Xcel Energy 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.After the filing of the lawsuit, several additional lawsuits were filed with similar allegations, one of which added claims on behalf of a

purported class of purchasers of two series of Senior Notes issued by NRG in January 2001. The cases have all been consolidated, and

a consolidated amended complaint has been filed. The amended complaint charges false and misleading disclosures concerning “round

trip” energy trades and the existence of provisions in Xcel Energy’s credit agreements for cross-defaults in the event of a default by NRG in

one or more of NRG’s credit agreements; it adds as additional defendants Gary R. Johnson, general counsel; Richard C. Kelly, president

of Xcel Energy Enterprises; three former executive officers of NRG, David H. Peterson, Leonard A. Bluhm and William T. Pieper, and a

former independent director of NRG, Luella G. Goldberg; and it adds claims of false and misleading disclosures, also regarding “round

trip” trades and the cross-default provisions, as well the extent to which the “fortunes” of NRG were tied to Xcel Energy, especially

in the event of a buyback of NRG’s publicly owned shares, under Section 11 of the Securities Act with respect to issuance of the

Senior Notes. The amended complaint seeks compensatory and rescissionary damages, interest and an award of fees and expenses. The

defendants have not yet responded to the amended complaint. Discovery has not commenced.

Xcel Energy Inc. Shareholder Derivative Action; Essmacher v. Brunetti; McLain v. Brunetti On Aug. 15, 2002, a shareholder derivative action

was filed in the United States District Court for the District of Minnesota, purportedly on behalf of Xcel Energy, against the directors and

certain present and former officers, citing essentially the same circumstances as the securities class actions described immediately preceding

and asserting breach of fiduciary duty. This action has been consolidated for pre-trial purposes with the securities class actions. After the

filing of this action, two additional derivative actions were filed in the state trial court for Hennepin County, Minnesota, against essentially

the same defendants, focusing on allegedly wrongful energy trading activities and asserting breach of fiduciary duty for failure to establish

adequate accounting controls, abuse of control and gross mismanagement. Considered collectively, the complaints seek compensatory

damages, a return of compensation received and awards of fees and expenses. In each of the cases, the defendants have filed motions to

dismiss the complaint for failure to make a proper pre-suit demand, or in the federal court case, to make any pre-suit demand at all,

upon Xcel Energy’s board of directors. The motions have not yet been ruled upon. Discovery has not commenced.

Newcome v. Xcel Energy Inc.; Barday v. Xcel Energy Inc. On Sept. 23, 2002, and Oct. 9, 2002, two essentially identical actions were filed

in the United States District Court for the District of Colorado, purportedly on behalf of classes of employee participants in Xcel Energy’s

and its predecessors’ 401(k) or ESOP plans from as early as Sept. 23, 1999, forward. The complaints in the actions name as defen-

dants Xcel Energy, its directors, certain former directors and certain of present and former officers. The complaints allege violations

of the Employee Retirement Income Security Act in the form of breach of fiduciary duty in allowing or encouraging purchase, con-

tribution and/or retention of Xcel Energy’s common stock in the plans and making misleading statements and omissions in that regard.

The complaints seek injunctive relief, restitution, disgorgement and other remedial relief, interest and an award of fees and expenses.

The defendants have filed motions to dismiss the complaints upon which no rulings have yet been made. The plaintiffs have made cer-

tain voluntary disclosure of information, but otherwise discovery has not commenced. Upon motion of defendants, the cases have been

transferred to the District of Minnesota for purposes of coordination with the securities class actions and shareholders derivative action

pending there.

Stone & Webster, Inc. v. Xcel Energy Inc. On Oct. 17, 2002, Stone & Webster, Inc. and Shaw Constructors, Inc. filed an action in the

United States District Court in Mississippi against Xcel Energy; Wayne H. Brunetti, chairman, president and chief executive officer;

Richard C. Kelly, president of Xcel Energy Enterprises; NRG and certain NRG subsidiaries. Plaintiffs allege they had a contract with

a single purpose NRG subsidiary for construction of a power generation facility, which was abandoned before completion but after

substantial sums had been spent by plaintiffs. They allege breach of contract, breach of an NRG guarantee, breach of fiduciary duty,

tortious interference with contract, detrimental reliance, misrepresentation, conspiracy and aiding and abetting, and seek to impose

alter ego liability on defendants other than the contracting NRG subsidiary through piercing the corporate veil. The complaint seeks

compensatory damages of at least $130 million plus demobilization and cancellation costs and punitive damages at least treble the

compensatory damages. On Dec. 23, 2003, defendants filed motions to dismiss the complaint, which have not yet been ruled upon.

No trial date has been set in this matter, and Xcel Energy cannot presently predict the outcome of this dispute. Plaintiffs have commenced

what they characterize as jurisdictional discovery, which defendants are resisting.

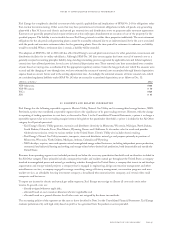

New York Independent System Operator (NYISO) Claims In November 2002, the NYISO notified NRG of claims related to New York

City mitigation adjustments, general NYISO billing adjustments and other miscellaneous charges related to sales between November 2000

and October 2002. NRG contests both the validity and calculation of the claims and is currently negotiating with the NYISO over the

ultimate disposition. Accordingly, NRG reduced its revenues by $21.7 million and recorded a corresponding reserve for the receivable.

Huntley and Dunkirk Litigation In January 2002, the New York Attorney General and the New York Department of Environmental

Control (NYDEC) filed suit in federal district court in New York against NRG and Niagara Mohawk Power Corp. (NiMo), the prior

owner of the Huntley and Dunkirk facilities in New York. The lawsuit relates to physical changes made at those facilities prior to

NRG’s assumption of ownership. The complaint alleges that these changes represent major modifications undertaken without the

required permits having been obtained. Although NRG has a right to indemnification by the previous owner for fines, penalties, assessments

and related losses resulting from the previous owner’s failure to comply with environmental laws and regulations, NRG could be enjoined

from operating the facilities if the facilities are found not to comply with applicable permit requirements. In addition, NRG could be

notes to consolidated financial statements

xcel energy inc. and subsidiaries page 91