Xcel Energy 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

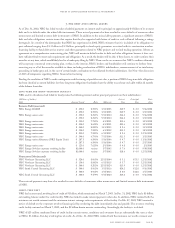

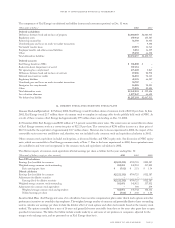

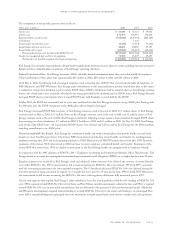

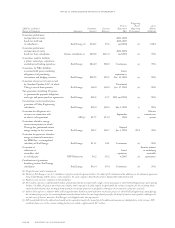

A comparison of the actuarially computed pension benefit obligation and plan assets, on a combined basis, is presented in the following table.

(Thousands of dollars) 2002 2001

Change in Benefit Obligation

Obligation at Jan. 1 $2,409,186 $2,254,138

Service cost 65,649 57,521

Interest cost 172,377 172,159

Acquisitions 7,848 –

Plan amendments 3,903 2,284

Actuarial loss 65,763 108,754

Settlements (994) –

Special termination benefits 4,445 –

Benefit payments (222,601) (185,670)

Obligation at Dec. 31 $2,505,576 $2,409,186

Change in Fair Value of Plan Assets

Fair value of plan assets at Jan. 1 $3,267,586 $3,689,157

Actual return on plan assets (404,940) (235,901)

Employer contributions – acquisitions 912 –

Settlements (994) –

Benefit payments (222,601) (185,670)

Fair value of plan assets at Dec. 31 $2,639,963 $3,267,586

Funded Status of Plans at Dec. 31

Net asset $ 134,387 $ 858,400

Unrecognized transition asset (2,003) (9,317)

Unrecognized prior service cost 224,651 242,313

Unrecognized (gain) loss 182,927 (712,571)

Net pension amounts recognized on Consolidated Balance Sheets $ 539,962 $ 378,825

Prepaid pension asset recorded $ 466,229 $ 378,825

Intangible asset recorded – prior service costs $ 6,943 $–

Minimum pension liability recorded $(106,897) $–

Accumulated other comprehensive income recorded – pretax $ 173,687 $–

Significant Assumptions

Discount rate for year-end valuation 6.75% 7.25%

Expected average long-term increase in compensation level 4.00% 4.50%

Expected average long-term rate of return on assets 9.50% 9.50%

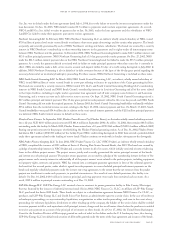

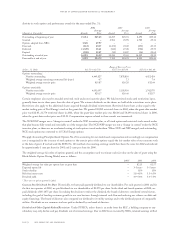

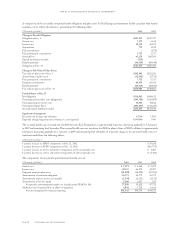

The discount rate and compensation increase assumptions above affect the succeeding year’s pension costs. The rate of return assumption

affects the current year’s pension cost. The return assumption used for 2003 pension cost calculations will be 9.25 percent. Pension costs

include an expected return impact for the current year that may differ from actual investment performance in the plan. The cost calculation

uses a market-related valuation of pension assets, which reduces year-to-year volatility by recognizing the differences between assumed

and actual investment returns over a five-year period.

NRG offers another noncontributory, defined benefit pension plan sponsored by one of its affiliates. For the year ended Dec. 31, 2002,

the total assets of this plan were $20 million, and its benefit obligation was $30 million. The pension liability recorded by NRG for this

plan was $12 million, and its annual pension cost was $2 million.

During 2002, one of Xcel Energy’s pension plans, other than the NRG plan just described, became underfunded, with projected benefit

obligations of $590 million exceeding plan assets of $452 million on Dec. 31, 2002. All other Xcel Energy plans, excluding the NRG plan

just described, in the aggregate had plan assets of $2,188 million and projected benefit obligations of $1,916 million on Dec. 31,2002. A

minimum pension liability of $107 million was recorded related to the underfunded plan as of that date. A corresponding reduction in

Accumulated Other Comprehensive Income, a component of Stockholders’ Equity, was also recorded by Xcel Energy, as previously

recorded prepaid pension assets were reduced to record the minimum liability. Net of the related deferred income tax effects of the

adjustments, total Stockholders’ Equity was reduced by $108 million at Dec. 31, 2002, due to the minimum pension liability for the

underfunded plan.

page 74 xcel energy inc. and subsidiaries

notes to consolidated financial statements