Xcel Energy 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

offsetting gain or loss on the hedged item to be reported in an earlier period to offset the gain or loss on the derivative instrument.

A cash flow hedge requires that the effective portion of the change in the fair value of a derivative instrument be recognized in

Other Comprehensive Income, and reclassified into earnings in the same period or periods during which the hedged transaction

affects earnings. The ineffective portion of a derivative instrument’s change in fair value is recognized currently in earnings.

Xcel Energy and its subsidiaries formally document hedge relationships, including, among other things, the identification of the hedging

instrument and the hedged transaction, as well as the risk management objectives and strategies for undertaking the hedged transaction.

Derivatives are recorded in the balance sheet at fair value. Xcel Energy and its subsidiaries also formally assess, both at inception and at

least quarterly thereafter, whether the derivative instruments being used are highly effective in offsetting changes in either the fair value

or cash flows of the hedged items.

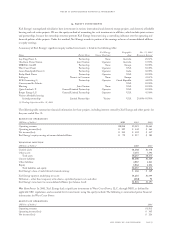

financial impacts of derivatives

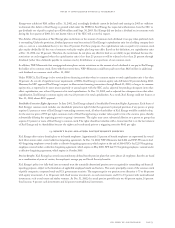

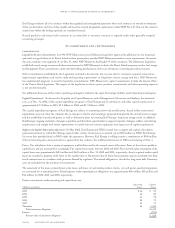

The impact of the components of SFAS No. 133 on Xcel Energy’s Other Comprehensive Income, included in Stockholders’ Equity, are

detailed in the following table:

(Millions of dollars)

Net unrealized transition loss at adoption, Jan. 1, 2001 $(28.8)

After-tax net unrealized gains related to derivatives accounted for as hedges 43.6

After-tax net realized losses on derivative transactions reclassified into earnings 19.4

Accumulated other comprehensive income related to SFAS No. 133 at Dec. 31, 2001 $34.2

After-tax net unrealized losses related to derivatives accounted for as hedges (68.3)

After-tax net realized losses on derivative transactions reclassified into earnings 28.8

Acquisition of NRG minority interest 27.4

Accumulated other comprehensive income related to SFAS No. 133 at Dec. 31, 2002 $22.1

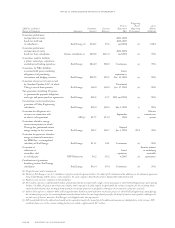

Xcel Energy records the fair value of its derivative instruments in its Consolidated Balance Sheet as a separate line item noted as

“Derivative Instruments Valuation” for assets and liabilities, as well as current and noncurrent.

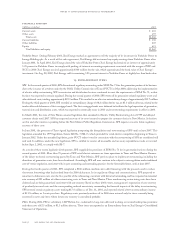

Cash Flow Hedges Xcel Energy and its subsidiaries enter into derivative instruments to manage exposure to changes in commodity prices.

These derivative instruments take the form of fixed-price, floating-price or index sales, or purchases and options, such as puts, calls and

swaps. These derivative instruments are designated as cash flow hedges for accounting purposes, and the changes in the fair value of these

instruments are recorded as a component of Other Comprehensive Income. At Dec. 31, 2002, Xcel Energy had various commodity-

related contracts extending through 2018. Amounts deferred in Other Comprehensive Income are recorded as the hedged purchase or

sales transaction is completed. This could include the physical sale of electric energy or the use of natural gas to generate electric energy.

Xcel Energy expects to reclassify into earnings during 2003 net gains from Other Comprehensive Income of approximately $12.9 million.

Xcel Energy and its subsidiaries enter into interest rate swap instruments that effectively fix the interest payments on certain floating

rate debt obligations. These derivative instruments are designated as cash flow hedges for accounting purposes, and the change in the

fair value of these instruments is recorded as a component of Other Comprehensive Income. Xcel Energy expects to reclassify into

earnings during 2003 net losses from Other Comprehensive Income of approximately $13.4 million.

Hedge effectiveness is recorded based on the nature of the item being hedged. Hedging transactions for the sales of electric energy are

recorded as a component of revenue, hedging transactions for fuel used in energy generation are recorded as a component of fuel costs,

and hedging transactions for interest rate swaps are recorded as a component of interest expense.

Hedges of Foreign Currency Exposure of a Net Investment in Foreign Operations To preserve the U.S. dollar value of projected foreign

currency cash flows, Xcel Energy, through NRG, may hedge, or protect, those cash flows if appropriate foreign hedging instru-

ments are available.

Derivatives Not Qualifying for Hedge Accounting Xcel Energy and its subsidiaries have trading operations that enter into derivative

instruments. These derivative instruments are accounted for on a mark-to-market basis in the Consolidated Statements of Operations.

All derivative instruments are recorded at the amount of the gain or loss from the transaction within Operating Revenues on the

Consolidated Statements of Operations.

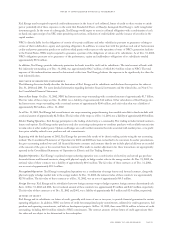

Normal Purchases or Normal Sales Xcel Energy and its subsidiaries enter into fixed-price contracts for the purchase and sale of various

commodities for use in its business operations. SFAS No. 133 requires a company to evaluate these contracts to determine whether the

contracts are derivatives. Certain contracts that literally meet the definition of a derivative may be exempted from SFAS No. 133 as

normal purchases or normal sales. Normal purchases and normal sales are contracts that provide for the purchase or sale of something

other than a financial instrument or derivative instrument that will be delivered in quantities expected to be used or sold over a reasonable

period in the normal course of business. Contracts that meet the requirements of normal are documented as normal and exempted from

the accounting and reporting requirements of SFAS No. 133.

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 83