Pizza Hut 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9MAR201101440694

deferrals into the Matching Stock Fund vest immediately and RSUs attributable to the matching

contribution vest pro rata during the period beginning on the date of grant and ending on the first

anniversary of the grant and are fully vested on the first anniversary.

LRP Account Returns. The LRP provides an annual earnings credit to each participant’s account

based on the value of participant’s account at the end of each year. Under the LRP, Mr. Bergren receives

an annual earnings credit equal to 5%.

Distributions under EID and LRP. When participants elect to defer amounts into the EID Program,

they also select when the amounts ultimately will be distributed to them. Distributions may either be made

in a specific year—whether or not employment has then ended—or at a time that begins at or after the

executive’s retirement or separation or termination of employment.

Distributions can be made in a lump sum or up to 20 annual installments. Initial deferrals are subject

to a minimum two year deferral. In general, with respect to amounts deferred after 2005 or not fully vested

as of January 1, 2005, participants may change their distribution schedule, provided the new elections

satisfy the requirements of Section 409A of the Internal Revenue Code. In general, Section 409A requires

that:

• Distribution schedules cannot be accelerated (other than for a hardship)

• To delay a previously scheduled distribution,

• A participant must make an election at least one year before the distribution otherwise would

be made, and

• The new distribution cannot begin earlier than five years after it would have begun without the

election to re-defer.

With respect to amounts deferred prior to 2005, to delay a distribution the new distribution cannot

begin until two years after it would have begun without the election to re-defer.

Investments in the YUM! Stock Fund and YUM! Matching Stock Fund are only distributed in shares

of Company stock.

Proxy Statement

Under the LRP, participants receive a distribution of their vested account balance following the later

to occur of their attainment of age 55 or retirement from the Company.

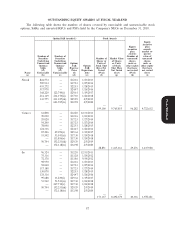

Executive Registrant Aggregate Aggregate Aggregate

Contributions Contributions Earnings Withdrawals/ Balance

in Last FY in Last FY in Last FY Distributions at Last FYE

Name ($)(1) ($) ($)(2) ($)(3) ($)(4)

(a) (b) (c) (d) (e) (f)

Novak 2,993,760 — 32,068,678 67,603 114,530,171

Carucci — — 2,118,368 335,245 9,136,836

Su 1,718,917 — 1,393,948 2,458,912 5,498,655

Allan — — 3,736,866 — 12,788,939

Bergren — 336,700 2,172,894 207,192 9,097,392

(1) Amounts in this column reflect amounts that were also reported as compensation in our Summary

Compensation Table filed last year or would have been reported as compensation in our Summary

Compensation Table last year if the executive were a NEO.

(2) Amounts in this column reflect earnings during the last fiscal year on deferred amounts. All earnings

are based on the investment alternatives offered under the EID Program described in the narrative

above this table. Since these earnings are market based returns, they are not reported in the Summary

Compensation Table.

64