Pizza Hut 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

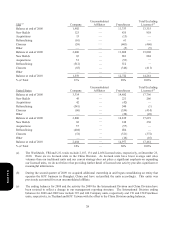

U.S. Business Transformation Measures

The U.S. business transformation measures in 2010, 2009 and 2008 included: expansion of our U.S. refranchising; a

reduced emphasis on multi-branding as a long-term growth strategy; G&A productivity initiatives and realignment of

resources (primarily severance and early retirement costs); and investments in our U.S. Brands made on behalf of our

franchisees such as equipment purchases. We do not believe these measures are indicative of our ongoing operations and

are not including the impacts of these U.S. business transformation measures in our U.S. segment for performance

reporting purposes.

In the years ended December 25, 2010 and December 27, 2008, we recorded pre-tax losses of $18 million and $5 million

from refranchising in the U.S., respectively. In the year ended December 26, 2009, we recorded a pre-tax refranchising

gain of $34 million in the U.S. The loss recorded in the year ended December 25, 2010 is the net result of gains from 404

restaurants sold and non-cash impairment charges related to our offers to refranchise restaurants in the U.S., principally a

substantial portion of our Company operated KFC restaurants. The non-cash impairment charges related to our offers to

refranchise a substantial portion of our Company operated KFC restaurants in the U.S., which were mostly recorded in the

first quarter of 2010, decreased depreciation expense versus what would have otherwise been recorded by $9 million in

the year ended December 25, 2010. This depreciation reduction was recorded as a Special Item, resulting in depreciation

expense in the U.S. segment results continuing to be recorded at the rate at which it was prior to the impairment charge

being recorded for these restaurants. The refranchising gains and losses are more fully discussed in Note 4 and the Store

Portfolio Strategy Section of the MD&A.

In connection with our G&A productivity initiatives and realignment of resources (primarily severance and early

retirement costs) we recorded pre-tax charges of $9 million, $16 million and $49 million in the years ended December 25,

2010, December 26, 2009 and December 27, 2008, respectively. We realized a $65 million decline in our U.S. G&A

expenses in the year ended December 26, 2009 driven by the U.S. productivity initiatives and realignment of resource

measures we took in 2008 and 2009.

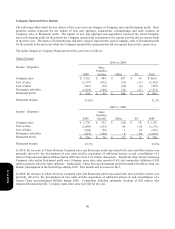

As a result of a decline in future profit expectations for our LJS and A&W U.S. businesses due in part to the impact of a

reduced emphasis on multi-branding, we recorded a non-cash charge of $26 million in Closures and impairment expenses,

which resulted in no related income tax benefit, in the fourth quarter of 2009 to write-off goodwill associated with these

businesses.

Additionally, the Company recognized a reduction to Franchise and license fees and income of $32 million, pre-tax, in the

year ended December 26, 2009, related to investments in our U.S. Brands. These investments reflect our reimbursements

to KFC franchisees for installation costs of ovens for the national launch of Kentucky Grilled Chicken. The

reimbursements were recorded as a reduction to Franchise and license fees and income as we would not have provided the

reimbursements absent the ongoing franchisee relationship. In the year ended December 27, 2008, the Company

recognized pre-tax expense of $7 million related to investments in our U.S. Brands in Franchise and license expenses.

Form 10-K