact of the conservation incentive adjustment in Minnesota in 2001, as discussed previously, partially offset the increased margins and

contributed to the lower revenues.

Short-term wholesale margins consist of asset-based trading activity. Electric and natural gas commodity trading activity margins consist

of non-asset-based trading activity. Short-term wholesale and electric and natural gas commodity trading sales margins decreased an

aggregate of approximately $223 million, or 84.5 percent, in 2002, compared with 2001. The decrease in short-term wholesale and

electric commodity trading margin reflects lower power prices and less favorable market conditions. The decrease in natural gas

commodity trading margin reflects reduced market opportunities.

2001 Comparison to 2000 Base electric utility revenue increased by approximately $500 million, or 9.8 percent, in 2001. Base electric

utility margin increased by approximately $47 million, or 1.6 percent, in 2001. These revenue and margin increases were due to

sales growth, weather conditions in 2001 and the recovery of conservation incentives in Minnesota. Increased conservation incentives,

including the resolution of the 1998 dispute, as discussed previously, and accrued 2001 incentives, increased revenue and margin by

$49 million. More favorable weather during 2001 increased revenue by approximately $23 million and margin by approximately

$13 million. These increases were partially offset by increases in fuel and purchased power costs, which are not completely recoverable

from customers in Colorado due to various cost-sharing mechanisms. Revenue and margin also were reduced in 2001 by approximately

$30 million due to rate reductions in various jurisdictions agreed to as part of the merger approval process, compared with $10 million

in 2000.

management’s discussion and analysis

xcel energy inc. and subsidiaries page 19