Pizza Hut 2010 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

108

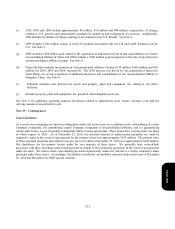

Other. This item primarily includes the impact of permanent differences related to current year earnings and U.S. tax

credits.

In 2009, this item was positively impacted by a one-time pre-tax gain of approximately $68 million, with no related

income tax expense, recognized on our acquisition of additional interest in, and consolidation of, the entity that operates

KFC in Shanghai, China. This was partially offset by a pre-tax U.S. goodwill impairment charge of approximately $26

million, with no related income tax benefit.

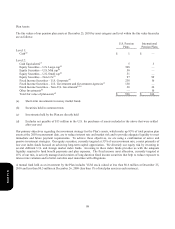

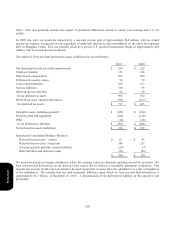

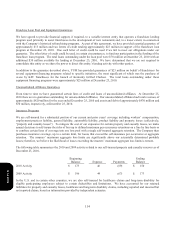

The details of 2010 and 2009 deferred tax assets (liabilities) are set forth below:

2010 2009

N

et operating loss and tax credit carryforwards

$

220 $ 222

Employee benefits 158 148

Share-based compensation 102 106

Self-insured casualty claims 50 59

Lease related liabilities 166 157

Various liabilities 130 99

Deferred income and other 82 59

Gross deferred tax assets 908 850

Deferred tax asset valuation allowances (191

)

(187)

Net deferred tax assets

$

717 $ 663

Intangible assets, including goodwill

$

(243

)

$ (240)

Property, plant and equipment (104

)

(118)

Other (14

)

(46)

Gross deferred tax liabilities

$

(361

)

$ (404)

N

et deferred tax assets (liabilities)

$

356 $ 259

Reported in Consolidated Balance Sheets as:

Deferred income taxes – current

$

61 $ 81

Deferred income taxes – long-term 366 251

Accounts payable and other current liabilities (20) (7

)

Other liabilities and deferred credits (51

)

(66)

$

356 $ 259

We have investments in foreign subsidiaries where the carrying values for financial reporting exceed the tax basis. We

have not provided deferred tax on the portion of the excess that we believe is essentially permanent in duration. This

amount may become taxable upon an actual or deemed repatriation of assets from the subsidiaries or a sale or liquidation

of the subsidiaries. We estimate that our total temporary difference upon which we have not provided deferred tax is

approximately $1.3 billion at December 25, 2010. A determination of the deferred tax liability on this amount is not

practicable.

Form 10-K