Pizza Hut 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9MAR201101440694

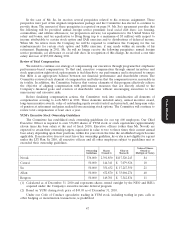

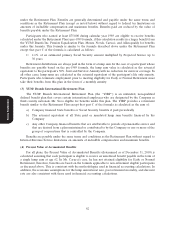

SUMMARY COMPENSATION TABLE

Change in

Pension

Value and

Non-Equity Nonqualified

Incentive Deferred

Stock Option/SAR Plan Compensation All Other

Name and Salary Awards Awards Compensation Earnings Compensation

Principal Position Year ($)(1) Bonus($) ($)(2) ($)(3) ($)(4) ($)(5) ($)(6) Total($)

(a) (b) (c) (d) (e) (f) (g) (h) (i)

David C. Novak 2010 1,400,000 — 740,005 5,029,877 5,066,880 2,038,361 338,783 14,613,906

Chairman, Chief 2009 1,400,000 — 739,989 4,192,111 2,993,760 3,565,977 239,455 13,131,292

Executive Officer 2008 1,393,846 — 8,342,345 4,711,780 4,057,200 5,255,931 239,709 24,000,811

and President

Richard T. Carucci 2010 715,000 — 225,023 1,387,559 1,589,445 361,071 58,213 4,336,311

Chief Financial 2009 711,923 — 224,994 1,479,567 907,818 1,083,683 50,713 4,458,698

Officer 2008 669,231 — 845,057 2,650,380 497,980 1,131,924 36,963 5,831,535

Jing-Shyh S. Su 2010 815,000 — 7,106,211 1,387,559 2,628,986 1,470,360 909,904 14,318,020

Vice Chairman, 2009 811,923 — 310,011 1,479,567 1,718,917 1,532,322 868,468 6,721,208

Yum! Brands, Inc. 2008 769,231 — 536,533 4,122,812 1,609,598 1,107,629 1,434,625 9,580,428

Chairman and

Chief Executive

Officer, YUM’s

China Division

Graham D. Allan 2010 815,000 — 310,012 1,387,559 1,425,557 1,572,049 63,331 5,573,508

Chief Executive 2009 811,923 — 310,011 1,479,567 1,023,477 732,364 50,235 4,407,577

Officer, Yum! 2008 769,231 — 2,620,275 1,766,927 — 502,319 207,063 5,865,815

Restaurants

International

Scott O. Bergren 2010 650,000 — 180,005 659,090 1,367,438 6,006 417,813 3,280,352

Chief Executive 2009 647,692 — 179,995 1,479,567 291,168 — 397,011 2,995,433

Officer, Pizza Hut U.S. 2008 610,769 — 324,632 1,472,432 973,896 22,863 381,919 3,786,511

and Yum! Innovation,

Yum! Brands, Inc.

Proxy Statement

(1) Amounts shown are not reduced to reflect the NEOs’ elections, if any, to defer receipt of salary into the Executive Income Deferral

(‘‘EID’’) Program or into the Company’s 401(k) Plan.

(2) Amounts shown in this column represent the grant date fair values for performance share units (PSUs) granted in 2010 and 2009 and

restricted stock units (RSUs) granted in 2010 and 2008 under our Long Term Incentive Plan. Further information regarding the 2010

awards is included in the ‘‘Grants of Plan-Based Awards’’ and ‘‘Outstanding Equity Awards at Fiscal Year-End’’ tables later in this proxy

statement. The grant date fair value of the PSUs reflected in this column is the target payout based on the probable outcome of the

performance condition, determined as of the grant date. The maximum potential values of the PSUs would be 200% of target. For 2010,

Mr. Novak’s PSU maximum value at grant date fair value would be $1,480,010; Mr. Carucci’s PSU maximum value would be $450,046;

Messrs. Su’s and Allan’s PSU maximum value would be $620,024; and Mr. Bergren’s PSU maximum value would be $360,010. For 2010,

Mr. Su was the only NEO to receive an RSU grant. Mr. Su’s RSU grant vests after five years and Mr. Su may not sell the shares until

12 months following retirement from the Company. The expense of Mr. Su’s award is recognized over the vesting period. The RSUs

granted in 2008 were granted pursuant to the EID Program with respect to annual incentives deferred into the EID and subject to a risk

of forfeiture at the time of deferral, rather than amounts paid or realized by each NEO and, in Mr. Novak’s case, granted under our

Long Term Incentive Plan in the amount of $7 million. RSUs granted under the EID Program were granted, as described in more detail

beginning on page 63, when an executive elected to defer all or a portion of his/her annual incentive award under the EID Program and

invested that deferral in RSUs.

Under the terms of the EID Program for 2008, an employee who is age 55 with 10 years of service is fully vested in the amount of the

deferral attributable to the actual incentive award. Upon attainment of this threshold, the matching contributions attributable to the

deferral is subject to forfeiture on a pro rata basis for the year following the deferral. Messrs. Novak, Su and Bergren had attained this

threshold at the time of their 2008 annual incentive awards and thus only the grant date fair value of the matching contributions

attributable to their 2008 annual incentive awards are included in this column. The remainder of their deferrals attributable to the 2008

annual incentive award (that is the amount not subject to forfeiture) is reported in column (f).

In Mr. Novak’s case, for 2008 this also represents the grant date fair value with respect to a RSU grant. The grant vests after four years

and Mr. Novak may not sell the shares until 6 months following his retirement from the Company.

52